JaguarConsumer Weekly Callouts – June 4 (CROX, CCL, NCLH, RCL, LVS, WYNN)

![]()

Stifel recently hosted investors at Crocs (CROX) headquarters in Broomfield, CO to discuss direction and strategies for the Crocs and HEYDUDE brands. Also in attendance was the Crocs management team. Analyst Jim Duffy would highlight that results and commentary from family channel partners has been less inspiring. Management comments suggest that spring trends have been difficult to read with wet weather in the West and the shift of Easter clouding the picture. Consumers have reportedly been “making choices” in May suggesting discerning allocation of discretionary spend capacity. Against the uncertain backdrop, wholesale customers have reportedly tightened inventory management.

For the HEYDUDE brand, management believes distribution opportunity is 100% overlap with Crocs plus some additional avenues. The strategic priority for HEYDUDE, however, is to build the foundation for the Wally and Wendy franchises before overreaching with new product. Test and learning opportunities are laying the groundwork for product diversification including testing apparel and accessories. Following broad distribution expansion for HEYDUDE in Q2/Q3 2022 aimed at raising brand awareness on the coasts, the HEYDUDE brand has difficult wholesale comparisons in 2023. “In combination with incrementally more cautious wholesale customer base (inflationary pressures weighing on family channel, sporting goods, and mall channel consumers), wholesale growth (~2/3 of revenue) will be pressured until FY4Q when compares ease, new distribution such Foot Locker contributes, and the new Las Vegas distribution center eases limitations on growth.”

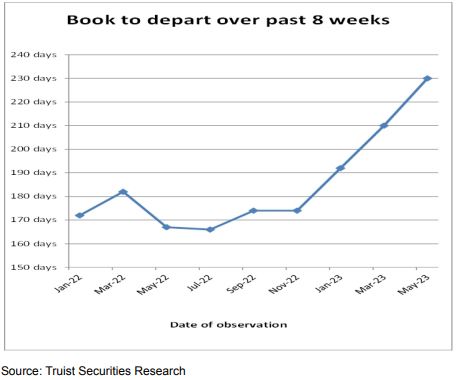

From conversations with senior executives at very large travel agencies that specialize in cruises and from examining “big data” on future bookings and pricing, Truist noted that there were no “negative surprises” during the two months following the front-end loaded Wave Season that began in late November and ended in March. 2023 bookings and pricing trends were fairly consistent with their observations from eight weeks ago. However, what stood out to them was the strength of bookings for 2024 and 2025.

“Consumers realize that besides the limited cruise inventory they cannot wait to book last-minute due to airfare prices that only get more expensive the longer one waits to book. Reflecting the strong pace of bookings for 2024 and 2025, the booking window (book to depart) is approx. 230 days at the moment, up nearly 60 days since last fall. The ongoing mix shift to direct bookings is also a tailwind to a lengthening booking window for travel agencies.”

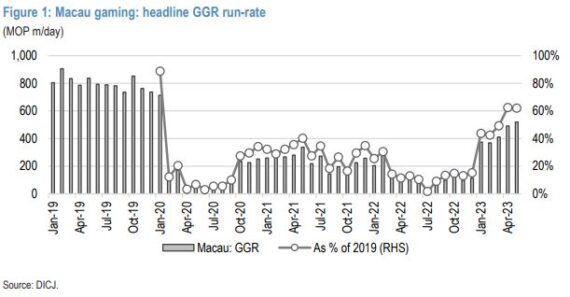

In case you missed it, Macau reported May gross gaming revenues of 15.57B patacas, representing a 366% increase versus the prior year’s 3.34B patacas and a 6% sequential increase. The May result was essentially in-line with the +371% ConsensusMetrix (CM) consensus forecast.

Stifel was out saying that the May Golden Week holiday early in the month drove high levels of visitation into the market which translated into healthy gaming revenues, but the fear was that the second half of May had slowed due to macro concerns or even upticks in COVID cases. That may be true but the May GGR result was still better than most expected and probably would have been higher if not for the recent COVID outbreaks. “For us, there are two things that we would point out as being important moving forward. First, there was once again monthly sequential improvement as May GGR was +6% relative to April. Second, April GGR was -40% relative to May 2019. We believed that getting to, and sustaining, that down 50% or lower level relative to 2019 was always going to be an important threshold. We continue to believe that staffing levels and visitation patterns into Macau probably won’t become more “normal” until after June.”

Meanwhile, JPMorgan said that the absolute level of GGR will soften in June given seasonality (the weakest month of the year), but QTD trends suggest casinos will see strong Q2 results that should continue to beat consensus with mass and EBITDA likely recovering 80%+ and 65%+ of pre-COVID levels (vs. about 65% and 45% recovery, respectively, in 1Q). “Q2 results will coincide with summer holiday season – which will be the first holiday since re-opening with no hotel/ labor constraints – by which time we hope the investment sentiment (for Macau, as well as HK/China) will stabilize to appreciate bottom-up fundamental improvements.”