Earnings Preview – Kroger (KR)

This grocery retailer will be reporting Q4 earnings before the open tomorrow and wanted to share recent commentary as well as recent option flow from our new JaguarScan.

BAML – Analyst Robert Ohmes, on February 27th, said he is forecasting 1.8% identical store sales & $0.52 EPS (in-line with consensus). He sees potential upside to his ID forecast as store remodels (affecting roughly 30% of KR’s store base in F19) are expected to be less of a disruption during the F4Q holiday selling period.

The analyst would also say that Kroger has guided for a similar level of margin compression in F4Q as reported for F2Q (which was -40bps Y/Y), implying 4Q gross margin of 21.5% (vs. their 21.3% estimate). “In the near-term, we believe KR’s merchandising initiatives and continued penetration of higher margin private label could help offset margin pressures from the pull-forward of F20 price investments into F19 as well as rising transportation costs.”

Credit Suisse – On March 4th, they said the setup is similar, in their view, to the one heading into the company’s 2018 Investor Day at the end of October: Consensus expectations are for an eventual material miss versus 2020 EBIT guidance. However, a reiteration of the guide, coupled with 2019 EBIT growth above current consensus, could move the stock higher. Also, any indication of progress within Media and Kroger Personal Finance, in particular, could allay bearish sentiment if commentary around the base business is anything short of discouraging. Finally, Credit Suisse believes outsized fuel profitability is likely to boost Q4 and FY2018 EPS above guidance as well.

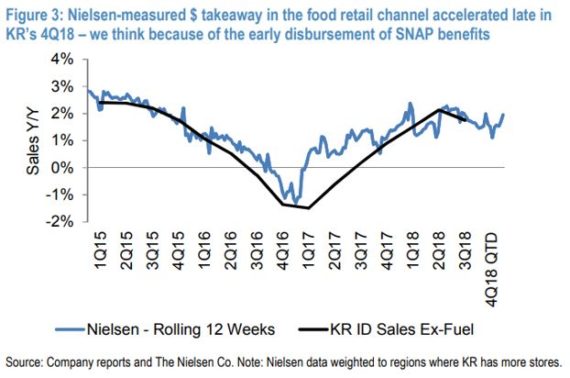

JPMorgan – On February 27th, they commented that per their analysis of Nielsen takeaway data at food retailers, they think Kroger’s ID sales ex-fuel were likely running a bit below the Street’s +1.8% estimate for much of fiscal 4Q18. However, the early disbursement of February’s SNAP benefits seems to have boosted food retail sales – and probably KR’s comps – in the last couple of weeks of its quarter. “As a result, we think KR’s comps are more likely to come in a bit higher than the Street than below (we model +2.0%).” That said, the pull-forward of some of February’s SNAP spending into January could cause Kroger’s 1Q19-to-date comp to trend below 4Q18.

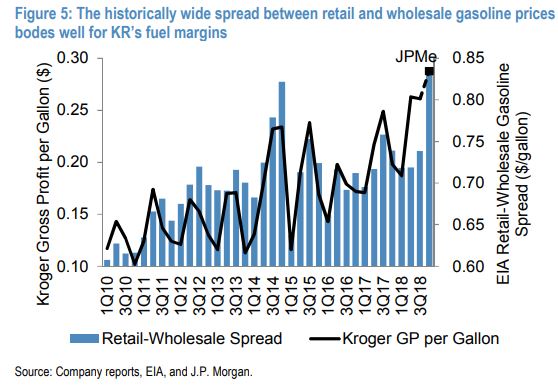

JPMorgan also thinks fuel gross profit per gallon could come in at a record high for KR. They see two key drivers:

1. Retail pricing tends to be less volatile than wholesale pricing, so the crude oil sell-off in late 2018 resulted in a very wide spread between retail and wholesale gasoline prices ($0.92 per gallon in November and $0.84 in December versus an average spread of $0.72 in the preceding 24 months).

2. Kroger’s fuel gross profit per gallon has expanded in recent years relative to the industry. Kroger’s reported fuel GP per gallon has outpaced our regression forecast in each of the past nine quarters, including by $0.05 in 3Q18 and $0.06 in 2Q18.

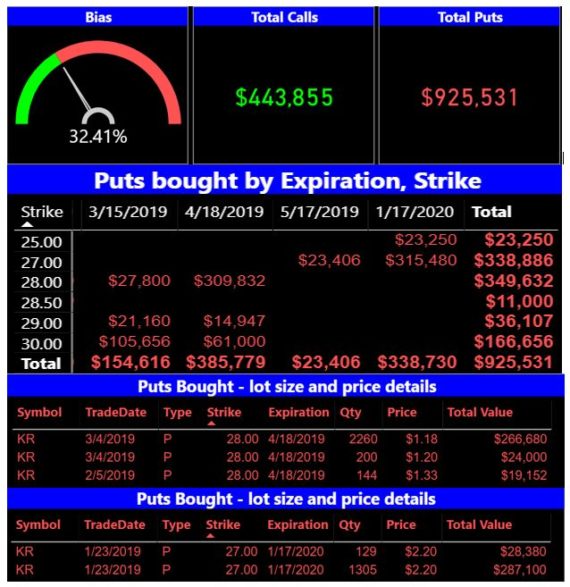

JaguarScan

Finally, if we take a look at recent option flow in JaguarScan, we see that the bias is weighted more toward the bear side, with the biggest $ amounts bought in the April 28 Puts and January (2020) 27 Puts.