Constellation Brands (STZ) Pullback Presenting Buying Opportunity

Constellation Brands (STZ) delivered strong 4Q16 results on April 6th. The company reported adjusted EPS of $1.19, beating Street analysts’ consensus estimate of $1.14. Constellation Brands has exceeded analysts’ earnings estimates for the past six quarters.

Earnings Highlights

- Adjusted EPS for FY2016 was $5.43 and company forecast their FY2017 EPS at $6.05-$6.35.

- Net beer sales y/y grew 9% from $6028.0MM to $6548.4MM, while net wine & spirits segment grew 3% from $2839.4MM to $2925.8MM.

- Organic growth for beer sales increased 13% while wine & spirits remained flat due to negative currency impact.

- Net non-GAAP fcf was $522M and the company projected fcf for 2017 at $250-$350M due to ongoing expansion expenses.

- Increased quarterly dividend by 29% to $0.40 per share Class A and $0.36 per share Class B common stock.

Constellation Brands is the #1 brewer and seller of imported beer in the U.S. market, and the #3 brewer and seller of beer overall. During 2016, their beer business outperformed key U.S. industry competitors, achieving depletion growth of more than 12%, led by Modelo Especial, the fastest-growing major beer brand in America, achieving depletion growth of nearly 20%.

Their best-know brand is Corona beer, which they acquired from Anheuser-Busch (BUD) in 2013.

In fiscal 2016, Constellation acquired Meiomi, a major luxury wine brand in the U.S., and craft brewer Ballast Point.

Other highlights from the past year

- Continued to dramatically expand brewery production capacity in Mexico.

- Building new brewery and glass plant in Mexicali, Mexico, initial capacity 10 million hectoliters, with ability to expand to 20 million.

- Planted 1,200 acres of new sauvignon blanc vineyards in their highly successful New Zealand wine business.

- Progressing to double production capacity at their main Marlborough (NZ) winery.

- In May 2016, acquired The Prisoner Wine Co.’s portfolio of brands.

Increasing Wine Segment

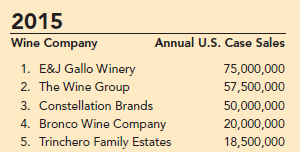

Constellation now manages 19 wineries in the U.S. and is the largest publicly traded company in terms of annual wine case sales with 50,000,000 in 2015. Over the past few years they have acquired premium, fast-growing high-end wine brands such as Meiomi and Prisone, brands that are trending with Gen X and Millennials. Additionally, they have eight wineries in Canada, four in New Zealand and five in Italy.

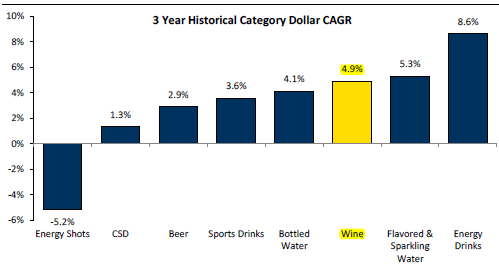

The increased exposure to this segment is appealing due to apparent consumer trends towards spirits; at 4.9% three-year CAGR revenue increase, wine is one of the fastest growing categories in U.S. beverages industry. With ongoing premiumization in the category, increasing millennials’ and per capita consumption, many industry analysts are forecasting for sustainable growth.

In addition to age demographic shifts, sales are increasing for wines priced above $10 and increasing even faster for wines above $15.

According to Wine Business Monthly, 2015 sales for wines in the $15 to $19.99 range had the most growth at 16% by volume. The $9 to $11.99 segment grew 8% by volume; the $12 to $14.99 segment increased nearly 13% in volume; and the more than $20 segment grew 9.5% in sales and 9% in volume. By contrast, RBC Capital estimates that the sub-$10 category will show a 5% overall decrease.

To learn more about our approach and how you can become a successful trader, sign up for 2 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

Canadian Wine Business IPO

Constellation’s Canadian wine business has grown steadily since its formation in 2006. In 2015, revenue was $587.5MM, and it now represents just under 9% of the company’s total annual revenue of $6.5B.

On April 6, along with their 4Q report, the company announced that they are considering spinning off their Canadian Wine segment with an IPO on the Toronto Stock Exchange valued at $1B Canadian, roughly $780 million at today’s exchange rates. Completion is anticipated for Fall of 2016.

There are many benefits to this spin-off scenario.

- Constellation can pay down its long-term debt. Years of acquisitions have left the company with a sizeable $6.8B debt and only $83 million in cash.

- The Canadian business wouldn’t have to compete for resources with other Constellation revenue streams to grow.

- Canadian dollar weakness wouldn’t affect bottom line for Constellation’s quarterly reports.

- The spin-off would represent a good growth opportunity for Canadian investors.

Analyst Ratings

- Evercore price target raised from $180 to $190.

- Stifel price target raised from $174 to $189.

- SunTrust rates at Buy, price target raised from $170 to $180.

-

Pivotal Research reiterates Buy, price target raised from $185 to $200.

RBC Capital rates at Outperform, price target $181.

- Wells Fargo rates at Outperform.

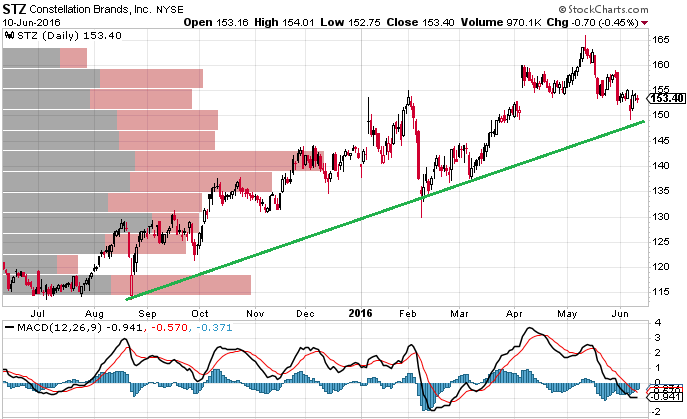

Technical Observations

Shares of Constellation have risen 17% from the 2016 low of $129.90. The peak was $165.81, 7% higher than today’s price. Post-earnings gap up has been filled and long-term support is a bit lower at near $149. MACD has flattened and possibly about to turn up. Option activity is generally light.

Final Thoughts

The recent pullback in Constellation Brands’ shares may be presenting a compelling entry point. Technically, there is room for a further decline of about 5%-7%. Their next earnings report is scheduled to be released pre-market, June 30th.

Given Constellation’s market share in imported beer, major acquisitions of premium and fast-growing brands, combined with industry-wide optimistic expectations for wine sales and demographics growth put the company’s future in a positive spin. Their 40 cent quarterly dividend payout adds another layer of flavor to the mix.