Behind The Numbers – PRGX Global (PRGX)

PRGX Global (PRGX), which I came across for the very first time last night when looking over the list of earnings transcripts, is a recovery audit services company that assists clients with their purchasing-related data for overpayments to third-party suppliers. As management puts it, they “help identify value leakage.”

After the close yesterday, the company beat on both the top and bottom line and shares are being rewarded this morning, currently higher by 8%.

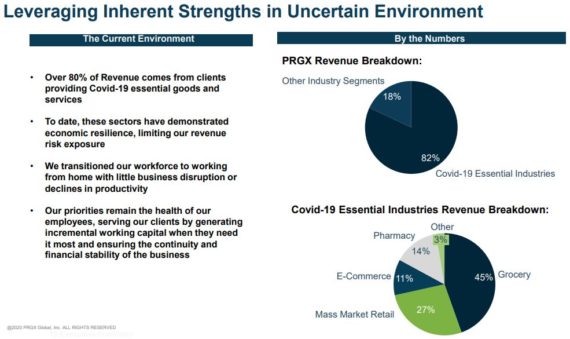

Analysts are also bullish as B. Riley FBR analyst Zach Cummins raised his price target to $8.50 from $7.25 saying the company’s revenue and adjusted EBITDA exceeded expectations for the third consecutive quarter as management continues to execute upon its initiatives to improve productivity and operating leverage within the business. Furthermore, the analyst believes PRGX presents an “especially attractive risk/reward opportunity for micro-cap value investors” in the current COVID-19 environment given its “favorable” revenue exposure and “highly defensive” business model. Meanwhile, Barrington analyst Alexander Paris raised his price target to $8 from $7 saying he sees “stable core revenues in these uncertain times and continued expansion of adjusted EBITDA margins ahead.”

What exactly stood out to me from their conference call?

COVID-19 Tailwinds – Barrington analyst Alex Paris would ask management when will they begin auditing this COVID impacted data and when should we start to see a lift from that? In the second half of the year or not until 2021?

CEO Ron Stewart would say that they’re just starting to audit the first wave of their COVID costs and expenses. The last quarter was primarily focused on pre-COVID, although they have a few clients that are more real-time and closer to the transaction. “So, we’ve just started to get into it and we have some clients that are three to six to nine months after the transaction that we’re auditing. So, it’ll continue, but we should start seeing some indications this quarter of the world of COVID. We’re not right now predicting in terms of a massive lift in our revenue as a result of COVID, but we are watching it carefully and we expect to deliver solid results for Q3 and Q4.”

Sales Team Adapting – Barrington would comment that they know historically, the company has relied on trade shows and conferences to generate new business so how did they shakeout in Q2?

CEO Ron Stewart said Q2 is coming in pretty close to plan. Some of the things that they expected to close in Q2 got pushed out to Q3. But looking ahead, they’re very pleased with the outlook for Q3 and Q4 in terms of the pipeline they have and the level of commitments they have for the new business, both in retail clients and commercial.

Yes, they admit that they relied on going to various industry shows and conferences to generate leads. However, they’ve really had to take a step back and put a lot more emphasis on webinars and white papers and generating interest from intellectual property. “And at this point in the year, our actual leads generated from our BDR team and our sales team is actually higher year-to-date than we were last year. So, I think we’ve made a solid transition and our sales teams are learning to sell.”

Bankruptcy Risk? – Management was asked about the recent retail bankruptcies like J.C. Penney, Pier 1, GNC and wanting to know if there is any exposure there?

CFO Kurt Abkemeier would say that over-represented by high quality customers and underrepresented by the retailers out there that are at risk. “Not any of the companies that you mentioned, that filed for bankruptcy are clients of ours. So, we’ve been very fortunate that that we have a very solid customer base and very low exposure at this point in bankruptcy risk.”