Earnings Preview – Ollie’s Bargain Outlet (OLLI)

Ollie’s Bargain Outlet (OLLI), the discount retailer, will be reporting earnings later this week on Thursday after the bell and wanted to provide recent checks ahead of the event.

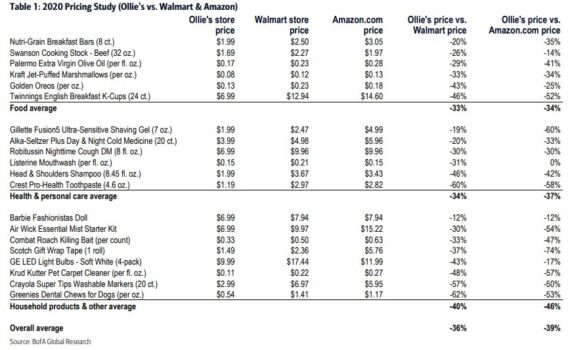

BofA analyst Jason Haas is out with a note today modeling EPS of $0.58 on 15% comps vs. consensus $0.57 on 12% comps. He expects a strong quarter from OLLI following their recent channel checks which found that stores remain well-stocked while many competitors have struggled with inventory shortages. OLLI’s stores were busy and prices remain very compelling vs. mass retailers (Table Shown Below). Meanwhile, OLLI’s closeout offering has been on-point with plenty of face masks, hand sanitizer, cold medicine and cleaning supplies in addition to more discretionary items such as toys, heaters and winter workwear.

Regarding price comparisons vs the competition, BofA found that on average, OLLI’s prices were 36% below Wal-Mart’s (WMT) and 39% below Amazon’s (AMZN). Their pricing study last year, which was conducted at the same stores at the same time, found that OLLI’s prices were 30% below Walmart’s and 29% below Amazon’s. They believe the change from last year is likely due to using a different basket. The large majority of OLLI’s product offerings are closeouts and therefore rotate in and out of availability.

Looking ahead to guidance, they expect OLLI will have a strong Q4 outlook as pandemic-driven buying trends should continue through the holidays. OLLI will lap heavy promos from last year but this may be offset by “Ollie’s Army Night” shifting to a full week.

Turning now to JPMorgan analyst Matt Boss, who earlier this month raised his Q3 comp to +15% on broad-based category strength with the combination of positive transactions (vs. Q2’s +18% transactions) and sequential acceleration in Army loyalty conversion (> 40% average spend) pointing to sustainable market share. Importantly, OLLI’s inventory closeout availability into Q4 remains “plentiful” across both hard goods and consumables/essentials with the pandemic accelerating CEO John Swygert’s strategic in-store inventory reset.

More specifically, their work showed continued strength across both hard goods (food prep / hard home & decor / seasonal / appliances) and consumables with inventory levels adequate across categories exiting Q3. Into Q4, they model +6% comps with a more strategically balanced category mix, annual Ollie’s Army Holiday event planned for 7 days (relative to 1 day in Q4 2019) given social distancing protocol, and favorable Y/Y calendar given two additional Holiday shopping days between Black Friday/Christmas (& 15 days between Christmas and Hanukah this year relative to 3 day spread last year).

Finally, turning our attention to “Ollie’s Army,” JPMorgan’s work points to a healthy combination of traffic/ticket gains in Q3. Specifically, OLLI’s +18% growth in transactions exceeded Dollar Store peers (Family Dollar -11.3%, Dollar Tree -15.9%, and DG down low singles) noting effective direct communication/email marketing with new and existing Army loyalty members to highlight inventory availability and closeout deals across essential products, consumables, and other discretionary goods in stores.

Digging deeper on Army member demographics, members typically spend ~40% more per trip than non-members with management noting a more diversified group of new Army member sign-ups during 1H with new younger shoppers spending on a variety of discretionary categories. “Importantly, our recent work points to initiative driven re-accelerated Army member conversion in 3Q (relative to comps) with 2Q’s spread between comps and new member growth transitory given outsized stock-up demand and limited employee base due to social distancing/cashier constraints.”