BMC Stock Holdings (BMCH) – Pro Sales and Oh, Canada!

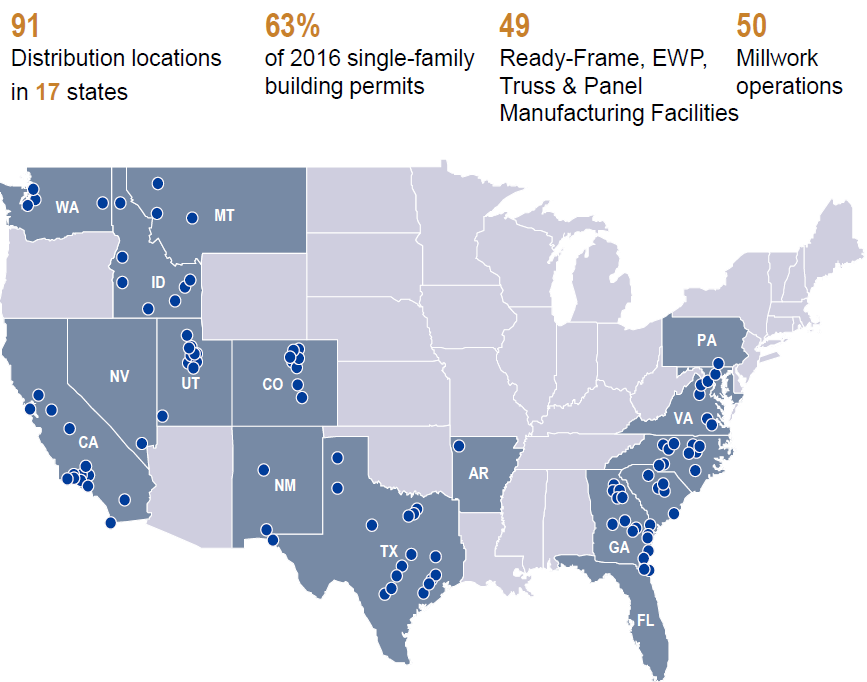

BMC Stock Holdings INC. (BMCH) is a leading provider of lumber and building materials (LBM) and solutions to new construction builders and professional remodelers in 17 US states and 42 metropolitan areas. Aside from lumber and sheeting materials, the company also offers millwork, doors, windows, structural components, floor and roof trusses and wall panels. They also provide services, such as design, product specification, installation and installation management. Furthermore, they manufacture trusses, stairs, pre-hung doors and to round it off, they can provide a range of installation services and special order products.

Following the housing crash in 2009, the company, then known as BMHC, filed for Chapter 11 “voluntary” bankruptcy while all locations remained operational. They completed their financial restructuring a year later to emerge with re-located headquarters and under the name BMC Select.

During 2015, BMC acquired VNS Corp in April and followed up shortly thereafter in August by buying Robert Bowden Inc, both Georgia-based companies for undisclosed amounts, increasing their market exposure to the state. Between these two transactions, they merged with Stock Building Supply in an all-stock transaction worth $1.5 billion, placing the newly formed entity as the 3rd biggest Pro Dealer in the LBM industry (at the time).

To date in 2017, BMCH has acquired two companies, one in Dallas, TX, and the other in Washington, D.C. Both bolt-on expansions will increase market share in their respective locations.

2016 Results

BMCH had a very sound 2016, aside from Houston TX, and late-year California markets.

- Total net Sales grew by 10.5% to $3.1 billion

- Expanded adjusted EBITDA by $60 million and Margin by 170 basis points (bp)

- Generated $107 million in cash from operating activities

- Achieved $31 million in savings through synergies (previous M&A)

- SG&A costs declined 100bp to 18.5% of Net Sales

Their cash generation enabled them to fund their acquisitions (VNS and Robert Bowden) without issuing new shares, and also helped further reduce debt. There are further savings expected from past synergies to the tune of $15 – $21 million for FY2017 and additional savings of $7 million due to refinanced long-term notes at lower interest rates. The company also introduced their transactional website in 14 markets driving significant growth with remodeling contractors.

In reference to California, heavy rains during the last calendar quarter and early 2017 have affected construction activities which are expected to abate and resume normal course as the weather returns to normal, drier state. Houston’s market, from which BMHC derives approximately 15% total yearly net sales fell 3bp to 12%during 2016, brought on by the energy sector’s decline from late 2014. However, management is happy to point out that entering 2017, the rate of decline has already begun to abate and their expectation is that this will continue over the next several quarters.

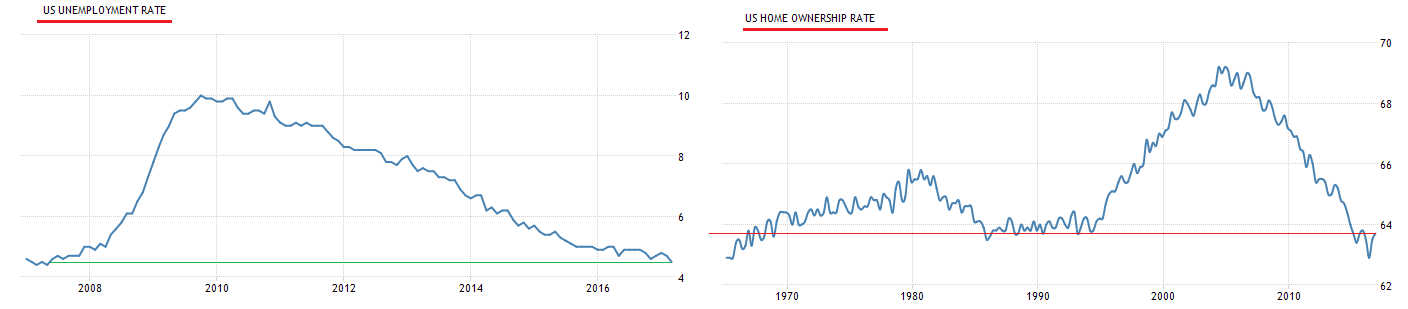

Overall, the CEO and company view is that new single-family homes and remodeling/renovating construction markets are to continue expanding, helped by strong consumer confidence levels, low unemployment and inventory levels and favorable demographics.

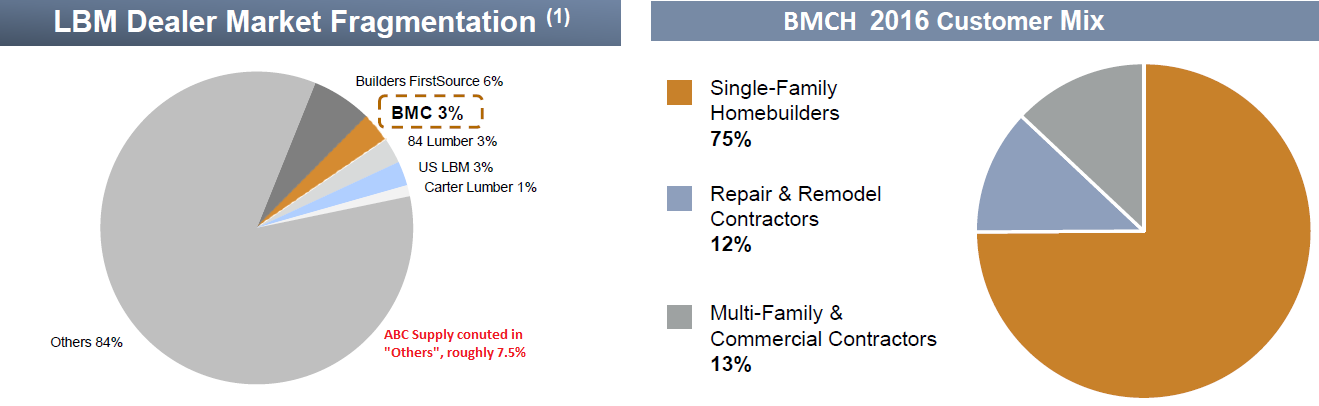

Fragmented LBM Market

In the Pro Sales sector, BMCH maintains the #3 spot in Total Net Sales (2016), behind privately held ABC Supply and publicly traded Builders FirstSource (BLDR).

For the top 100 Pro Sales dealers, representing ~$42 billion of the market, the top 10 companies account for nearly $29 billion in sales. Comparatively, Home Depot (HD) sold $6.8 billion in Lumber during FY2016, however they cater to Do-It-Yourself and Do-It-For-Me (customers who buy materials but have someone else do the work) segments, along with Pro clients. BMCH customer mix is 75% Homebuilders and 25% Contractors.

This high fragmentation offers ample opportunities for market share growth through bolt-on, established regional companies which BMCH management has indicated they are always looking for.

Oh, Canada

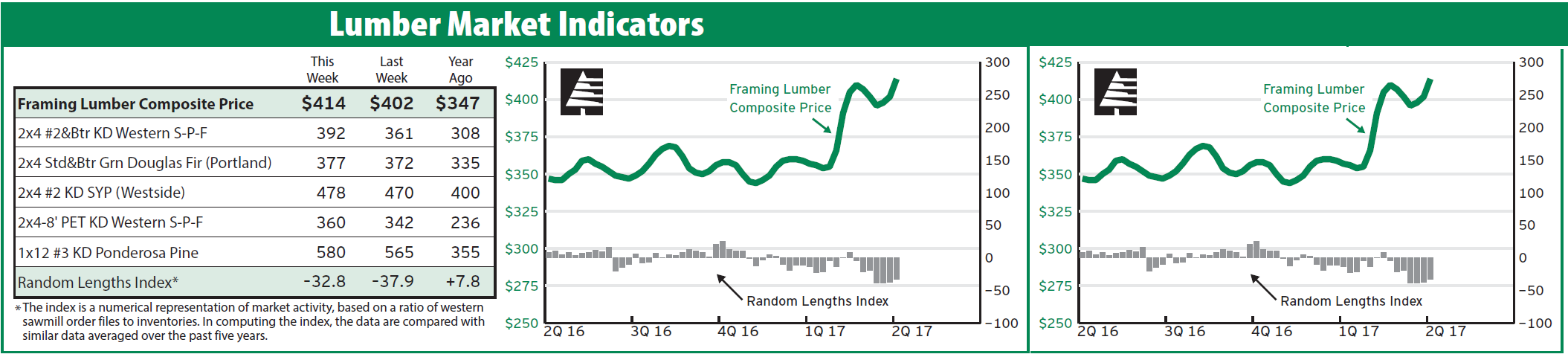

Since early 2017, random length dimensional lumber and structural panel prices have increased 15-25% in anticipation of anti-dumping duties that are expected to be levied on Canadian imports. In mid-April, The U.S. Department of Commerce postponed its deadline for preliminary anti-dumping duties on Canadian softwood lumber to June 23rd; however, the decision on countervailing duties is still expected to be released next week. The two duties combined will most likely be big enough to hurt Canadian producers, and if they are higher than expected, that will push lumber prices higher.

The U.S. doesn’t have enough domestic softwood lumber to meet its own housing demand, and higher prices stemming from duties will be passed on to consumers.

Enter Ready-Frame

Unique to BMCH, Ready-Frame is a whole-house solution that enables builders to frame a house 20% to 30% faster with less labor, significantly less weight, and under safer conditions. Instead of buying all the lumber, along with overages for the inevitable wrong measurements and cuts, the builder supplies all the details for framing dimensions, openings and whatever other detail that is needed to frame all of a dwelling’s partitions, and BMCH though their software and equipment will pre-cut all the necessary framing to within 1/16th of an inch tolerance, number it sequentially in order of build, package and deliver to the work site ready for assembly. Even with the associated charge for all this service, it still ends up benefiting the contractor, as along with lower material costs, there is less manpower required to cut, frame and assemble the structure. Here’s a short video from the company comparing traditional versus Ready-Frame building.

Ready-Frame has been gaining in popularity, although it represents just 1% of the company’s revenues at $103 million at the present time, it is expected to keep growing and reach around $300 million by 2020. There are some other factors aside from cost savings that could help this service grow: the lack of available workers due to lower overall unemployment, and tighter scrutiny around undocumented workers which traditionally have made up a large part of the construction industry’s work force.

Unemployment has dipped below 5%, last seen in late 2007, resulting in a tight labor market. With the majority of construction workers having transitioned to other jobs since the housing crash, there is less of a pool available to hire from. Compounding the issue are Trump’s as-of-yet undisclosed policies on undocumented residents and illegal workers in the US which could be causing some reluctance from employers to hire. Whatever the case may be, the worker shortage is real.

The Bureau of Labor Statistics estimates that there are 150,000 unfilled construction jobs across the US, nearly double the number five years ago. Metropolitan areas like Miami, Dallas and Denver are particularly affected causing delayed projects and raising costs.

A January survey by the Associated General Contractors of America found that 73% of firms had a hard time finding qualified workers. More firms identified worker shortages as a big concern (55%) than any other issue including federal regulations (41%) and lack of infrastructure investment (18%). Demand and salaries for subcontractors, for example carpentry and bricklaying, are rising very rapidly.

Final Observations

BMC Holdings’ largest client base is Single-Family home builders, the very segment that is expected to have a healthy, solid 2017 as market trend has shifted from multi-family units. With single-family dwellings, there are more windows and walls (as opposed to shared walls of townhouse or multiplex style homes), benefiting BMCH in more than one department. With the cost savings from ReadyFrame, increases in customer numbers are likely to stay strong and provide a helping hand to margins. Combined with all the data – low home ownership numbers, increasing consumer confidence, low interest rates (despite the forecast increases) and lower existing home inventory availability, the beneficial scale appears to favor BMC Holdings’ side.