Columbus McKinnon (CMCO) – Blueprint for Growth

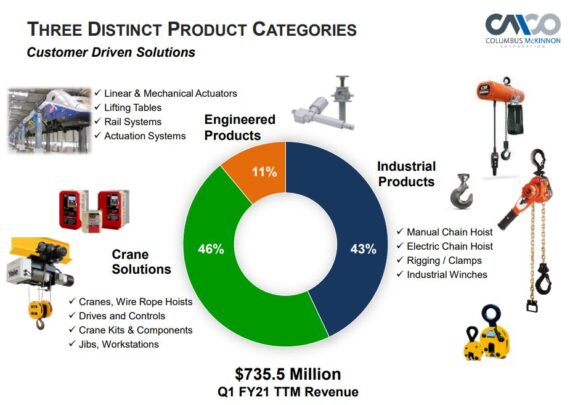

As mentioned this morning in Conversations, Columbus McKinnon (CMCO) is a global designer manufacturer of motion control products and automated systems and services that move, lift, and position materials across a variety of industries. The company operates through two main segments:

46% of Revenue comes from Crane Solutions (Cranes, Crane Kits, Jibs)

43% of Revenue comes from Industrial Products (Electric Chain Hoists, Manual Chain Hoists)

If we break it down even further, we can see that the company has exposure to a number of different industries: General Industrial at 25%, Rail at 10%, Automotive at 10%, Energy/Utilities at 10%, Construction at 5%, Heavy OEM at 5%, Elevators at 3%, Mining at 3%, Government at 3%.

On July 30th, the company reported its Q1 earnings:

-Q1 EPS of $0.07 vs $0.00 estimate – Beat

-Q1 Revenue of $139.1M vs $135.15M estimate – Beat

-Sees Q2 Revenue of $150M – $160M vs $154.85M estimate – In-Line

As one could probably guess, demand was severely impacted by COVID-19. This was not a surprise to the company either as they expected first quarter fiscal 2021 revenue of approximately $130M – $140M, which actually finished at the top-end of their previous guidance.

Looking ahead, management indicated it was seeing a rebound in orders, which they said were up approximately 25% through July driven by their projects business while their monthly short cycle orders were up in the mid-teens. Their expectation for the second quarter this year is for revenue to be in the range of about $150M – $160M. At the midpoint of this guidance, revenue would be up about 12% from the trailing first quarter.

With regards to the industries the company operates in:

-The utility market is improving as projects come back to life. The hurricane season in the Southeast and Gulf Coast region should also help demand.

-The North American automotive market has improved.

–Commercial construction is expected to pick up this quarter. Projects in the Middle East and Asia are continuing to move forward.

-Orders in the rail business were up nearly $2M, an 86% increase Y/Y. Quote activity has remained solid as well.

-Finally, they see opportunities in this market with their ProPath system, as manufacturers look at ways to provide additional lifting capacity for moving components within workstations in order to provide sufficient distance between employees. “In fact, our ProPath could be a great solution in a large variety of workstation environments across multiple industries.”

Blueprint for Growth

“Our Blueprint for Growth strategy, and specifically our 80/20 Process and operational excellence initiatives, have improved our business model and better enable us to perform in a significant recession.”

Per DA Davidson’s initiation note, under former CEO Mark Morelli’s leadership, CMCO formally launched its Blueprint for Growth (BFG) Strategy at the beginning of calendar 2018. BFG championed the multiyear evolution and transformation from a material handling company to more of an industrial technology enterprise and “Partners in Motion Control,” focused on solving complex, high-value problems for customers.

Based on commentary from the earnings call, management is focused on the next round of strategic work as they prepare to advance Phase III activity in the BFG strategy.

“The final portion of BFG, Phase III, targets portfolio management, including defining and identifying inorganic growth opportunities through a prescribed and formalized corporate development effort focused on two key, aforementioned themes: being a lifting specialist and smart movement technology provider (including IoT). These objectives are believed to expand CMCO’s TAM by ~$400M-$500M and ~$350M-$600M, respectively, and would also leverage CMCO’s engineering ability and complement legacy offerings in faster growing markets, some of which have less cyclicality. While the company appears open to more sizable M&A opportunities that could be more transformational in nature, in the more immediate term, we expect it to manage the balance sheet fairly conservatively amidst COVID-19 while also seeking to establish a M&A track record under current leadership via the execution and successful integration of deals that would likely be considered more bolt-on in nature.”