Darden (DRI) to Benefit from Lower Input and Higher SSS

On May 25th, Credit Suisse met with Darden Restaurants (DRI) management and came away with the conclusion that the same-store-sales momentum at Olive Garden and LongHorn Steakhouse brands is sustainable.

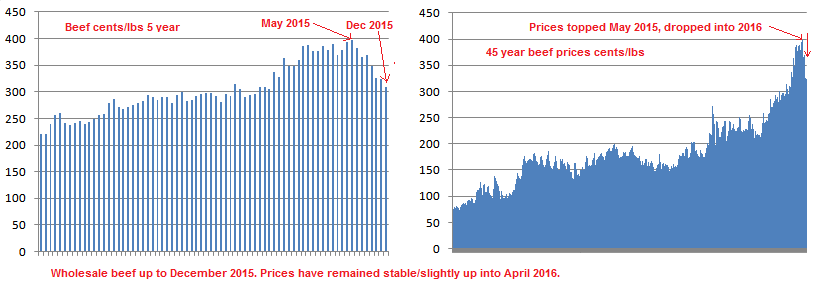

The research firm maintains its February-May (F4Q16) SSS forecasts at +1.9% for Olive Garden, and +2.2% for LongHorn, with a modest bias to the upside. They also maintain their FY17 eps estimate at $4.02, adding that they see a potential upside around SSS, supply chain cost savings and lower beef costs, and a possible improvement to COGS forecast that could add ~10-20 cents to EPS, but caution that these may be partially offset during the Olympics and Elections with higher advertising costs.

The CS report states that DRI has decided to hold back on menu pricing and instead focus on simplified menus, catering (delivery ToGo), everyday value and “staffing values” (report does not elaborate this point) to support their sales and profits. They are launching a major catering promotion this week, “Table Across America”, for which details are unfortunately lacking.

To learn more about our approach and how you can become a successful trader, sign up for 2 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

DRI management thinks they can further optimize their supply chain costs by rebidding with key vendors for better terms, as well as reevaluating their beverage segment’s marketing and purchasing agreements. Competitively, they see internal initiatives such as simplified menus, operations, everyday value focus, and ToGo catering contributing to significant sales and share upside. They do not expect any noticeable impact from the new overtime rules as managerial salaries are mostly over the $47k threshold.

Other Research Firms

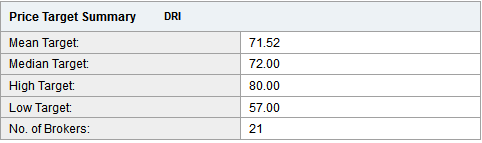

On May 17th Piper Jaffray upgraded DRI to Overweight from Neutral and raised the price target to $78 from $67 citing confidence in the restaurant’s operating model.

RBC Capital has a Sector Perform rating and a price target of $70. Outlining that Olive Garden’s take-out business now generates over 10% of sales which management believes will more than double over time, and that LongHorn had 29% profit growth last quarter, they believe that DRI’s April 5th earnings report and guidance were indicative of further share gains, and that Olive Garden and LongHorn gains have “accelerated against a deteriorating industry backdrop”. RBC also thinks that DRI could either buy back shares or make acquisitions.

Sterne‘s notes from May 31st show that their channel checks for the first half of May suggest that s-s-s for the casual dining industry are tracking slightly positive in the range of +0.5% to +1.0%. Their forecast for May is flattish for the casual diners, and expectation is that restaurant stocks will be range-bound until these numbers turn up. Their favorite casual dining name remains DRI with a Buy rating.

KeyBanc has lower eps estimates than consensus, however on May 27th they did raise their F4Q16 estimate from $1.04 to $1.05 (consensus $1.08), and their FY17E from $3.80 to $3.90 (consensus $3.99).

Consumers benefiting from wage growth, lower gas and beef prices keep seeing value in casual, family-oriented Darden Restaurants’ brands. DRI’s upcoming quarter should continue to reflect the upside of these factors.