Behind The Numbers – R1 RCM (RCM)

On February 6th, a bullish write-up for R1 RCM (RCM) was sent out to clients in Weekend Research that covered three specific topics (Cloudmed, Labor, and Contracts). Shares are up just over 13% since that report went out and this past week, the company reported its Q4 earnings:

-EPS of $0.11 vs $0.11 estimate – In-Line

-Revenue of $398.9M vs $399.26M estimate – Miss

-Revenue increased 21.5% Y/Y

-Adjusted EBITDA increased 51.7% Y/Y

-Net Operating Fees increased 60.6M Y/Y and 23.5% Q/Q

-Sees FY22 Revenue of $1.66B – $1.70B vs $1.72B estimate – Miss

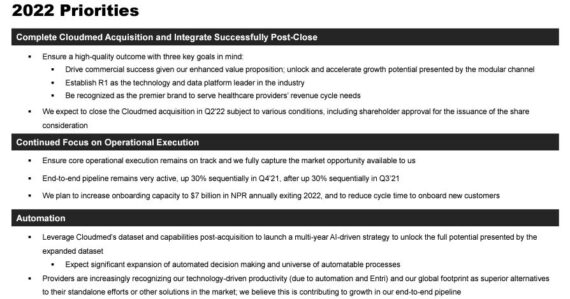

On the topic of Cloudmed, this is the Revenue Intelligence solutions company RCM acquired on January 10th. Management would highlight that in 2021, Cloudmed processed over $800B of NPR for more than 400 health systems in all 50 states, including 87 of the top 100 health systems. Even with this scale, management sees a significant opportunity to cross-sell additional solutions to current customers, since a majority use only 1 out of the 9 Cloudmed solutions. “Their commercial engine has a multi-year demonstrated track record of increasing the attached rate with existing customers and continuing to develop new opportunities across the remaining $1.2T of NPR at health systems and physician practices that are not Cloudmed customers today.” According to JPMorgan analyst Anne Sanuel, “Importantly, the guidance does not yet reflect the Cloudmed transaction, which management expects to close in 2Q, and subsequently update guidance.”

On the topic of Labor, CEO Joe Flanagan would highlight on the call that their technology is playing an important rule in process workflows and helping navigate tight labor markets. “While we are not immune to the current labor environment, as we sit today, with the efficiencies created by automation and Entri, our labor needs are 10% to 15% lower than providers’ in-house revenue cycle operations.” He added that the company accelerated the pace of automation to 10M tasks per quarter, and exited the year with a run rate of 70M tasks automated annually, up from 30M at the end of 2020. They also uncovered new opportunities for automation and currently have an additional 110M tasks they can automate. “We expect to exit 2022 with over 100 million tasks automated contributing approximately $45 million to our expected adjusted EBITDA for the year.”

Finally, as it relates to Contracts, I had highlighted in W/E Research that the company had a handful of large contracts approaching the finish line. According to management on the call, they admitted that they were well below their target of $4B in new end-to-end NPR in 2021. However, they were pleased to share that they were in the contracting stage and have increased the scope of business with a $10B NPR customer. “We are substantively complete on negotiations with this customer, but have not executed the contracts pending the customer’s internal processes. This continued progression is a positive step and we expect to execute the contract in the coming weeks. This is an important relationship for us across three key dimensions.” According to JPMorgan, the $10B will be onboarded in a phased approach over a couple of years, and RCM noted it has the “flex” capacity in the near-term to both implement the first phase of the $10B contract and book additional NPR in 2022.