Ducommun (DCO) – Focusing on Aerospace Market Growth

Ducommun (DCO) operates primarily in aerospace, defense and industrial sectors and also supplies solutions and products to many other industries including equipment for testing laboratories, Doppler radar simulators, switching matrices for satellite control stations and RF/Coaxial products for application in the harsh environment of outer space, such as the International Space Station.

DCO has been providing the aerospace industry since the pioneering days of Lindbergh, Douglas and Lockheed, long before flying was the commonplace and uneventful occurrence it has become today. Interesting trivia, DCO is the oldest company in California, having had its start in 1849 with a hardware store in Los Angeles.

The Company specializes in two areas: Electronic Systems and Structural Systems.

- Electronic Solutions – Low-volume production of complex electronics required in critical condition applications. This segment includes high-reliability interconnect systems, PC boards and integrated electronic, electromechanical and mechanical assemblies.

- Structural Solutions – Complex structural assemblies and components for aerospace and defense applications. These parts, large and small, are precision formed and finished to customer specifications and requirements.

The product offering list is long and varied, from small push-button switches to large composite airplane tail cones and cargo doors, DCO’s primary markets are the commercial aerospace and defense sectors.

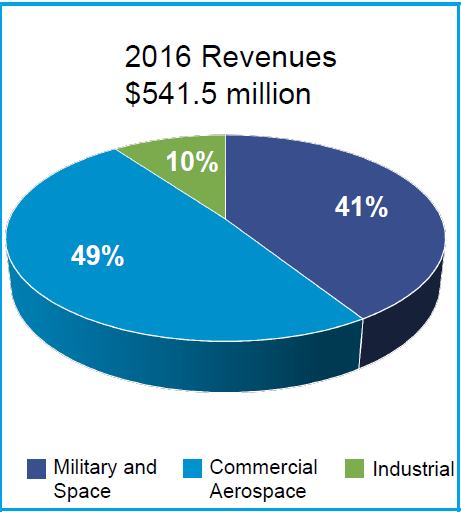

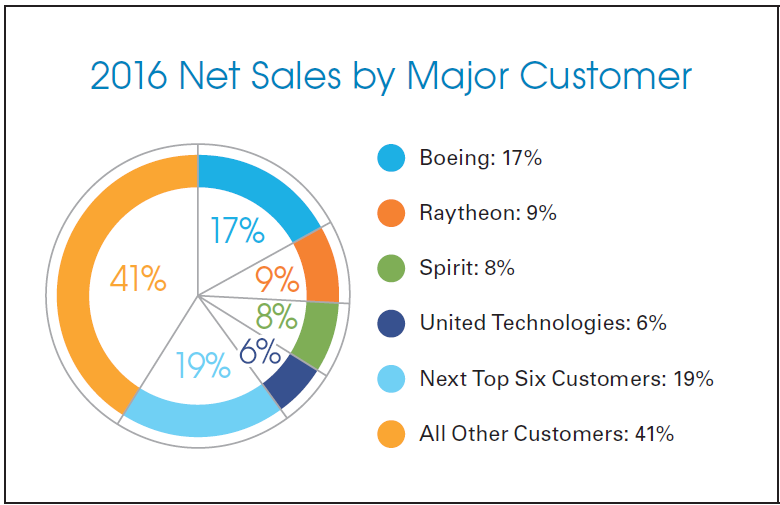

As DCO’s top four customers account for 40% of sales (FY2016), we’ll concentrate on the sectors they represent: commercial and military aircraft and land/sea/air key missile platforms.

The largest segment the company provides content for is airplanes in which their reach is for both structural and electronic devices.

Structural – Components vary from critical surface areas to interior surfaces and include:

- Ailerons, spoilers, winglets

- Tail cones

- Fuselage skins, window surrounds

- Doors, both passenger and cargo

- Engine ducts and exhaust nozzles

The company also provides helicopter components; along with the list above, they manufacture rotor blades for both commercial and military variants.

Electronics – The list here is just as extensive and also applies to commercial and military, fixed and rotary wing aircraft. Partially, they include:

- Avionics systems

- Cockpit controls, including switches and lighting

- Radar assemblies

- Brake and Flight Surface systems

- De-icing systems

Missile Platforms – DCO supplies components for the defense industry. Again, the parts and components list is long with some of the key components being target acquisition and guided missile launch systems, warhead electronics command, control and navigation systems and associated supportive equipment.

Top Customers

Ducommun’s top four major customers are industry-leading, globally operating companies. Boeing (BA) and Raytheon (RTN) manufacture aircraft while Spirit AeroSystems (SPR) and United Technologies (UTX) provide parts and components, OEM and aftermarket.

Other well known companies include Rolls-Royce (RYCEY) and Airbus SA (EADSY), for which DCO has recently gotten some new contracts, on top of existing work.

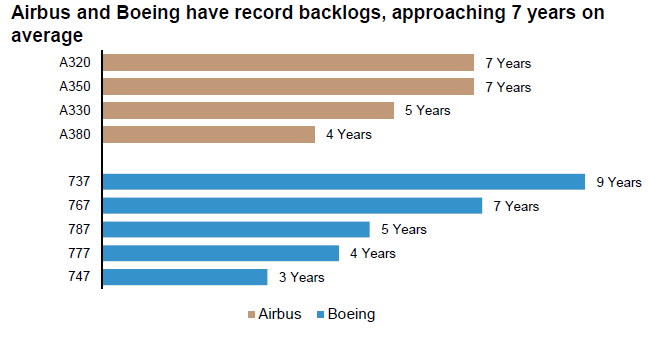

Management forecasts mid-term commercial sales to growth of 4-6% from aircraft and engine build rates. Its exposure to the very successful Boeing 737 and 737Max series could provide it with nearly a decade of work as the manufacturer has a nine-year backlog. The 787 Dreamliner with its most recent variant is seeing favor over larger aircraft and has at least four years of backlog. On the Airbus side, both the A320 and A350 show seven years of backlogs.

Recently, Rolls-Royce signed a $1.7B agreement with Singapore airlines for the provision of an additional 19 Trent 1000 engines, for which DCO builds complex interconnect systems. More directly, in January Airbus awarded the company a multi-year, multi-million dollar contract to produce engine frames and supports for the A320neo’s new engine option, and in mid-November another Airbus deal for switch matrices for use in space was signed.

It should be noted that there is a trickle-down effect, with extended or additional contracts for aircraft or components that the companies dealing with DCO are awarded, work finds its way down the supplier line.

Focus on Aerospace

Management has been restructuring the company to streamline its operations into more core business segments:

- In 2015, they closed an operation in Houston TX that served the company’s oil and gas market, a non-core segment

- In January 2016, they sold a PC card making facility in Pittsburgh PA for $38.5M, it serves the energy market

- In February 2016, they sold their Miltec Corporation subsidiary for $14.6M, reducing exposure to non-core military activities

These asset divestitures are intended to prepare the company for future growth in the aerospace industry as Airbus and Boeing ramp up production of aircraft models that they sell into.

Analyst Coverage

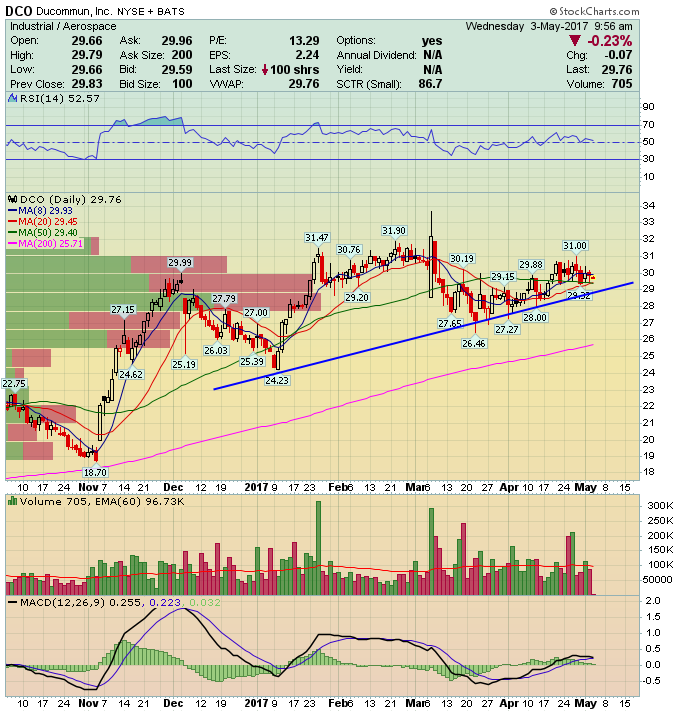

Analyst coverage on DCO is sparse; B. Riley note from May 2nd reiterates Buy rating with a $32.50 price target on easing Defense Budget headwinds and diverse commercial content. On April 11th, Canaccord reiterated their Buy rating and $35 target on deleveraging, sales growth acceleration and expanding titanium business. In March, FBR & Co raised their price target from 30$ to $35 and reiterated Outperform rating (note that B. Riley agreed to acquire FBR in February).

Final Observations

During their last earnings conference in early March, management mentioned they anticipate a more productive second half in FY2017 due to new programs currently under development which may reduce gross margins for the present quarter. Overall, the expectation is for a very productive year with titanium sales growing rapidly (engine support and parts), better cost management from divestitures of units outside of the core business, and debt reduction of $75M in 2016 which in turn reduces interest expenses.

Long-term production in commercial aviation still remains active with multiple sources expecting growth for the next 10 years. To cap it off continued and possibly increased Department of Defense spending as proposed in the US budget could provide some additional sources of contracts for the company, increasing revenues from the military segment.