Behind The Numbers – Vapotherm (VAPO)

Officially debuting last November, Vapotherm is a global oxygen treatment company focused on the development and commercialization of its proprietary Hi-VNI® Technology products that are used to treat patients of all ages suffering from respiratory distress.

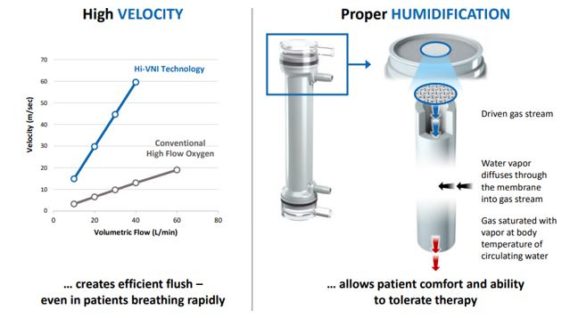

“Our Hi-VNI® Technology delivers noninvasive ventilatory support by providing heated, humidified and oxygenated air at a high velocity to patients through a comfortable small-bore nasal interface. Our Precision Flow systems, which use Hi-VNI® Technology, are clinically validated alternatives to, and address many limitations of, the current standard of care for the treatment of respiratory distress in a hospital setting.”

As I type this, shares are lower in today’s session by 6% after reporting its Q1 earnings:

-EPS of ($0.76) vs ($0.78) estimate – Beat

-Revenue of $12.3M vs $11.98M estimate – Beat

-Revenue increased 14.5% Y/Y

-Capital Revenue (Product & Lease) increased 8.5% Y/Y

-Disposable Revenue increased 19.2% Y/Y

-Gross Margins of 42.1% vs 39.5% Y/Y

CEO Joe Army, in the press release, would say, “We drove top-line growth and exceeded our gross margin expectations. We expanded our body of clinical data and our new product development projects are tracking to plan. For the rest of 2019, our focus will be to drive adoption of Hi-VNI Technology and leverage the momentum we continue to build with the expansion of our salesforce and focus on the Emergency Department (ED). We are also excited about the potential future launch of multiple new products, including IntellO2™ (which BTIG notes is not in their model yet), and its compelling clinical data showing the value of our Hi-VNI Technology versus the current standard of care.”

**A recent clinical trial showed that the company’s IntellO2 module for its Precision Flow system greatly improved the chances of keeping premature babies in the target oxygenation range. “The prospective, multi-center, controlled, order-randomized crossover trial demonstrated that using the IntellO2 module helped clinicians maintain newborns in the physician-prescribed oxygen saturation range 80% of the time, compared with 49 % for manual control alone, the company said in a statement. The study was published in the Archives of Disease in Childhood: Fetal and Neonatal Edition.”

Capital Revenue – In the Q1 report, Vapotherm announced that it had sold and leased 324 and 141 Precision Flow units in the U.S. and International markets, respectively, bringing their total installed base of Precision Flow units to 10,713 and 3,846 units in the U.S. and International markets, respectively.

While this segment increased 8.5%, it came in below analyst expectations by $600K – $800K, depending on which note you read. BAML notes that the company placed the same number of new capital units as they had expected, selling 324 in the quarter in the U.S., but VAPO sold no replacement units in the quarter. “We normally expect to see ~100 replacement units sold per quarter. This is not a significant issue in our view as the timing of replacements could be lumpy and the normal friction associated with adding a high number of new reps could have temporarily slowed replacements.”

Salesforce – Another topic investors should be paying attention to going forward surrounds its sales reps. BAML noted that growth would have been higher in the quarter if not for some normal friction related to salesforce expansion. However, this should subside throughout the back half of the year as the new reps that were hired in Q4 begin to mature, the company onboards new territories, as well as continuing to place PF+ units. Analyst Bob Hopkins believes the VAPO story is on track and continues to view the VAPO pipeline as one of the most attractive in small cap medtech. In addition, BTIG Research analyst Sean Lavin thinks the decision to hire more experienced medtech sales reps instead of B2B reps, the revision in sales territories, and rep distraction—are understandable and make sense to drive sales in the long run. He expects future expansions to be smaller and for tenured reps to be more familiar with the process going forward.