Behind The Numbers – The Lovesac Company (LOVE)

The Lovesac Company (LOVE), the furniture retailer that sells Sactionals and Sacs, reported its Q4 earnings yesterday which resulted in a 20% pop in the stock:

-EPS of $2.03 vs $0.54 estimate – Big Beat

-Revenue of $196.2M vs $174.3M estimate – Beat

-Comp Sales of +50% vs 24.5% estimate – Big Beat

-Sactional Net Sales increased 56.8%

-Sacs Net Sales increased 12.6%

-Accessories Net Sales increased 81.5%

The company did cite a decrease in gross margin percentage of 200bps over the prior year period, primarily driven by an increase of approximately 480bps in total freight costs, which includes inbound and outbound freight, tariff expenses and warehousing costs. Fortunately, CFO Donna Dellomo would comment, “And the good news is that with the redundancies in our supply chain and distribution network, we had no degradation in CSAT scores or customer delivery times. In addition, we saw higher product margin as a result of less promotions, better leveraging of our warehousing and outbound freight costs than projected.”

Other topics of conversation on the conference call included:

Touch Points – Management said its showrooms continue to be an important part of their omnichannel touch-point strategy and continue to deliver strong results as reflected in “our quarter four showroom comp of plus 72.6% or plus 95.1% on a 2-year comp basis.” Appointments continue to play an important role in the shopping experience. “And during quarter four, we conducted more than 3,200 appointments, which was a 25% increase over quarter three.” COO Mary Fox would mention the strength of the Costco (COST) business, where they’re hosting online roadshows directly on costco.com. They have seen productivity increases year-over-year driven by an expanding premium cover and Lovesoft offering that have also significantly expanded product margin year-over-year. They also continue to be excited about the partnership with Best Buy (BBY), as they opened 16 additional shop-in shops in the quarter.

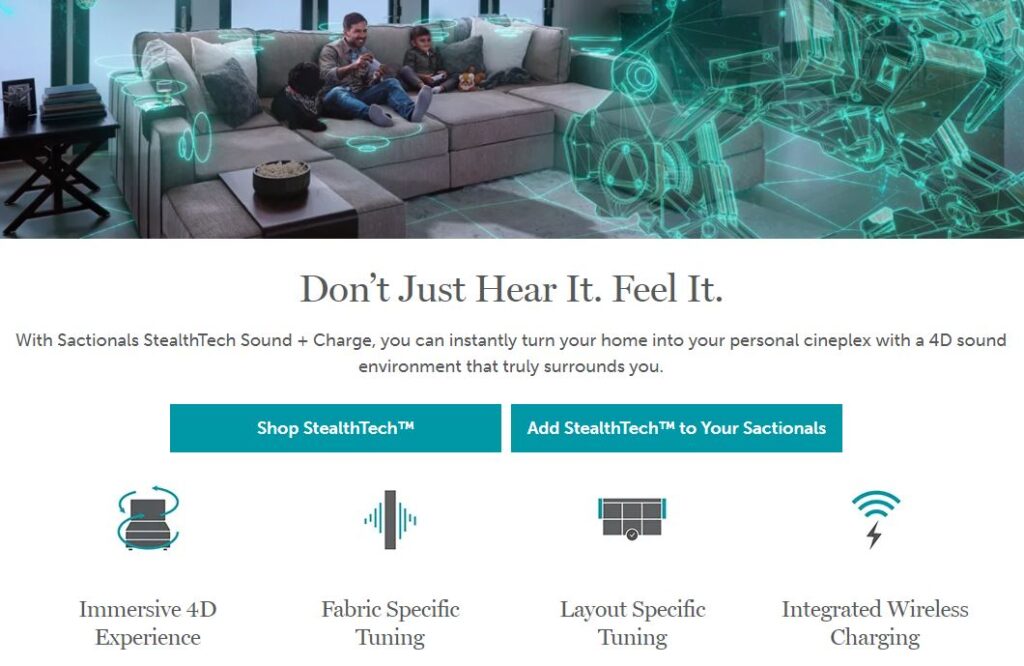

Product Innovation – When I last covered this name in Conversations late last year, I discussed their latest product called StealthTech, speakers embedded and hidden inside Sactionals. Management would say on the call, “We continue to be very pleased with the launch of StealthTech, and it is meeting our internal expectations. The only element that has been different to our plan is the customer demand on satellite side per transaction is higher than we had anticipated, and we are actively getting back in stock on this item. The launch generated activity of over 1 billion impressions and was a great jump start to the product launch. Since launch, StealthTech has demonstrated the ability to accelerate Sactionals AOV by over 700 basis points as well as overall brand preference even for those who are not buying StealthTech.”

Marketing – The company reported +64% Y/Y growth in advertising and marketing spend. Management said in fiscal ’22, their customer lifetime value was $2,840, and their customer acquisition cost was $548.74, delivering a ratio of 5.17, which was their highest level yet and up 10% Y/Y. “Broadcast indication was rolled out for the holidays after successful local testing during Memorial Day and Labor Day, which resulted in a 25% increase in overall TV reach. In addition, we have expanded into TikTok and Snapchat, which has resulted in more efficient CPMs that we continue to expect through fiscal ’23. Lastly, we ran a premium placement for the first time. This placement was around the NFC and AFC Championship games, and we saw significant performance that drove over 30 million impressions that translated into traffic to The Lovesac website.”

Analyst Reaction

Stifel analyst Lamont Williams said Lovesac is well positioned heading into FY23 with a healthy inventory position, numerous levers to offset gross margin degradation, and demand momentum stemming from new product innovations and strong performance from recent marketing initiatives. They would raise their estimates for Q1 and FY23 following the company’s better-than-expected outlook, while their target price rises to $110.

DA Davidson analyst Tom Forte raised his price target to $135 from $111 saying the company has been able to reach consumers faster than competitors while allocating marketing spend judiciously, thus benefiting from timing, execution, and marketing decisions during the pandemic. He adds that Lovesac has benefited from its inventory and supply chain management throughout Q4 while delivering product to customers at a best-in-class rate.

BTIG Research analyst Camilo Lyon raised his price target to $118 from $113 saying the company’s Q4 results were “superb,” driven by strong revenue growth and far less gross margin contraction than expected. He adds that Lovesac’s showroom revenue grew an “impressive” 60%, allaying any concerns about the impact of omicron on in-store traffic during the quarter.