IPO Watch – Leslie’s (LESL)

Headquartered in Phoenix, Arizona, LESL is the largest direct-to-consumer brand in the U.S. pool and spa care industry, serving residential, professional, and commercial consumers. Leslie’s markets its products through more than 900 physical locations and multiple digital platforms. These products primarily consist of regularly purchased, non-discretionary pool maintenance items such as chemicals, equipment, cleaning accessories and parts, and also include fun, safety and fitness-oriented recreational items. Meanwhile, their locations are strategically located in densely populated areas mainly throughout the Sunbelt, including California, Arizona, Texas, and Florida.

For reference, this isn’t the first time the company has been public. Way back in 1991, the company listed on the NASDAQ. In 1997, the company was taken private for $140M by Hancock Park Associates, assisted by private equity firm Leonard Green & Partners. Then, in 2010, Leonard Green & Partners put the company up for sale, seeking $1B. Fast forward to 2017 when the company was acquired by L Catteron, one of the largest consumer-focused private equity firms in the world. Terms of the transaction were not disclosed.

Per their S-1, they estimate the average in-ground pool owner spends $24,000 or more on maintenance products and services over the life of a pool. According to P.K. Data, the U.S. market is comprised of a growing installed base of more than 14 million pools and spas. The industry generated revenue of nearly $11 billion in 2019 and grew at a 3.8% CAGR from 2015 to 2019. The industry is currently experiencing a significant increase in demand, as the COVID-19 pandemic has accelerated secular trends in consumer behavior. In particular, the stay-at-home reality of the pandemic has led to significant growth in new pool installations and pool usage. Based on research performed by P.K. Data, new pool permit activity through July 2020 has grown by 32% over the comparable period in 2019 and is forecasted to achieve unprecedented year-over-year growth in new pool installations in 2020. This significant increase in new pool construction activity represents a permanent increase in demand for aftermarket products and services. Nearly 200,000 new pools are expected to be constructed in 2020 and 2021, representing nearly $5 billion in estimated lifetime maintenance spend. “While our business is not dependent on new pool construction, we believe we are uniquely positioned to capture a meaningful portion of the related aftermarket spend.”

Services

The company offers essential services, such as equipment installation and repair for residential and commercial consumers. Consumers receive the benefit of extended vendor warranties when purchasing product through their locations or when their certified in-field technicians install or repair equipment on-site. It also offers complimentary, commercial-grade, in-store water testing and analysis via their proprietary AccuBlue® system, which increases consumer engagement, conversion, basket size, and loyalty, resulting in higher lifetime value. “Our water treatment expertise is powered by data and intelligence accumulated from the more than 40 million water tests we have performed over the past 57 years, positioning us as the most trusted water treatment solutions provider in the industry.”

Across their integrated platform, it has a total of approximately 11 million consumers, of which approximately 5.5 million are active consumers who rely on them for their ongoing pool and spa care needs. Through a team of highly trained pool and spa experts, they offer sophisticated product recommendations and other expert advice, which cultivates long-standing relationships with their consumers. “The comprehensive nature of our product and service offering eliminates the need for consumers to leave the Leslie’s ecosystem, driving exceptional retention with annuity-like economics.” In addition to their owned e-commerce websites, they are the leading partner for Amazon (AMZN) in the pool category, and accounted for more than 40% of Amazon’s estimated pool and spa care business in the last twelve months ended June 27, 2020.

In 2014, it launched its loyalty membership program, which now serves more than 3.2 million active consumers, allows members to save, earn, and redeem via discounts, points, and rewards. They track consumer preferences, order frequency, and pool profiles in order to curate and enhance their recommendations and promotions, anticipate product demand, and track lifetime value to better incentivize our loyalty members. In the nine months ended June 27, 2020, their loyalty program represented more than 60% of all transactions and more than 70% of total sales. On average, a loyalty member spends twice as much with them per year than a non-loyalty members.

In 2018, Leslie introduced a custom-designed mobile app that allows consumers to create a personalized pool profile, sync in-store prescriptions, and monitor the performance of at-home water tests. As of August 2020, the mobile app has more than 500,000 downloads and an average user rating of 4.6/5.0. In the last year, the average active mobile app user completed 93% more transactions and spent 86% more with them than the average non-mobile app user. “We plan to continue enhancing this critical element of our network by introducing new features, including transaction capabilities. The next version of our mobile app is scheduled to launch by the end of calendar year 2020.”

Financial Performance

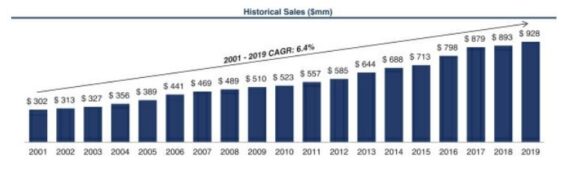

Due to the non-discretionary nature of their products and services, the business has historically delivered strong, uninterrupted growth and profitability in all market environments, including the Great Recession and the COVID-19 pandemic. “Our growth has recently accelerated, and for the nine months ended June 27, 2020, our sales have increased 16.0% over the prior-year period.”

Comparing the last twelve months ended June 29, 2019 and the last twelve months ended June 27, 2020, it achieved the following results:

-Increase in sales from $912.8M to $1.03B, representing Y/Y growth of 12.7%.

-Comparable Sales Growth of 11.5% for the last twelve months ended June 27, 2020.

-Increase in operating income from $114.8M to $137.3M, representing Y/Y growth of 19.6%.

-Increase in Adjusted EBITDA from $151.3M to $174.3M, representing Y/Y growth of 15.1%.

-Increase in Adjusted Free Cash Flow from $125.5M to $152.3M, representing Y/Y growth of 21.3%.