InflaRX (IFRX) – Waiting to SHINE

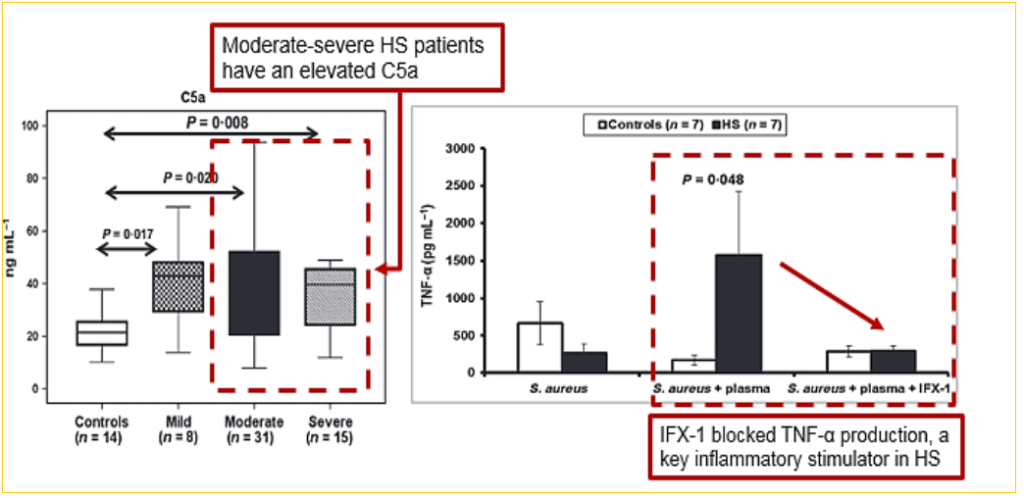

Based just outside of Munich, Germany, InflaRx (IFRX) was founded in 2007 with the objective of focusing on the role of C5a and C5aR in certain diseases. C5a is a gene that attracts inflammatory cells and, along with its receptor C5aR, activates system-protecting cells enabling the release of enzymes to fight immune function inhibiting or tissue damaging foreign organisms.

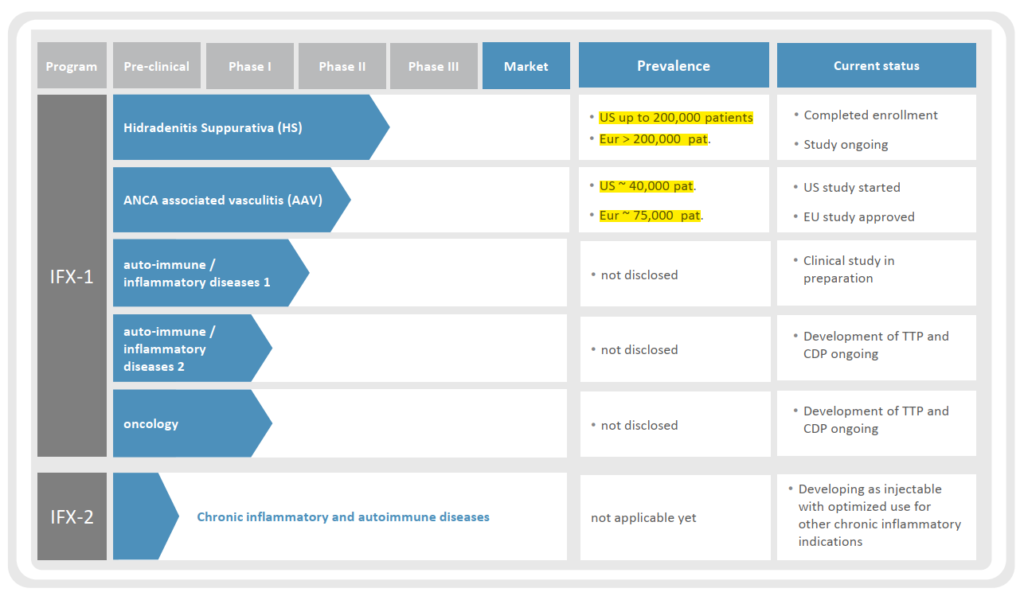

InflaRx is currently developing an anti-C5a monoclonal antibody which could turn out to be a first-in-class agent. Topline results from ongoing 175-patient, randomized, multi-center, double-blind, placebo-controlled Phase IIb SHINE study for the treatment of Hidradenitis Suppurativa (HS) is expected in 2Q2019. A successful outcome would support further development in their lead asset IFX-1 which is also being tested for a second indication as well.

IFX-1

HS is a chronic debilitating systemic skin disease which results in painful inflammation of the hair follicles, typically in the armpit and groin areas. The disease usually manifests itself by the apparition of inflammatory nodules, abscesses, draining fistulas and scarring, causing pain and significant discomfort that often leads to socially isolating situations.

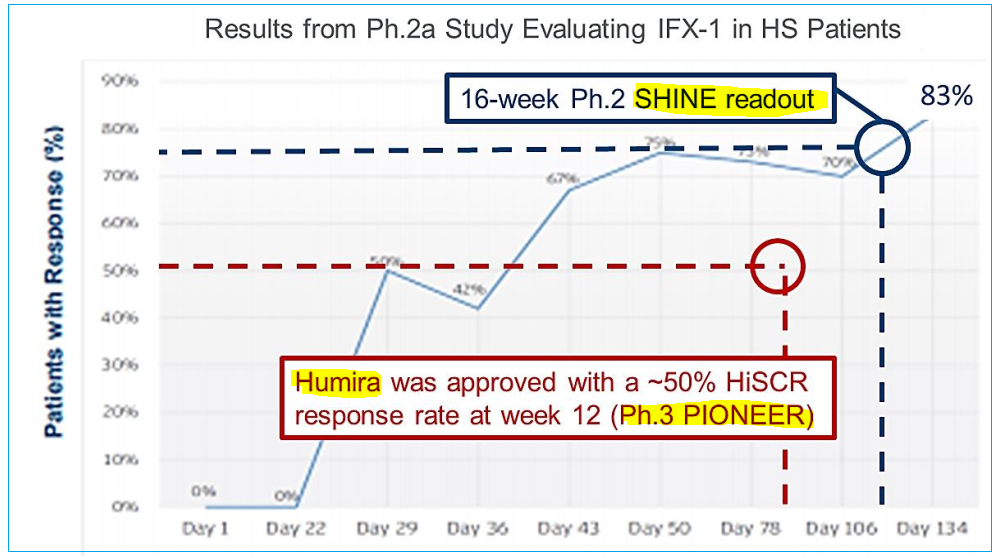

To date, results have been very encouraging for treating the debilitating condition which currently has just one approved therapy, AbbVie’s (ABBV) Humira (adalimumab), a drug with multiple indications that was original developed in 2002 for Rheumatoid arthritis. Despite Humira’s approval, patient responses are, in most cases, not durable with loss of effectiveness after a few months of usage and also, to its detriment, there have been cases where it has made some patients’ affliction worse. Perhaps this isn’t all that surprising as during its clinical trial period, only around 50% of targeted subjects responded positively. Even so, AbbVie has seen sales for this indication climb towards the $1B mark as it remains the only approved therapy.

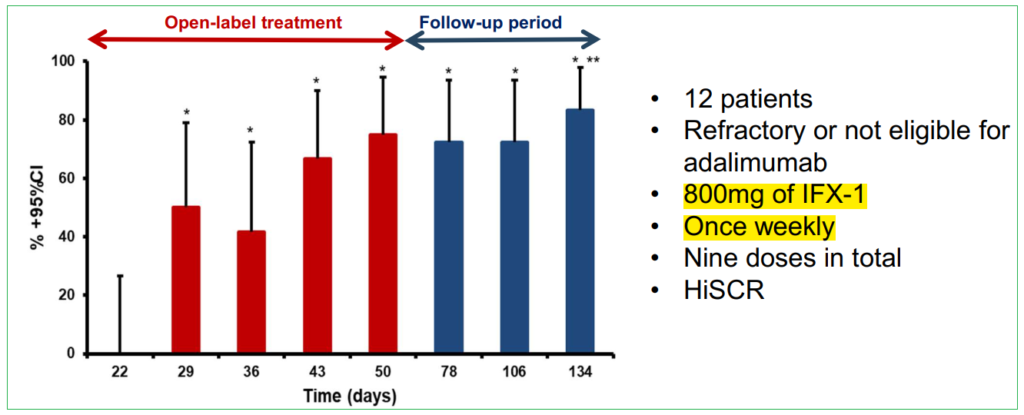

While Humira appears to weaken and lose efficacy over longer time frames, peaking around week 12 and then waning, IFX-1 treatment in contrast showed increased response rate with repeated applications until it reached 83% after 20 weeks during Phase IIa trials – this was the uncontrolled, open label study and therefore has less merit than a double blind placebo-control trial, however it is very supportive nonetheless and could be representative of the therapy’s true potential which is the goal of the SHINE study.

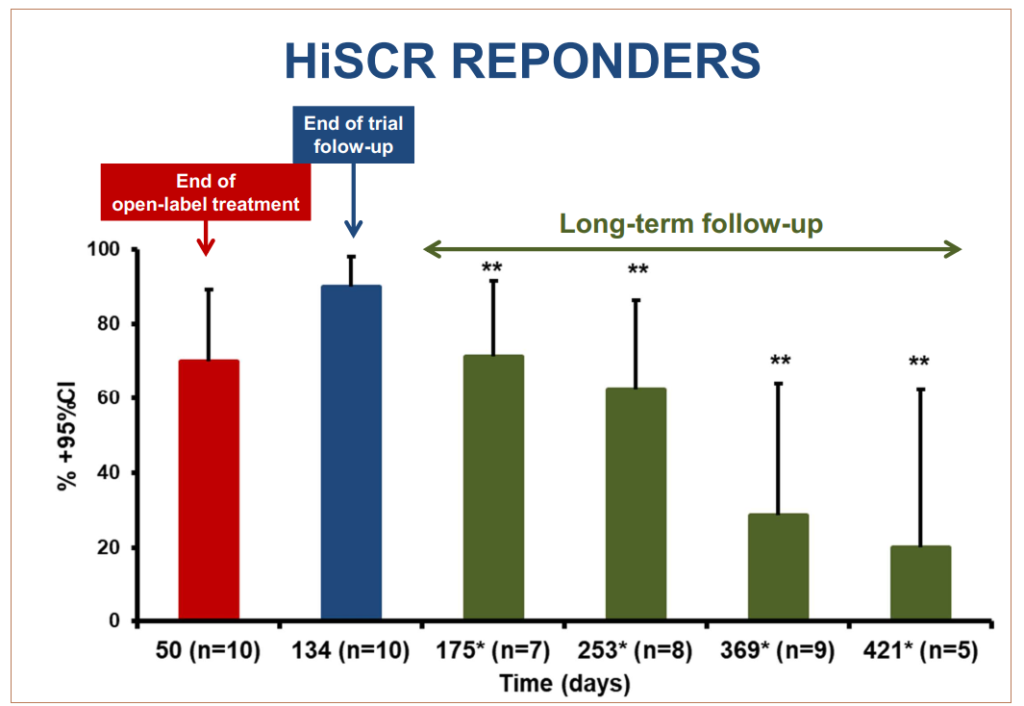

On February 6th, InflaRx released long-term follow-up data on ten of twelve Phase IIa open-label clinical trial patients supporting the continued efficacy of IFX-1 treatment after discontinuation.

As measured by the occurrence of flare-ups, median time to first event after the last dose was 209 days (range was 54-318 days); 50% of patients had no flares up to day 203. Sustained remission was observed in most patients during the trial conducted in Athens, Greece. Furthermore, the principal investigator of the study noted that the time to first flare post-discontinuation was achieved after just eight weeks of treatment.

Due to IFX-1’s target C5a being upstream of other treatment methods, it is theorized that the resulting effect could be reducing the negative actions of other cytokines that contribute to inflammation associated with HS. It’s possible that the drug’s application is lowering tumor necrosis factor (TNF-α), a protein that itself causes inflammation which is a natural defense mechanism reaction – except in this case it is not desirable. Similarly, it is thought that SHINE 16-week Hidradenitis Suppurativa Clinical Response (HiSCR) readout being much higher than Humira’s rate was a result of upstream application as well; HiSCR is the clinical endpoint used to determine response rates in patients.

Analyst Commentary

Leerink projects a 75% probability of success in both the EU and US for IFX-1 and has a $42 price target on the shares. Market opportunity could be as much as ~€2bn (2030E)

JP Morgan assigns a 70% probability of success, which was raised from 69% after speaking to physicians recently. The analyst has a target of $65 on the shares.

Credit Suisse currently assigns 60% probability of success to the program and models around $1B opportunity for IFX-1. Positive Phase IIb results could add $15-$20 to the analyst’s $47 target.

Caveat Emptor

InflaRx does not have any existing revenue stream as IFX-1 is still under testing, and IFX-2 is in the very early clinical trial stage. As such, shares could face material downside in case of SHINE outcome failure. While results to-date have been very positive on a small patient base, the upcoming data readout will see a tenfold increase in test subjects and may not have a similar outcome.

Needless to say, continued positive readouts will send shares much higher.