Behind The Numbers – Plexus Corp (PLXS)

As an electronic manufacturing services company in North America and internationally, Plexus offers Design and Development, Supply Chain Solutions, New Product Introduction, Manufacturing, and Aftermarket Services to companies around the world.

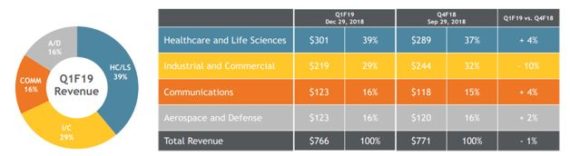

After the close yesterday, the company reported its Q1 earnings that saw them beat on EPS ($0.91 vs $0.90 estimate), but miss on Revenue ($765.5M vs $768.3M estimate). In terms of segments, it achieved sequential growth in Healthcare & Life Sciences, Aerospace and Defense and Communications, which offset weakness in its Industrial and Commercial segment, or more specifically, its semiconductor capital equipment space.

The company, when speaking about its Healthcare segment, discussed two manufacturing facilities. First, their Guadalajara facility successfully completed its first FDA Class III audit. This would bring the total number of Plexus facilities manufacturing FDA Class III products to four globally. Second, they shipped their first products built in their new Healthcare, Life Sciences Center of Excellence in Penang, Malaysia. They are now prepared to increase customer deliveries in the fiscal second quarter and expect a rapid ramp of this facility.

Areas to Improve

COO Steven Frisch would comment that there would be two areas that they are focused upon in the near-term. First, is inventory. “As expected, our days of inventory rose to 105 days in the fiscal first quarter. With some improvements in component availability and an initiative to improve planning with our customers, we are committed to reducing inventory throughout fiscal 2019.”

“The second focus is on operating margin. Our operational improvements will not overcome the headwinds associated with the U.S. payroll reset and annual salary adjustments that occur in the fiscal second quarter. Although we expect to return to our target operating margin range in the fiscal third quarter, we are guiding operating margin in the range of 4.3% to 4.7% for the fiscal second quarter.”

Semi Cap Headwinds

Analyst Matt Sheerin of Stifel would ask management about the weakness the company saw in its Semi Cap segment. COO Steven Frisch would respond by saying that within the first fiscal quarter, “three of our large semi cap customers brought down the forecast in aggregate of about $7 million. That was in the November time frame. So that impacted Q1 a bit. In the December time frame, they brought it down by about an additional $20 million for Q2. So that’s what’s really kind of driving some of the challenges for us in Q2 with inventory and a little bit of headwind in margins as well because we were planning an additional $20 million of revenue for them in the fiscal Q2 time frame.”

He would also add that one of the challenges that they have with this is that for these customers, a ot of the components are customer engineered components. “So from an inventory standpoint, it’s difficult to push them back into the pipeline. And so it’s going to take us a little bit of time through ’19 to burn through those. We expect that that’s about a three-day impact in Q2 in terms of days of inventory associated with what’s happening there.”