Behind The Numbers – Vocera Communications (VCRA)

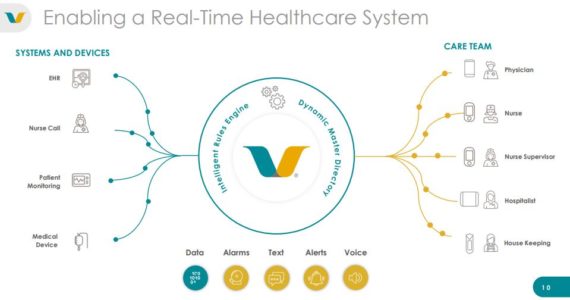

Vocera Communications, whose mission is to simplify and improve the lives of healthcare professionals and patients, while enabling hospitals to enhance quality of care and operational efficiency reported Q2 earnings after the close yesterday:

-EPS of $0.07 vs ($0.01) estimate – Beat

-Revenue of $44.8M vs $43.49M estimate – Beat

-Total Revenue increased 4.9% Y/Y

-Total Product Revenue increased 6% Y/Y

-Total Service Revenue increased 3.7% Y/Y

-Q3 EPS Guidance of $0.14 – $0.22 vs $0.26 estimate – Miss

-Q3 Revenue Guidance of $48M – $52M vs $54.62M estimate – Miss

Several analysts have already issued post-earnings notes, including:

Cantor Fitzgerald – Analyst Steven Halper lowered his price target to $36 from $40 and reiterated an Overweight rating on the shares. Based on company commentary, the analyst believes a handful of contracts did not sign, but he notes that Vocera has received verbal commitments. With delayed signings, the company reduced its 2019 revenue guidance by about 3% at the mid-point of the range. The analyst, though, still expects a stronger second half of 2019.

William Blair – Analyst Ryan Daniels recommends buying shares of Vocera Communications today on any material weakness. The company last night reported “relatively solid” Q2 results, however, management modestly updated its 2019 guidance, reducing its sales forecast by about $6M, or 3%, at the midpoint of the range. He attributes this to the timing of several larger enterprise bookings. This is merely a timing issue, as the company has good visibility into closing these deals, just later than anticipated. While the stock likely will sell off modestly on the guidance reduction, the risk profile is actually lower now, and management alluded that the new guidance is somewhat conservative.

Taking a closer look at the conference call, there was plenty of healthy discussion on the company’s Badge product and Engage software.

CEO Brent Lang would highlight that from a bookings perspective, the company added new facilities and saw healthy Badge refreshes and expansions with existing customers. One strategic win was at Hoag Hospital where the company already had a large Engage installation. Hoag is expanding their use of the solution from Engage to the full platform on smartphones. In international, Latifa Hospital in Dubai is expanding the use of their solutions to its physician staff. They also added two aged care facilities in New Zealand.

Regarding awareness around the new product, the CEO stated that while they continue to believe the shift in Smartbadge will be gradual, they are seeing orders start to come in. As an example, the University of Virginia ordered Smartbadges for their emergency department and thoracic cardiovascular ICU. Last year, UVA expanded from a single department installation of Vocera’s voice solution to the full platform. In their purchase of the Smartbadge, they were particularly excited about the dedicated panic button and expanded screen size and they are looking forward to adding integrations over time. Customers seem excited about the larger screen and the ability to receive patient context on a wearable device. “We believe the Smartbadge has the potential to accelerate our software revenues in the long run with the greater attach rate of our Engage software. We are still in these early days of introduction and some of the conversations about the Smartbadge are leading to more involved investigations about how Engage can handle clinical workflow.”

Meanwhile, “Go-Lives” during Q2 was busy, with one notable deployment being Northwestern Medical’s Lake Forest and Marianjoy hospitals. Northwestern is moving away from in-building wireless phones and is adopting Vocera’s Engage software, analytics and smartphone application to connect physicians and staff across multiple hospitals and different EHRs. And another new deployment during the quarter was at the Alaska Native Medical Center, which is using the company’s products to improve staff safety.

Other Growth Areas

Finally, management would mention two other areas where they are investing for growth:

-First is the new version of Vocera Care Experience that was launched in Q2. “This entirely cloud-based SaaS offering includes the next generation of our rounding solution and our post-discharge patient communication platform called Care Inform, both of which are now closely integrated with the rest of our platform.”

-The second area of investment is international, where during the quarter, they hired new leadership for both their Canadian and Australia-New Zealand sales teams. They have also invested in marketing resources and programs to bolster their international sales efforts.