Caustic Prices – Another Leg Higher?

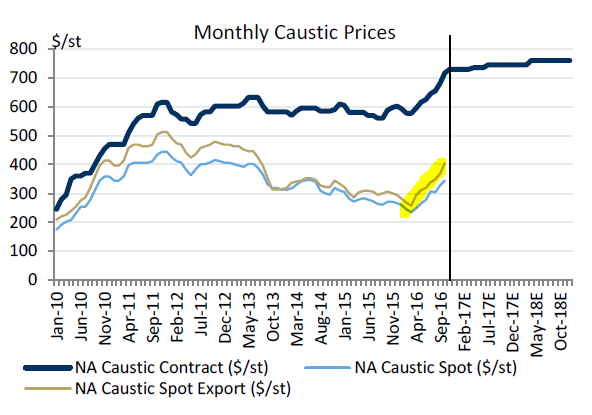

IHS is showing Bullish industry numbers this week for Chlor-Alkali markets; November Caustic spot prices were up $20/ton, and contract prices up $5-15/ton.

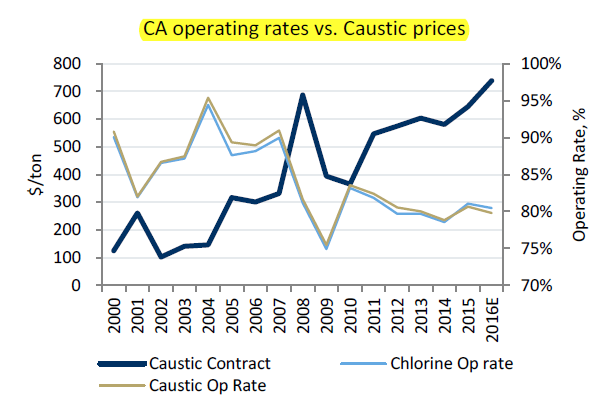

Current lower than expected operating rates, strong export and steady domestic demand, and forecasts of continued low inventory levels are helping support higher pricing with analysts anticipating caustic markets to remain tight into the first quarter of 2017. Helping along are coal and oil rising faster than natural gas, although caution is warranted with the latter’s price as a turn higher can offset benefits.

Another factor helping North American pricing is reduced exports of Chinese production, in part from planned or unplanned outages, coupled with their increased domestic offtake requirements for rayon and alumina manufacturing. Net US exports increased 50% YTD (through September) compared to last year. Outside of China, supply/demand remains balanced; North American demand is steady-to-seasonally weak, otherwise steady outside of the West Coast. On the downside, India’s need is expected to stall from their recent currency control actions.

Based on the above factors, RBC Capital is increasing price targets for two of the top-three producers: #1 ranked Olin (OLN) and #3 ranked Westlake Chemicals (WLK).

- OLN price target is revised to $30 from $25, based on increased EBITDA of $10M. This should come from two channels, caustic increases and lower ethylene prices.

- WLK target is raised to $68 from $62, again on caustic pricing. However, they do mention WLK’s net short position on ethylene could be disadvantageous, as could higher ethane prices. Both stocks are rated Outperform.