Canadian Natural Resources (CNQ) Oil Sand Overachiever

*All prices except for Crude Oil/WTI and Technical Observations are in Canadian Dollars*

Operating largely in Northern Alberta’s oil-rich areas, Canadian Natural Resources (CNQ) is one of Canada’s largest energy companies by revenue, and the largest by oil and gas production volume. CNQ trades on NYSE and TSX with a very liquid 1.069B share float as well as Options on both sides of the border.

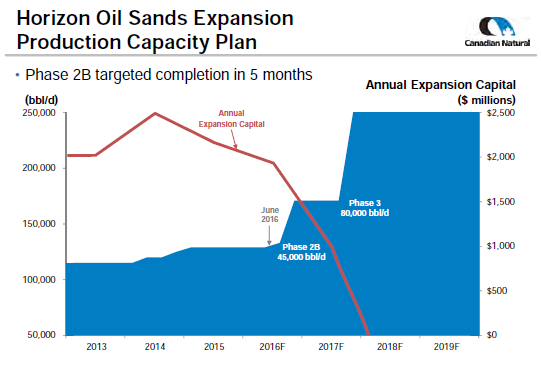

Horizon Expansion

Horizon oil sands expansion is nearing its next completion phase which will add 45,000 bbl/d to production in 4Q16. The final phase of completion is slated for 4Q17 and that will add another 80,000 bbl/d. Once complete, production life- rate will be 250,000 bbl/d for approximately 40 years.

Just north of Fort McMurray AB, the Horizon fields produce high quality synthetic crude oil (SCO). CNQ holds extensive leases there with 3.6 billion barrels of proven and probable SCO reserves. Further phases of expansion could potentially bring the capacity to 500,000 bbl/d.

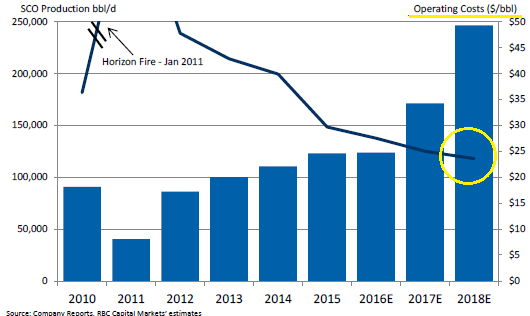

Low Production Breakeven Costs

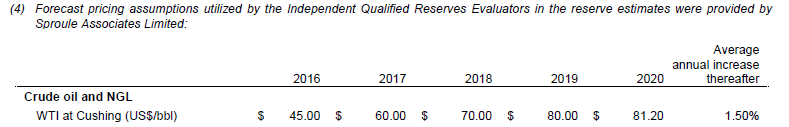

Once Phase 2B is completed in 2018, CNQ expects production costs to be below $25/bbl. Industry estimates for WTI are for $60/bbl in 2017 and 2018, although these numbers get revised periodically.

Expansion Spending Wind-Down

Horizon’s costs are projected at $1.9 billion in 2016, $1.0 billion in 2017 and dropping to zero in early 2018.

Healthy Dividend Payout

CNQ pays out a quarterly dividend of $0.23, yielding 2.5%. The company has never cut its dividend, one of the very few exceptions to the trend that saw a multitude of energy producers slash their dividends over the past year to preserve operating cash flow to remain operational.

Dividend CAGR over the past five years has been 25%, just over triple in dollar terms (or cents?) from $0.30 to $0.92. RBC Captial estimates a dividend increase to $1.00-$1.10 by the end of 2018.

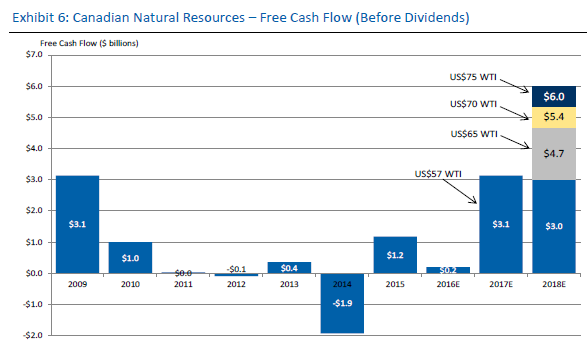

Free Cash Flow

2015 fcf was $1.2B, 2016 should finish with $200MM. In 2014 fcf was negative due to purchase of Devon Energy’s (DVN) assets for $3.1B.

RBC Capital forecasts fcf of $3.1B and $3.0B for 2017 and 2018 respectively, and notes that the company’s main objective is to improve their balance sheet and pay down debt. Dividends, further development and acquisitions round out the list.

Fcf forecast takes into consideration an average $57 WTI price. CNQ presentations use a slightly higher forecast.

Other Projects

- Pelican Lake, another field in north Alberta, produces 51,000 bbl/d and is expected to peak at 60,000 bbl/d in 2016. Costs have been reduced from near $13/bbl to $6.25/bbl. The shallow crude oil pool was estimated to contain 4.1 billion barrels of oil and a 2P reserve life index of 21.3 years. Extraction method is polymer flooding.

- West African oil production is 29,000 bbl/d with 31,000 mcf/d of natural gas.

- North Sea production adds another 24,000 bbl/d of oil and 36,000 mcf/d of natural gas.

There are other projects currently producing oil and natural gas in Alberta, and many that are awaiting development.

PrarieSky Royalty Shares

In November 2015, CNQ sold its royalty production to PrairieSky (PSK.to) for $1.8B, $680MM in cash and 44.4 million PSK shares. In early June, distributed 21.8 million of those shares as dividend. The remaining shares have a market value of nearly $540MM which the company plans to deploy at some point in the future, either as a liquidity lever or yet another dividend.

North West Redwater Upgrader

In February 2011, CNQ entered into a 50/50 joint venture partnership with North West Upgrading, a private entity, to build, manage and operate a new bitumen refinery Northeast of Edmonton. Starting in 4Q17, Phase one of the project will process 50,000 bbl/d of bitumen, 37,500 for the Alberta Petroleum Marketing Commission (APMC), and 12,500 for CNQ.

To learn more about our approach and how you can become a successful trader, sign up for 2 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

Recent Analyst Ratings

- June 14th RBC Capital raised pt $43 to $50, Outperform rating

- May 6th TD Securities raised pt $37 to $38, Hold rating.

- May 6th Desjardins raised pt $35 to $36, Hold rating.

- April 15th CIBC raised pt $40 to $47.

- April 15th Barclays lowered pt $37 to $36.

- February 7th National Bank Financial downgraded from Outperform to Sector Perform.

Recent Options Activity

US market

- June 15th: 500 December 32 calls bought at ask

- June 14th: 3,000 December 34 calls bought mostly at ask

- April 20th: 900 September 33 calls bought at ask

Technical Observations

Shares have recently pulled back about 5% after a 100% rise and have dropped slightly below the steep uptrend line. MACD could come down a little more. Support at $28.46.

Final Thoughts

There are many more reasons to like Canadian Natural Resources: growth potential, rising cash flow, capital spending reduction, deleveraging of balance sheet and dividend payouts are just some of the key reasons. Add to that the entire energy sector’s convincing rebound since crude’s February bottom, plus industry analysts’ forecasting WTI to balance around $60/bbl, and it gets very hard to look past CNQ’s potential.