Colony Northstar (CLNS) – RevPAR and Occupancy Tracking Strong

Colony Northstar (CLNS) is a US-based, $7.9 billion market-cap REIT which has a global portfolio and no malls in its holdings. Primarily, the company operates in three core segments: Healthcare, Industrial and Hospitality.

TriParty Merger

In January, Colony North Star was formed through a merger between Colony Capital (which CLNS used to operate as), NorthStar Asset Management Group and NorthStar Realty Finance. Colony’s original operations date back to 1991.

Colony Northstar’s 1Q Funds From Operations (FFO) were $0.31, $0.04 below consensus expectations with the company being in a transitional stage form the 3-company merger. Management and analysts remain optimistic while the newly formed entity goes through a period of consolidation with asset dispositions, adjustments and integration process.

Last quarter Colony Northstar sold off several assets totaling around $1.2 billion with management having said they will continue to sell off portions of the merged businesses that are outside of the core segments they want to concentrate on. Some assets that were divested of included an 18.7% joint venture that was in their healthcare portfolio, their entire manufactured housing business and 50% of their ownership interest in Colony Starwoood Homes. For the remainder of 2017, another $1.0 billion in assets are earmarked for monetization which will free-up capital for reinvestment.

Investment Operations

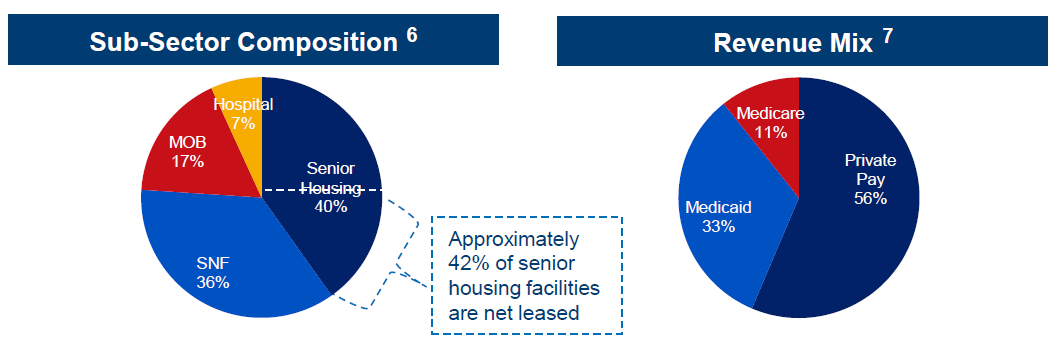

Healthcare – Diversified over 425 properties that include seniors’ housing facilities, medical office buildings hospitals and skilled nursing facilities with over 24,000 beds/units that during 1Q showed a 86.8% occupancy rate. Revenues for the same period topped $138 million; geographically Indiana has the highest number of properties at 56.

Industrial – With a 96% leased-rate, total square footage in 353 buildings is 39 million square feet generating $57 million in 1Q revenues. Located in 15 US cities (Atlanta 20% and Dallas 19% being the 1-2 spots), the portfolio’s total value exceeds $2.5 billion, has 900 tenants of which not one represents greater than 1% in rent and has a nicely staggered lease expiration setup with less than 16% rolling out in any given year.

- 74% Distribution & Warehouse

- 23% Manufacturing

- 3% Offices & Retail Showrooms

Hospitality – This segment is comprised of 167 hotels in 26 US States that exclude most of the Midwest and Northern portions. Highest concentration is in touristy destinations of California (19%) and Florida (19%). 1Q2017 occupancy rates were 70% with an average RevPAR of $89 for its 22,091 rooms, generating $175 million in revenue. Hospitality is 95% branded with Marriott (MAR) and Hilton (HLT) hotel chains and provides 87% upscale lodging services.

Lodging Sector – Recent channel checks have shown a strong start to 2Q during Spring break followed by weakness through June and a sharp acceleration as summer holidays began. RevPAR was up 6.8% for the last week of June, occupancy +3.8% and average daily room rate +2.8% for the same period. Overall growth for the quarter is 2.6% which while down from 1Q expectations, still remains strong. Both Marriott and Hilton are expected to benefit from RevPAR growth, lower US corporate tax structure, share repurchases (MAR) and margin expansion (HLT).

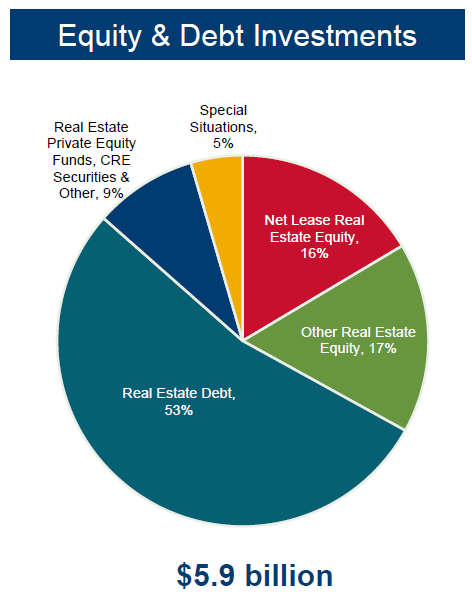

Equity and Debt Investments Business

Colony Northstar derived 29% of its revenue from this segment in 1Q – the $6 billion portfolio is primarily comprised of real estate debt in the form of mortgages and loans from global locations.

Management is also exploring a “potential third-party permanent capital plan” for their debt and equity investments business. As this is still in its early stages, there did not elaborate any further in specific details beyond saying it may be a “separate, permanent capital vehicle”, which may mean a separate mortgage REIT outside of the present one.

Investment Management

At 10% of 1Q revenues, this segment consists of $41 billion in 3rd party assets under management (AUM).

For 2017, they have targeted $2 billion in new capital in funds raised and, up to the last quarter’s earnings time-frame, nearly half of that target was already achieved with the company remaining positive, reporting strong momentum in both the institutional and retail channels.

Analyst Coverage

Coverage by analyst firms is very light with only three firms providing research.

- RBC rating it at Outperform with a $20 price target

- Wedbush rates it at Outperform with a $17.25 price target

- JMP Securities rates shares at Market Perform

RBC analyst commented that he sees valuation as being “very modest” at 8.7x 2017 core FFO adding that their 7.4% dividend offers significant income, helped along by a strong buy-back program.

Options Activity

Options are relatively active, however they often carry a very large bid/ask spread. Of interest, the most recent meaningful transaction was on July 12th when a Bullish trader rolled 2,000 September 14 calls into 2,000 January 15 calls, paying $0.45 on a bid/ask spread of $0.35 to $0.50. There are also 1,800 calls in September 15 open interest, mostly bought on June 26th.

Final Observations

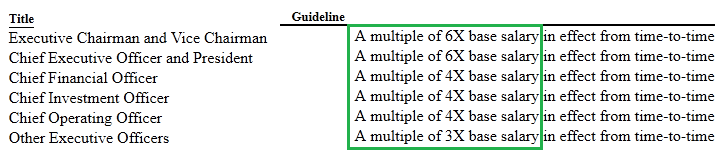

Aside from its very attractive yield, the management team itself owns an appreciable amount of shares and the company has heavy institutional holders. A strong, $300 million share buy-back program is still in place with $168 million completed, mainly in open-market transactions: this is expected to remain aggressive, as, according to company filings, management is expected to hold a significant amount of company shares based on their position in the company.

Colony Northstar reports earnings on August 8th. Due to the transitional period, management expects some near-term disruptions to their financial results. Moving forward, they do anticipate that the company will end the year with a “significantly improved and simpler balance sheet and earnings profile“.