Behind The Numbers – Texas Roadhouse (TXRH)

As most are probably aware, Texas Roadhouse is the owner, operator, and franchisor of Texas Roadhouse and Bubba’s 33 restaurants, both operating within the casual dining segment. It owns and operates over 550 restaurants across the U.S. and three countries, including over 90 franchised restaurants.

Shares are off by over 10% following the release of its Q1 earnings after the close yesterday:

-EPS of $0.70 vs $0.81 estimate – Miss

-Revenue of $690.6M vs $694M estimate – Miss

-Company Comps increased 5.2% vs 5.5% estimate – Miss

-Company Revenue of $685.1M vs $688.5M estimate – Miss

-Restaurant Margin of 17.9% vs 18.8% estimate – Miss

-Operating Margin of 8.8% vs 10.1% estimate – Miss

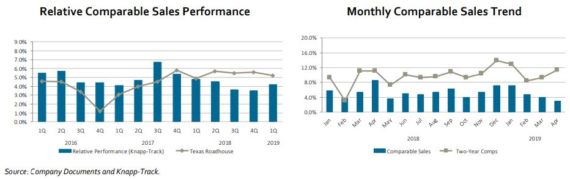

Taking a closer look at sales trends, total revenue came in at +10%, while comparable sales increased 5.2% at company-owned restaurants, slightly below analyst estimates of 5.5%, with these results composed of +2.6% traffic and +2.6% average check growth. Meanwhile, domestic franchise comps were strong at +4.3%. These results continued to outperform the industry, exceeding Knapp-Track by 420 bps with traffic 360 bps better. According to BTIG Research, two-year stacked comps increased 10.1% in the quarter, decelerating from 11.4% in 4Q18, but still showing very healthy trends.

Chief Financial Officer Tonya Robinson, on the call, would unfortunately highlight that for the quarter restaurant margin decreased 128 bps to 17.9% as a percentage of total sales compared to the prior year period. “The change in margin was primarily driven by increases in cost of sales and labor. Cost of sales as a percentage of total sales increased 7 basis points compared to the prior year period. The benefit of a higher average tax was more than offset by the impact of approximately 1.8% commodity inflation and the impact of a shift to higher price, but lower gross margin menu item.”

In addition, she would mention that total sales were negatively impacted by approximately $1.5M as a result of higher gift card fees net of gift card breakage income. “Increased gift card sales during the fourth quarter of 2018 led to higher redemptions and resulting fees, which impacted restaurant margins by approximately 18 basis points. We expect these higher gift card sales to have an impact on restaurant margin of approximately 10 basis points for all of 2019.”

Finally, in the Q&A session, the company was asked about its commodity/beef outlook. Management would respond that regarding the full commodity basket, they are about 50% locked in, which apparently is a little bit more than where they were at the beginning of the year. From an ASF (African Swine Flu) perspective, they feel good about the impact on pork prices for 2019, but they admit it could be more impactful heading into 2020 while they say it may have more of impact on ground beef, but a lot remains to be seen.

In a post-earnings note this morning, BMO Capital highlights that TXRH realized 1.8% commodity inflation and expects the headwind to accelerate to 3% in 2Q before moderating in the back half of the year.