Insider Spotlight – Koppers Holdings (KOP)

Koppers Holdings is a global provider of treated wood products, wood treatment chemicals and carbon compounds. It operates under three main segments: Railroad & Utility Products and Services (RUPS), Performance Chemicals (PC), and Carbon Materials and Chemicals (CMC).

On Friday, March 15th, Form 4 filings showed an insider purchase from Michael Johnson, Vice President, Utility and Industrial Products. He acquired 20,000 shares for $25.50, a total value of $509,964. According to openinsider.com, this was the first purchase since mid-December when insiders, including Michael Johnson, bought the stock between $17.10 – $17.35.

Earlier this month, Koppers reported its Q4 results that saw its RUPS segment increase 50% (due to acquisitions), PC segment increase 6.8%, and CMC segment decrease 1%.

On the conference call, CEO Leroy Ball would discuss the company’s outlook for RUPS, in which he said that certain Class I railroads are having service issues due to their own restructuring actions. “And as a result, there have been delays in availability of railcars to transport and accept delivery of treated crossties.” On the whole, the company anticipates that these challenges are being addressed by the railroads and eventually service performance will improve. Mr. Ball would add that their success will depend upon getting more ties into their yards to put up for air drying so they can get to a cylinder for treatment. Untreated tie purchases in 2018 were approximately 30% lower than the 2015/2016 highs and need to improve by at least half that amount in 2019 to begin getting inventories back to where they need to be. “If we get cars and the weather cooperates, that shouldn’t be a problem.”

Seaport Global analyst Michael Harrison, in a post-earnings note, said KOP was clear to point out that Class I treated-tie demand is there if the RUPS business can improve untreated tie procurement. He would add, “We think KOP is working with suppliers as well as with customers who might accept Boltonized (fast-dried) ties.”

Then, turning to its CM&C segment, management would do their best to discuss their China subsidiary, KJCC, who is projecting to post significantly lower results in 2019 due to their ongoing customer dispute. CEO Mike Ball would say, “I’m very limited in how I can comment on this subject. So I’ll just say that we continue to work towards coming to some resolution on this business in the second quarter of this year. In the meantime, we’re supplying our customer under a temporary special purchase order that runs through March 31, 2019.”

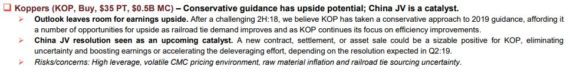

Seaport Global, on March 14th, issued their Key Themes & Positioning report in which they mentioned KOP. As it relates to this joint venture, Seaport believes a new contract, settlement, or asset sale could be a sizable positive for KOP, eliminating uncertainty and boosting earnings or accelerating the deleveraging effort, depending on the resolution expected in Q2:19.

Finally, it should be noted that per the company’s IR page, it will be hosting its Annual Meeting on May 2nd.