Behind The Numbers – Silk Road Medical (SILK)

Silk Road Medical is a medical device company focused on reducing the risk of stroke and its devastating impact. They believe a key to stroke prevention is minimally-invasive and technologically advanced intervention to safely and effectively treat carotid artery disease, one of the leading causes of stroke. They have pioneered a new approach for the treatment of carotid artery disease called transcarotid artery revascularization, or TCAR, which they seek to establish as the standard of care.

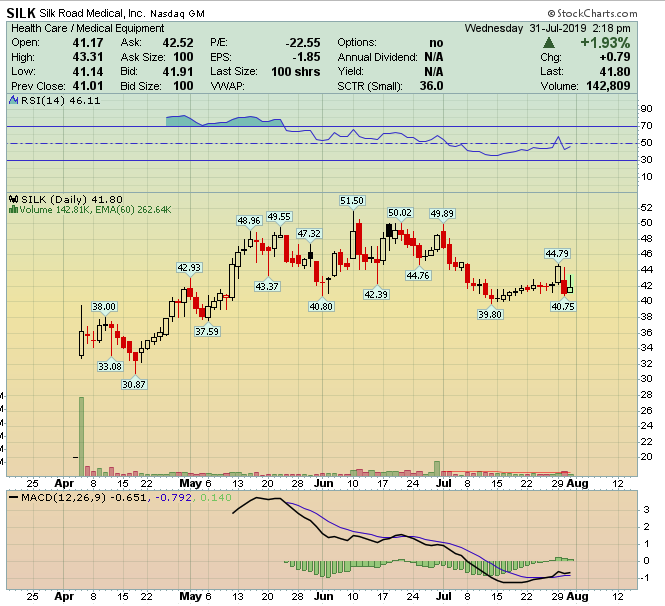

After the close on Monday, the company reported its Q2 earnings:

-EPS of ($0.42) vs ($0.27) estimate – Miss

-Revenue of $14.9M vs $13.64M estimate – Beat

-Total Revenue increased 92% Y/Y

-Gross Margin of 75% vs 69% Y/Y

-Raised 2019 Revenue Guidance to $60M – $62M, a 74% – 79% increase Y/Y

In their post-earnings note, BAML said that the guidance raise to a new range of $60-62M looks conservative in their view, especially given that they have yet to see any impact from the ground-breaking data presentation from the surveillance project registry presented in June.

As a reminder, back on June 13th and June 16th, Silk Road Medical announced results from its presentation at the Society for Vascular Surgery and from its ROADSTER-2 study, respectively.

The presentation, “Outcomes of Transcarotid Revascularization with Dynamic Flow Reversal Versus Carotid Endarterectomy in the Transcarotid Revascularization Surveillance Project,” evaluated patients between 2015 and 2018, with 5,716 patients receiving TCAR compared to 44,442 patients receiving carotid endarterectomy with 5,160 patients in each group analyzed using propensity score matching. Key findings for TCAR compared to CEA included: 59% lower odds of in-hospital myocardial infarction; 87% lower odds of in-hospital cranial nerve injury; 35% lower odds of in-hospital stroke, death and myocardial infarction; 26% lower odds of hospital stay longer than 1 day.

With regards to its results from the ROADSTER-2 post-marketing study evaluating real world use of the ENROUTE Neuroprotection and Stent Systems in TransCarotid Artery Revascularization procedures, the study met its primary endpoint of procedural success, defined as acute device and technical success in the absence of stroke, death or myocardial infarction at 30 days, at 97.9%. Significant findings from the study showed TCAR to have low rates of 30-day major adverse events. In addition, ROADSTER-2 showed lower rates of acute and permanent cranial nerve injury than is typically observed for patients receiving carotid endarterectomy, the current standard of care.

JPMorgan has stated, “The take-home message is that TCAR has the lowest stroke rates and a short and safe learning curve.”

Switching back to the conference call, management highlighted that in the quarter, there were approximately 2,000 TCAR procedures performed (above the 1,876 procedure projection). These procedures were performed by both new and experienced physicians in new and established hospital accounts and in new and established sales territories. “In short, we remain on track toward our commitment to deliver in excess of 8,000 procedures in 2019, as we continue to expand our commercial footprint and train new physicians.”

As they look towards the second half of the year, they remain on track for their full year guidance to train approximately 500 new physicians, which would bring accumulative trained physician base to approximately 1,250 by year-end. They are also on track to end 2019 with approximately 35 sales territories.

Analyst Commentary

BMO Capital – Analyst Joanne Wuensch would comment that Silk Road continues to make progress with 2Q19 revenue of $14.9M (up 92% Y/Y) translating to ~4.5% of the total carotid artery interventions performed in the quarter, representing an increase from 2.4% Y/Y and 4.0% Q/Q. Further, management commentary would indicate that not only is TCAR taking share in the CAS and CEA market, but there are anecdotal examples of patients entering the procedural pool.

Stifel – Analyst Rick Wise said that looking ahead, they see the company’s unique TCAR procedure as still being at the very earliest stage of penetrating/converting a large established market (CEA) with still substantial room for meaningful physician uptake (both established and new), and the opportunity for both label and market expansion.