Facebook (FB) – 2Q17 Earnings Review

Facebook (FB), the planet’s most popular online social media and networking platform reported yet another strong quarter, surpassing analyst estimates handily and sending shares higher by 7% pre-market on Thursday.

By the numbers, the company reported:

- 2Q EPS $1.32 versus $1.13 consensus estimate

- 2Q Revenue $9.32 billion versus $9.2 billion consensus estimate

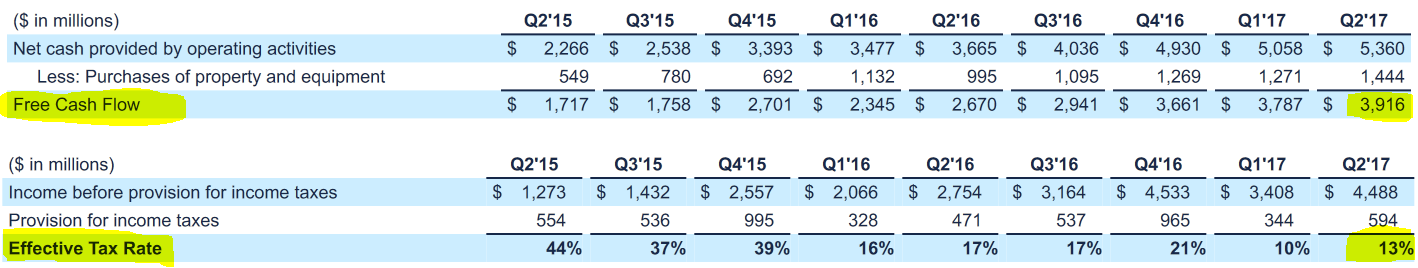

Management narrowed full-year 2017 expense growth slightly from 40-50% to 40-45%, also said they would be accelerating their headcount growth from today’s ~20,000 level, and also ramp up spending in video content. CapEx is expected to be in the range of $7 to $7.5 billion which will contribute to infrastructure expansion to support global growth, including two new building at their New Mexico and Iowa data centers – last quarter, they went online with their Fort Worth location.

Ad Revenue Growth

Facebook derives nearly all its revenue from advertising income and the majority of the revenue is from mobile platforms, 85% versus 15% from desktop. Since 1Q2015, desktop has seen a 1200bps share decline as users progressively embrace Smartphone and tablet technologies – however, due to higher ad rates, the actual dollar amount continues to increase, posting a 26% YoY change this quarter.

Ad Impressions showed a second consecutive quarter of deceleration, from 49% YoY to 32% and now at 19%, however this appears to be from changing ad format fine-tuning and new methods. By contrast, pricing saw an increase of 24% which helped offset the Ad Impressions decline.

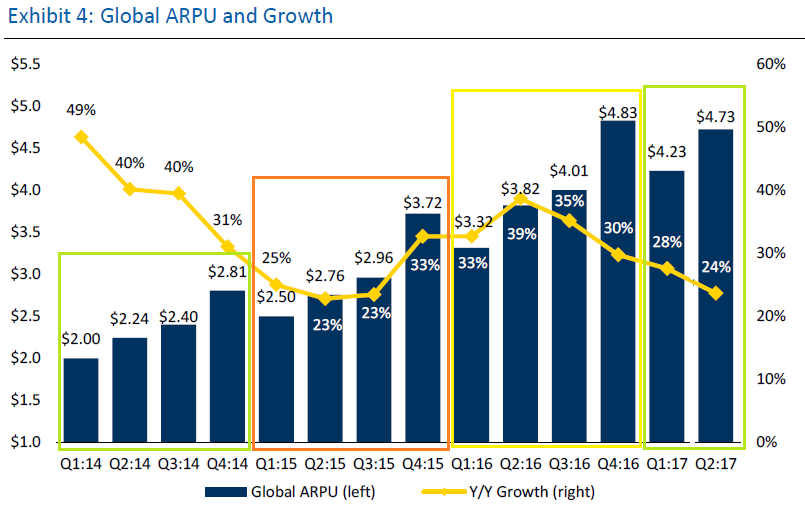

ARPU

Global average revenue per user (ARPU) grew 24% YoY driven by Ad Revenue growth of 25% per user. This is a positive mark which points to advertiser traction combined with Facebook’s ability to monetize additional users and usage. Compared to Google’s (GOOG GOOGL) ARPU levels, Facebook still has plenty of monetization headroom to aim for.

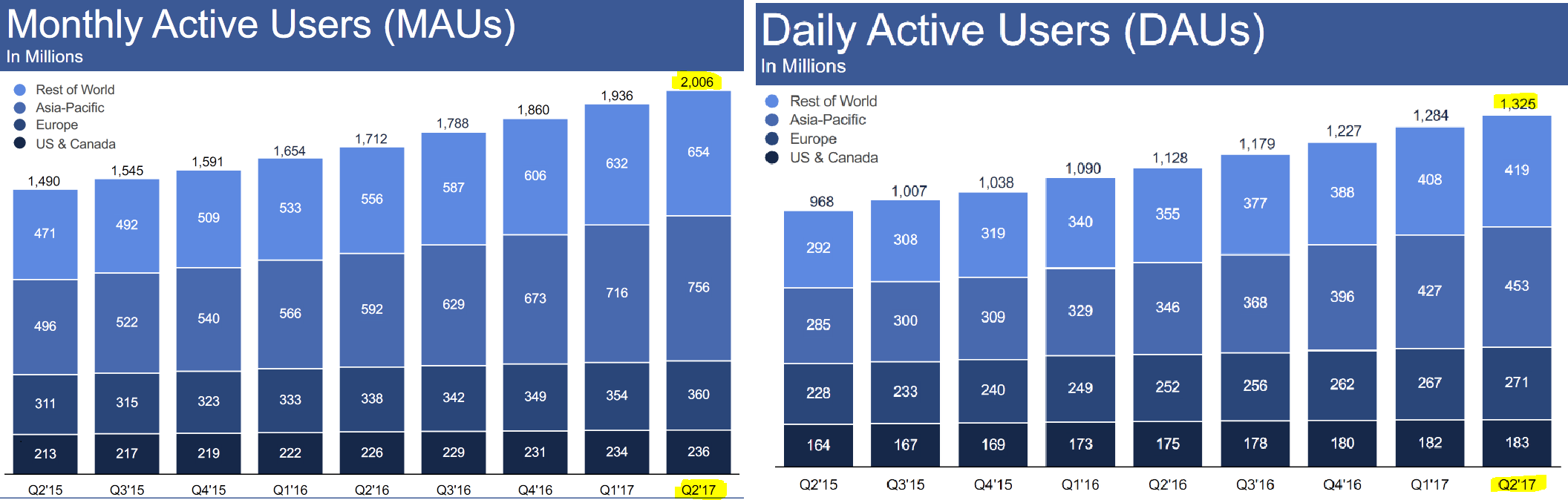

More Friends Than Ever

Perhaps the most looked-at metric, Daily and Monthly Average Users both showed growth. MAU grew by 17% YoY which was the fastest since 3Q2013, bringing the total to 2.01 billion users and above Street consensus of 1.98 billion. DAU also saw 17% YoY growth and sees 1.32 billion members using the website on a daily basis. Engagement levels remained steady from 1Q at 66.1% and seasonally in-line.

The 2 billion-member number does not include Facebook’s other two platforms: WhatsApp with 1.2 billion MAU, and Instagram with 700 million MAU.

Facebook’s MAU represents nearly 27% of Earth’s population of around 7.5 billion people, and this does not include China from where they have been banned from since 2009. For the next billion users, access to the Chinese market would represent a massive opportunity, however to this date all efforts have failed and the dominant social network there remains Tencent’s “WeChat” with around 938 million users.

Monetization Opportunities

There are two platforms that are completely unmonetized: WhatsApp and Messenger, although the later has started showing ads to a small number of people. This is a work in process that may take a few years to fully implement and could eventually have material impact on top and bottom line. Not much more information was given out during the conference call.

Analyst Commentary

Post-earnings, Baird commented the results as being “strong” and reflecting market share gains the benefits of increasing monetization of Instagram, action-based ads and video ad contributions. They maintain their Outperform rating and $163 price target.

Canaccord reiterated their Buy rating and raised price target from $175 to $190. UBS also reiterated their Buy rating and raised their price target from $168 to $190. Deutsche Bank’s price target was raised to $215 from $189 with the comment that Messenger monetization will likely drive the next leg up.

Other firms raising prices are Credit Suisse to $190, JPMorgan to $210, Piper Jaffray to $195 with an Overweight rating and RBC Capital increased their price target from $185 to $195 with an Outperform rating and they keep maintaining Facebook as their Number 1 pick.