HP Inc. (HPQ): Latest Checks and Commentary

HP Inc. is due to report fiscal Q3 earnings on August 30th. Below are the latest relevant checks and commentary on the company from sell-side, industry research firms, and peer management teams. On the whole, they paint a negative picture for 2H (and possibly beyond), especially within personal computing.

Checks from International Data Corporation (IDC)

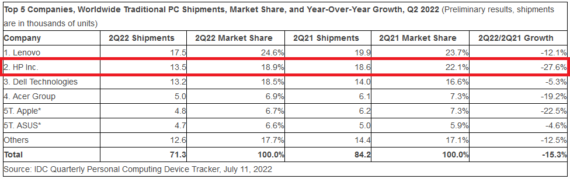

According to IDC’s Worldwide Quarterly Personal Computing Device Tracker, global shipments of traditional PCs declined -15.3% YoY to 71.3M units in 2Q22. The research firm would note that:

“This was the second consecutive quarter of lower shipments following two years of growth. The decline was worse than expected as supply and logistics further deteriorated due to the lockdowns in China and persistent macroeconomic headwinds. With education PC appetite saturating and consumer demand stagnating, the US PC market is staring at another quarter of double-digit decline across most segments. Commercial PC demand is also showing signs of a slowdown.”

By company, IDC’s tracker showed that HP Inc. lost substantial market share over the past year (from 22.1% in 1Q21 to 18.9% in 2Q22) while also seeing shipments drop -27.6% YoY during the latest quarter.

Checks from Gartner

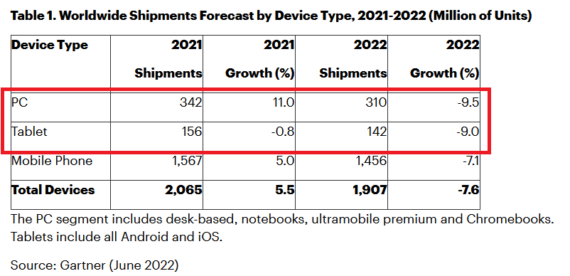

Gartner noted at the end of Q2 that worldwide PC shipments are on pace to decline -9.5% in 2022, the steepest decline of all device segments this year.

“A perfect storm of geopolitics upheaval, high inflation, currency fluctuations and supply chain disruptions have lowered business and consumer demand for devices across the world and is set to impact the PC market the hardest in 2022. Consumer PC demand is on pace to decline 13.1% in 2022 and will plummet much faster than business PC demand, which is also expected to decline 7.2% YoY. From a regional perspective, the EMEA PC market is forecast to record a 14% decline in 2022, driven by lack of consumer PC demand. The Russian Invasion of Ukraine, price increases and unavailability of products due to of lockdowns in China are significantly impacting consumer demand in the region. Overall, global shipments of total devices (PCs, tablets, and mobile phones) are on pace to decline 7.6% in 2022, with Greater China and Eastern Europe including Eurasia recording double-digit declines.”

Evercore ISI downgrade on July 5th

Evercore analyst Amit Daryanani downgraded HP Inc., citing checks that led him to taking down his PC market shipment estimate to 300M units by year-end, vs 325M to 330M previously. Additionally, the company’s shareholder returns (traditionally a supportive factor for HPQ investors) may undergo a haircut due to the ongoing sales and margin compressions:

“We think PC headwinds could get more severe at HPQ and higher inventory levels in a deflationary environment could impede both sales & margins. Any boost from the average selling price is likely to become muted… We believe HPQ could slow down its stock buyback to less than $500M per quarter, down from roughly $1.5B per quarter over the past two years, especially if free cash flow declines.”

JPMorgan on July 14th and August 9th

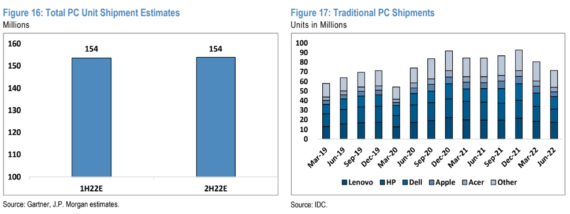

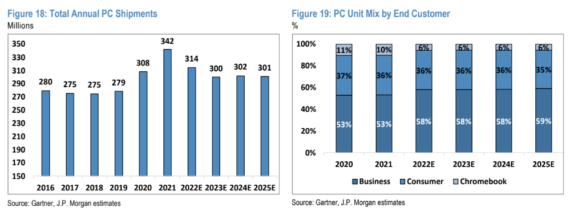

JPMorgan IT/Hardware analyst Samik Chatterjee would forecast on July 14th that “PC units will remain flat in 2H22 vs 1H22, relative to the typical double-digit increase seen from 1H to 2H in a given year”. Chatterjee went on to note that the primary driver of his moderating unit forecasts is the “reduction in consumer demand outlook as well as the increasing macro challenges in Europe, while lapping a strong compare from 2021”. Over a longer-term perspective, the analyst also warned that annual PC shipments are also expected to continue declining in 2023 before staying flat through 2025 (see Figure 18 below).

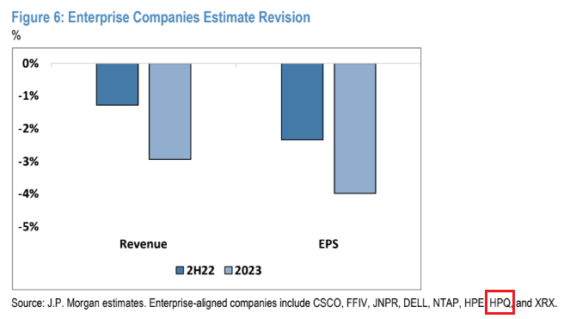

Separately, on August 9th, Chatterjee proceeded to take down his 2023 estimates across the enterprise computing industry, as robust near-term demand from his verbal checks combined with customer hesitation leads him to expect most of the downside next year: “As a result of the robust demand commentary near-term but increasing hesitation around spending intent around the macro, we see the downside risk to estimates to be centered on 2023.”

In the same note, the analyst would go on to add: “For the off-cycle earnings print in late August, we expect increasing indications of a slowdown in Enterprise spending in the coming months and have low expectations from the upcoming report.”

Notable management commentaries from other PC/computing companies

- Nvidia (NVDA) CEO Jensen Huang on August 8th (while pre-announcing July quarter guidance cut): “Our gaming product sell-through projections declined significantly as the quarter progressed. As we expect the macroeconomic conditions affecting sell-through to continue, we took actions with our gaming partners to adjust channel prices and inventory.”

- Micron (MU) announcing a second guidance cut for FQ4 revenue and shipments: “Recently, due to macroeconomic factors and supply chain constraints, we have seen a broadening of customer inventory adjustments. As a result, our expectations for CY22 industry bit demand growth for DRAM and NAND have declined since our June 30th, 2022 earnings call, and we expect a challenging market environment in FQ4 22 and FQ1 23.”

- Logitech (LOGI) CEO Bracken Darrell on July 26th: “Logitech like many other companies, is experiencing the impact of a wide range of overlapping macroeconomic and geopolitical issues. The war in Ukraine directly reduced our net sales about 2% versus last year, as we talked about earlier. Foreign currency headwinds have increased with the dollar strengthening to nearly 1:1. Inflation rose further and consumer confidence has weakened… As we look at the quarter and head into the rest of the year, we believe it’s prudent to take a more conservative view than we had previously.”

- Turtle Beach (HEAR) CEO Juergen Stark on August 8th: “Like many other consumer products companies, our second quarter results were impacted by the difficult macroeconomic conditions, which have slowed discretionary spending across gaming and many other categories. The slump in consumer spending also caused retailers to reduce purchases above and beyond the drops in demand for gaming gear and more than we expected. In addition, high gaming accessory inventories have led to increased promotional activities as retailers and competitors look to bring down inventory levels. Most major gaming categories of spending experienced declines. US retail sales in our core category console headsets were down over 30% in Q2. PC gaming accessories fared a bit better, but were also down over 20%. Major European countries were down even more than the US.”

- Western Digital (WDC) CEO David Goeckeler on August 5th: “Outside of cloud, our expectations for calendar year 2022 demand growth have moderated since our last earnings call. As the fiscal fourth quarter progressed, we saw consumer spending soften, impacting both retail Flash and HDD demand. This weakness has migrated to the PC end market as we enter the second half of the calendar year. In Client, we generally expect PC shipments to decline approximately 10% in calendar year 2022. We are seeing our PC OEM customers aggressively right size their inventory to reflect current demand conditions, which will impact our business in this market in the second half of the calendar year.”

- Acer Chairman Chen Junsheng on August 9th: “Now is not the time to watch the excitement. This is a black swan of the entire PC industry, not a single event. Faced with changes in the prospects of the entire ecosystem, we must deal with it carefully. This is not a problem of a single company, but a problem that the entire industry has to face, from the upstream semiconductor industry, to equipment factories, to the system and customers. Frankly, although the amount of inventory in the second quarter has declined slightly, the turnover days have increased compared with the original 8 weeks due to weak market sales momentum. This is why Acer is now trying to improve and find ways to reduce the inventory by the end of the year. That is still the goal.”

- Intel (INTC) CEO Pat Gelsinger on July 28th: “We are prepared to manage through a slowdown typical of the normal cycles the semiconductor industry has experienced over the last 50 years… As a result of macro weaknesses, we now expect the PC TAM to decline roughly 10% in calendar year ’22, characterized by broadening consumer weakness. Our Q2 PC unit volumes suggest we are shipping below consumption as some of our largest customers are reducing inventory levels at a rate not seen in the last decade.”

- Seagate (STX) CFO Gianluca Romano on July 21st: “While we believe the end-market demand disruptions are temporary, we are mindful of prevailing macro uncertainties. Within the legacy market, revenue was $489 million, down 24% sequentially and 43% year-over-year. The decline was most pronounced in the client PC end market, which now represents a mid-single-digit percentage of our overall revenue. Consumer demand also deteriorated more than anticipated, reflecting the sharp rise in inflation impacting consumer discretionary spending.”

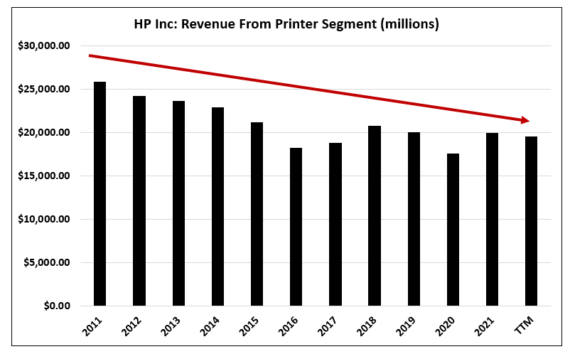

Lastly, as an aside, HP Inc.’s Printing segment (~32% of total revenue) remains in secular decline