Behind The Numbers – Procept BioRobotics (PRCT)

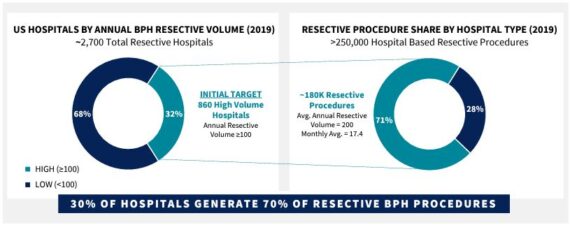

Procept BioRobotics (PRCT) is a medtech company that offers the AquaBeam Robotic System, an advanced, image-guided, surgical robotic system for use in minimally-invasive urologic surgery with an initial focus on treating benign prostatic hyperplasia, or BPH. BPH is the most common prostate disease and impacts approximately 40M men in the United States.

An original write-up for PRCT was published on December 4th in our Weekend Research report Fast forward a couple of months on February 8th, I provided an update in our morning Conversations podcast. Admittedly, the stock is down since the initial report, but I said I would come back to this one after they reported earnings.

Earlier this week on February 28th, the company reported Q4 EPS of ($0.63) vs ($0.54) estimate and Q4 Revenue of $23.8M vs $23.01M estimate. This $23.8M number was at the higher-end of its pre-announced range of $23.6M-$23.8M from the JPMorgan Healthcare Conference in early January.

U.S. system sales came in at $10.4M which included 28 installs vs. 26 Q/Q and 10 Y/Y. At the end of 2022, total installs stood at 167. Meanwhile, U.S. handpiece/consumables sales came in at $10.4M. Here, KeyBanc points out that average monthly utilization increased sequentially to 6.5 from 6.1, which they believe demonstrates positive reception and ongoing adoption into physician’s practices.

Looking at 2023 Guidance, the company offered in-line revenue of $125M. KeyBanc said they are not reading too much into this relatively in-line outlook, given PRCT’s historical cadence of beats-and-raises against achievable guidance. Meanwhile, B. Riley said the company offered conservative top-line guidance reflecting sustained interest from surgeons and patients, the expanding commercial team, and a number of contracts signed with large IDNs.

Sales Reps – The company said it made a meaningful sales ramp buildout in the second half of 2022 across three functions (robotic capital, utilization, clinical support), and they expect to have a consistent cadence of additional sales rep hires in 2023. At the end of 2022, PRCT said it increased its capital sales reps by 50% from the end of Q3 to 30 and plans to deploy them into new or expanding territories (Minneapolis, Charlotte, Seattle, Albany), while also increasing utilization/clinical support reps at a similar clip. B. Riley highlighted how the productivity ramp typically takes approximately 6 months and is expected to be a sales driver for 2H23.

Integrated Delivery Networks – Finally, looking at the conference call, CEO Reza Zadno would say that exiting 2022, the company has signed contracts with numerous IDNs, which will allow their sales team to operate in an expedited and more predictable manner. “The importance of these contracts is meaningful to our ability to penetrate the U.S. market, one of the most time consuming phases of selling capital equipment involved establishing a legal contract. The strategic benefit of working with IDN is that the corporate entity has agreed to a standardized legal contract across its hospital network. We anticipate having the majority of IDNs in the U.S. under contract by the end of 2023, which we believe will contribute meaningfully to our future revenue, which provides increased visibility in our pipeline.”