Bluegreen Vacations (BVH) – Taking Ownership

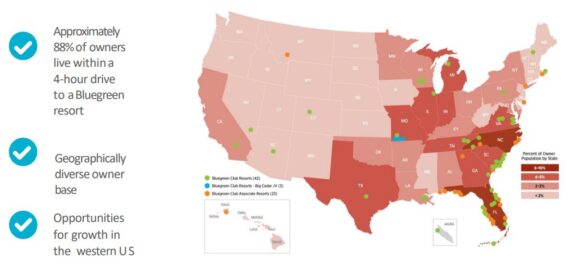

Bluegreen Vacations (BVH) operates as a vacation ownership company which markets and sells vacation ownership interests (VOIs) as well as manages resorts in leisure and urban destinations. Its resort network includes 45 Club Resorts (resorts in which owners in the Bluegreen Vacation Club have the right to use most of the units in connection with their VOI ownership) and 23 Club Associate Resorts (resorts in which owners in the Vacation Club have the right to use only a limited number of units in connection with their VOI ownership). These Club Resorts and Club Associate Resorts are primarily located in high-volume, “drive-to” vacation locations, including Orlando, Las Vegas, Myrtle Beach, Charleston and New Orleans, among others. Per the company’s recent 10-K filing, the average Vacation Club owner is 48 years old and has an average annual household income of approximately $83,000.

VOI sales are typically generated by attracting prospective customers to tour a resort and attend a sales presentation. Bluegreen’s sales and marketing platforms utilize a variety of methods to attract prospective customers, drive guest tour flow and sell VOIs in its Vacation Club. Bluegreen utilizes marketing alliances with nationally-recognized brands, which provide access to venues which target consumers generally matching Bluegreen’s core demographic.

Last month, the company announced its first quarter results in which it posted total revenue of $195.1M, an increase of 33% from last year, system-wide sales of VOIs of $151.5M, an increase of 42% from last year, and $31M in EBITDA. These metrics easily beat analyst estimates of $170M in total revenue, $122M in VOI system-wide sales, and $23M in EBITDA.

B. Riley analyst Mike Crawford highlighted that BVH generated these results on the back of nearly 49K total guest tours, 7.5K transactions, and a $20,226 average sales price per transaction, driving a $3,115 Value Per Guest, Bluegreen’s best in two years. “Each metric topped our model: tours, transactions, conversion ratio, ASP, and VPG, which we were pegging at 45k, 6.8k, 15.0%, $18,000, and $2,700, respectively.”

Further, boding well for future growth, BVH in Q1 booked what B. Riley believes is an industry-leading 43% of VOI sales to new customers, who on average in subsequent years will purchase 1x-2x the amount of vacation points purchased initially, and with these follow-on purchases generally the highest margin in the industry. Moreover, Bluegreen achieved these results in a Q1 that not only is the seasonally weakest in the year but also was hampered by sales center staffing challenges at the beginning of the period.

“As such, we continue to project a robust 2Q and remainder of the year and raise our estimates accordingly, carrying our FY22 VOI sales, revenue, and EBITDA projections from $659M, $794M, and $136M to $712M/$842M/$149M, respectively.”

Separately, Truist analyst C. Patrick Scholes was out with a Vacation Ownership note on May 13th recapping the industry’s earnings calls, highlighting that management teams laid-out some very encouraging statistics on how the rest of the year is pacing for customer demand. “At a high-level, rising inflation is a net positive for the vacation ownership model as increasing hotel and home rental rates create an even more compelling value proposition for existing and potential customers. We see this subsector the best positioned in our greater lodging leisure coverage universe to take advantage of the recent pull-back in share prices via share repurchases given recovered balance sheets and strong free cash flows.”