Cryoport (CYRX) – A Rich Clinical Pipeline

Cryoport (CYRX) is a leading provider of cold chain logistics solutions to the life sciences industry. This will be the third time covering this name on the home page (August 2019 and May 2020 being the other two). In addition, we have discussed this in JaguarLive on a number of occasions. Over the last couple of trading days, we have gotten a number of requests to revisit the stock.

Last week, Cryoport reported their Q3 earnings in which revenue came in at $11.2M, an increase of 17% Y/Y and a sequential growth of 19%. The revenue increase, as described by management, was due primarily to growth in biopharma and reproductive medicine markets. Q3 also marked the first revenue generated from another Cryoport-supported recently approved commercial therapy: Gilead’s (GILD) TECARTUS. “While the revenue generated from the therapy was small in the third quarter, it will continue to ramp in the fourth quarter and throughout 2021 along with Bluebird’s (BLUE) ZYNTEGLO, which is expected to launch its commercial activity during the fourth quarter.”

Separately, Bristol Myers Squibb (BMY) recently selected Cryoport to support the potential global launch of liso-cel, which was recently validated by the European Medicine Agency marking Cryoport’s fifth long-term agreement supporting the global commercial launch of a cell and gene therapy, which include KYMRIAH by Novartis (NVS), YESCARTA, TECARTUS by Gilead and TECARTUS by Gilead’s Kite, and ZYNTEGLO by Bluebird. Management added, “I think it’s useful to remember that, we have a deep working relationship with each of these companies and we support each of their clinical pipelines. During this quarter, Novartis renewed its contract with us supporting all their commercial and clinical programs in cell and gene therapy.”

In KeyBanc’s initiation note yesterday, analyst Paul Knight said they believe Cell and Gene Therapies (CGTs) represent the next era of biotechnology. The therapies not only provide cures for conditions like leukemia, but the production and delivery require new advances in technology and logistics. One notable feature is that unlike drugs or typical biotechnology treatments, most CGTs must be stored and shipped at ultra-low temperatures of approximately -150°C or lower. The analyst would add:

“We think the outlook for cell and gene therapy is compelling. The Alliance for Regenerative Medicine estimates that 1,078 therapies are in global clinical trial pipelines relative to only five approved therapies YTD. Cryoport is working with 517 of these clinical trials, and each approved therapy could drive $2M-$20M in potential revenue annually. Former FDA commissioner Scott Gottlieb, M.D. released a statement on January 15, 2019, that the FDA, by 2025, will be approving 10-20 cell and gene therapy products a year.”

BLA Pipeline

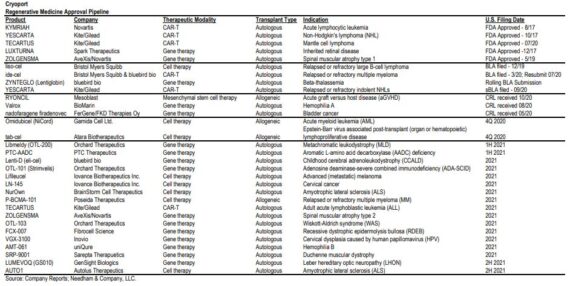

Finally, a total of seven Cryoport-supported marketing authorization applications or biologic license applications have been filed in 2020, and the company expects two more to be filed in the fourth quarter (specifically Atara with their Tab-cel product and Gamida Cell with Omidubicel). Management said they also anticipate up to 21 MAA or BLA submissions for Cryoport-supported products in 2021.

Needham In the table below, detailed anticipated near-term FDA approvals and biologics license application (BLA) filings for regenerative medicine developers and their product candidates. “We see commercial product approvals as the key-catalysts for revenue growth in 2021 and going forward.”