Behind The Numbers – Pool Corp (POOL)

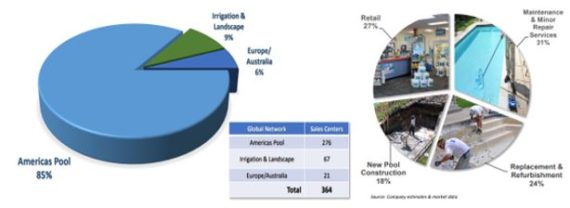

Pool Corp. is the world’s largest wholesale distributor of swimming pool and related outdoor living products operating over 360 sales centers in North America, Europe, South America and Australia. With a focus on enhancing the quality of outdoor home life, Pool Corp. offers a selection of services/products including: Pool Maintenance, Pool Construction & Renovation, Irrigation and Landscape, and Outdoor Living.

Before the open on Thursday, the company reported its Q1 earnings in which EPS came in at $0.59 vs $0.65 estimate and Revenue came in at $597.5M vs $608.5M estimate. Its net sales increased 2% while base business sales grew 1%.

On the conference call, CEO Peter Arvan highlighted that their year-round markets, primarily Florida, California, Arizona and Texas, were up 2% for the quarter. Florida, which experienced favorable weather in the period, saw sales up 7%. Moving to Texas, sales were up 4%, with January and February sales climbing over 7% only to be impacted by a very wet March. Finally, in California and Arizona, they saw sales on a combined basis decrease 2% as they were impacted by record-breaking cold and rain this year, making construction and remodel challenging.

“We believe the unfavorable weather pattern in the west impacted our sales by $10 million to $15 million based on normal growth rates. Our builders are reporting plenty of pent-up demand, and we believe the shortfall can be made up — or much of the shortfall can be made up assuming normal weather, as these are predominantly year-round markets.”

Finally, taking a look at the North American end markets, retail sales were essentially flat, largely driven by the Easter holiday falling later this year as it tends to delay pool openings and the associated buying and restocking at our independent retailers. Commercial product sales were up 2% while building materials were strong, with 8% growth in the quarter.

Gross Margins – Management would comment their overall gross margin percent increased in the quarter by 90 basis points to 29.2%. The increase was largely driven by the strategic inventory buys and the deferral of customer early buys. “As the second quarter progresses and we sell-through the remaining pre-increase inventory, we should see a slight uptick in margins.”

Europe – The company reported that international sales increased 9%, with Europe up 36% in local currency and 20% in U.S. dollars.

Sidoti analyst Anthony Lebiedzinski, in the Q&A session, would follow-up with questions regarding this region, asking about seasonality as well future opportunities for sales expansion.

CEO Peter Arvan would comment, “Europe is a good market for us. They — and remember, as I said, they — Europe had a very, very, very good weather pattern. I was over there a couple weeks ago, and they’ve had a very nice spring. So they’re benefiting from that. Our team is very good and is executing. We have a new facility planned in Europe, and I would tell you that our M&A strategy for Europe is no different than it is in the U.S. We’re strategic and opportunistic. When we find something that makes sense, great. If not, then we basically follow the same expansion strategy that we do here in the U.S.”

Lastly, one other item that was called out was the exchange rate, which management said should continue to be favorable, although as they get into the second quarter, the impact is less significant there but will still benefit them, assuming rates stay about where they are, specifically with the U.S./Euro being the primary rate that impacts expenses.