IPO Watch – Jumia Technologies (JMIA)

Set to debut today with lead underwriters Morgan Stanley, Citigroup, Berenberg, and RBC Capital, Jumia Technologies is a leading e-commerce platform that is active across multiple regions in Africa. According to their F-1 filing, though still nascent, the company believes that e-commerce in Africa is well positioned to grow. In 2018, less than 1% of retail sales for countries measured in their footprint in Africa were conducted online, compared to nearly 24% in China, according to Euromonitor.

The Platform

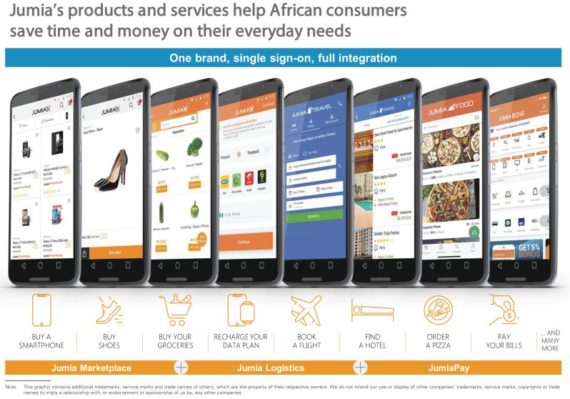

Marketplace – On its marketplace, a large and diverse group of sellers offer goods in a wide range of categories, such as fashion and apparel, smartphones, home and living, consumer packaged goods, beauty and perfumes and other electronics. They also provide consumers with easy access to a number of services, such as restaurant food delivery, hotel and flight booking, classified advertising, airtime recharge and “instant delivery.”

Logistics – Their logistics service, Jumia Logistics, facilitates the delivery of goods in a convenient and reliable way. It consists of a large network of leased warehouses, pick up stations for consumers and drop off locations for sellers and more than 100 local third-party logistics service providers, whom they integrate and manage through their proprietary technology, data and processes.

Payment Services – The company’s JumiaPay facilitates online transactions between participants on their platform, with the intention of integrating additional financial services in the future. JumiaPay was introduced in four markets, including Nigeria in 2016 and Egypt in 2018, through agreements with locally licensed sponsoring banks. In Q4 of 2018, 54% of orders placed on their platform in Nigeria and Egypt were completed using JumiaPay. Their payment service app, Jumia One, also allows consumers to complete online payments, such as airtime recharge or utility payments, and provides sellers with access to attractive financing solutions offered by their financial partners. “As of the date of this prospectus, we do not monetize our payment services. In the future, we may decide to do so, including by opening up our payment services to third parties.”

Growth and Engagement

As of December 31st, 2018, Jumia had 4.0 million Active Consumers, up from 2.7 million Active Consumers from the year prior. Its GMV was €828.2M in 2018, up from €507.1M in 2017 while Revenue was €130.6M in 2018, up from €94.0 M in 2017.

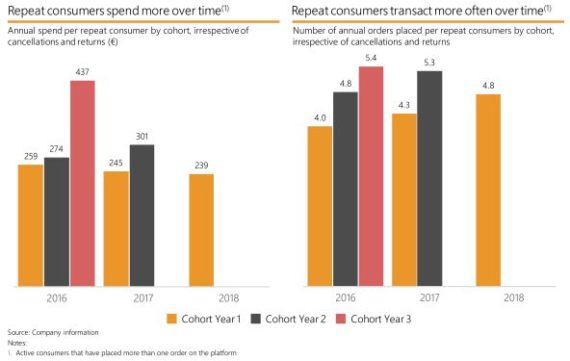

“We review the performance of our Active Consumers on a yearly cohort basis. Each consumer cohort is defined as consumers who made their first purchase during a specific period. We track the additional purchases made by consumers in each cohort during the period in which these consumers were acquired, as well as in subsequent periods. Every consumer cohort since 2013 had a repeat purchase rate during the year in which consumers in the relevant cohort made their first order of 28% to 39% and a repeat purchase rate during the following year of 21% to 31%. We observed that our 2018 cohort had the highest level of first year repurchase (39%) and our 2017 cohort had the second highest level (34%), demonstrating the relevance of our platform for consumers and its continued adoption by them.”

Jumia says that as their business matured, they have observed a trend towards higher order frequency when comparing repeat consumers across cohorts. For example, repeat consumers in their 2016 cohort placed on average 4.0 orders in 2016, compared to an average of 4.8 orders in 2018 for repeat consumers in our 2018 cohort. The following chart shows the annual spend and the number of annual orders placed per repeat consumer for our 2016, 2017 and 2018 cohorts.