JaguarConsumer Weekly Callouts – March 19 (AOUT, POOL, SAM, STZ, VSTO)

Macro

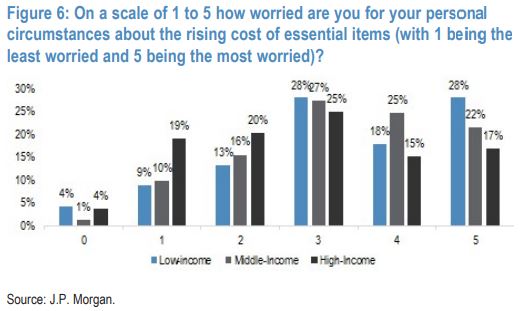

–During our Conversations podcast on March 15th (Subscribe HERE), we flagged a recent survey that JPMorgan retail analyst Matt Boss conducted to gauge consumer spending behavior. Some of the datapoints include:

• 50% of U.S. respondents expect to see their monthly cost of living (defined as essential spending in food, gas, energy, transportation) to rise by more than $100 in the coming months relative to last year. Importantly, this represents an 11-percentage point increase relative to the September 2022 survey at 39%.

• 51% of U.S. respondents cited an increase in their salary in recent months – though only 6% of respondents believe their salary is more than offsetting the increased cost of living. To that point, 27% of U.S. consumers have already begun to borrow more than usual via credit card or short term bank loan to support the standard of living this year. This represents a +400bps increase relative to the September survey.

• Putting it all together, 73% of survey respondents expect to reduce spending on non-essential items by at least 6% in the coming months relative to last year – increasing approximately 300bps relative to September’s survey and driving an “increasingly selective consumer.”

• The largest proportion of consumers expecting to reduce spending on non-essential items by at least 6% in the coming months relative to a year ago was the Middle-Income cohort at 79% (or 13 points higher today relative to the Low-Income at 66%) – which also represents a 4 point increase relative to Middle-Income cohort’s expectations of 75% in September. According to JPMorgan, this signals “a non-essential spending re-budget still ahead at the Middle-Income customer demographic.”

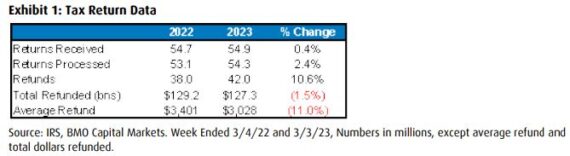

–Among the many other potential headwinds the consumer is facing this year, one that we’ve been highlighting in Jaguar is the size of tax refunds. Data is updated and covered by a number of analysts each week. In BMO Capital’s recent Retail & Services note, analyst Simeon Siegel would highlight:

“The number of refunds is continuing to normalize as the average dollars refunded remain under pressure (lapping COVID-related tax credits) highlighting a worse trend for the consumer. Through March 3, the number of returns filed are flat versus prior year levels (down from +1% last week), with the number of processed returns up ~2% (+4% last week). On those processed returns, the number of refunds are up ~11% (potentially due to fewer COVID-related delays and vs. +18% last week) with the total amount refunded actually down ~1% YoY (+5% last week) resulting in a lower average refund of $3,028 compared with $3,401 last year or down ~$373/return (vs. down ~$394/return last week).”

Leisure

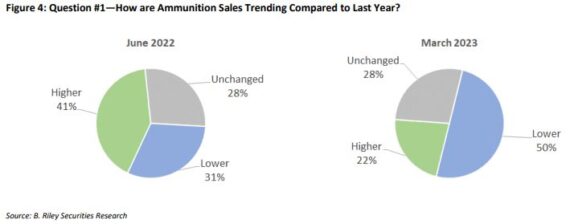

–During the month of March, B. Riley surveyed firearm and ammunition dealers across the United States. As was the case with their June 2022 survey, the number one question analyst Eric Wold was looking to address was how ammunition sales have held up with consumers—not only coming out of the pandemic-driven demand boost, but within an inflationary environment that may be leading into an economic recession.

“Based on the results from our most recent survey, a combined 50% of the respondents noted that ammunition sales were equal to or higher than they were at this same time last year—with 22% of the responses indicating that ammunition sales were higher than the already-elevated levels seen in 2022. This represents a decline from the 69% of respondents in our June 2022 survey that stated ammunition sales, at that time, were running equal to or higher than the year-ago period—with 41% of those respondents stating that sales were running higher. The most often cited reasons for the larger percentage of dealers in our most recent survey noting declines in ammunition sales compared to last year were (1) elevated retail prices for ammunition weighing on household budgets; and (2) an increasing shift in consumer purchasing behavior from stockpiling to consumption (i.e., purchasing only what you intend to use at these elevated prices vs. hoarding extra inventory due to concerns around scarcity).”

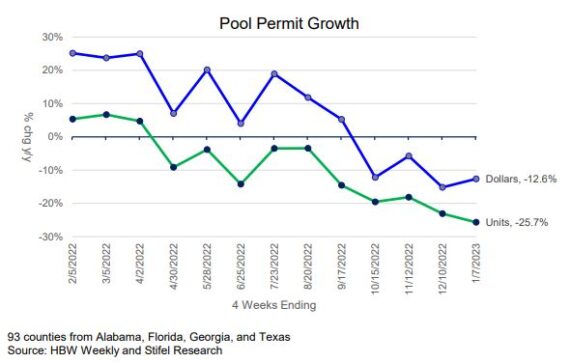

–In their Biweekly Pool Permit note issued on March 16th, Stifel would analyze HBW pool construction permit data from 93 counties in Alabama, Florida, Georgia, and Texas. They estimate that the counties in these states accounted for 50% of 2020/2021 residential inground pool construction with inground pool construction accounting for 26% of 2022 U.S. pool category dollars. The permit database is updated weekly with trends through January 7th, offering the most complete visibility given the lag in reporting. Analyst W. Andrew Carter would highlight:

“For the latest four weeks ending 1/7/2023, pool permits declined 25.7% on a unit basis, down from -23.1% last period. Permit dollars declined 12.6% improving from -15.2% four weeks ago. We believe colder weather in Texas contributed to a portion of the weakness with both Pool Corporation and Leslie’s noting it was a headwind during the calendar fourth quarter. Nevertheless, we believe the data reflects weaker underlying demand which drives our cautious outlook for 2023 residential inground pool construction (-20% units, -15% dollars). We believe trends will be soft through the early part of 2023.”

Food & Beverage

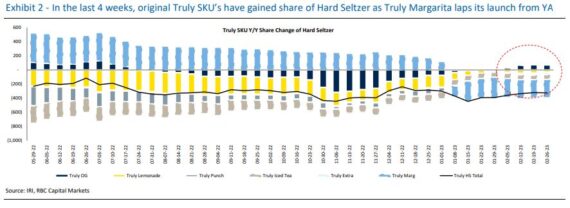

–After a meteoric fall in 2021, shares of Boston Beer Company (SAM) continued their downward slide in 2022, and thus far in 2023, shares are down 5.86%. These share losses can be attributed to the Truly brand. Looking ahead, one of management’s turnaround plan is to refocus on the core “original” Truly SKU as it shifts away from the cycle of innovation and line extensions that failed to be incremental to the portfolio. Within this turnaround plan, the company is also adjusting their marketing message. According to RBC Capital’s Nik Modi, if SAM’s new messaging goes according to plan, “Truly can reengage lapsed shoppers and the core 21-34 hard seltzer drinker. As a reminder, SAM’s guidance assumes Truly share does not improve.” RBC added that while the company is still in the process of executing this turnaround playbook, recent scanner trends do show a slight improvement in core Truly trends.

“In IRI, recent scanner trends show a modest improvement in Truly’s core original SKU’s down mid-teens in the last 4 weeks after being down low-to-mid 20’s in Dec-Jan, and down in the 30’s% in Nov’22. While these results are encouraging we believe it is still too early to call an inflection point on the brand or categories struggles but would view continued stabilization of core SKU’s favorably.”

–In 2021, AB InBev’s Mexican division, Grupo Modelo, filed a lawsuit against Constellation Brands (STZ) accusing it of breaching a deal by using the Corona brand name with a non-beer product, specifically its Corona Hard Seltzer. However, this past week, a jury sided with Constellation Brands, giving it the go-ahead to use the brand name with its hard seltzer. According to Beverage Daily, this decision also means Constellation can continue distribution of its Modelo Ranch Water.

JPMorgan analyst Andrea Teixeira believes that STZ prevailing is a small positive. While the company’s hard seltzer/FMB innovations have had limited success to this point, and thus the trial may have faded from investors’ radar, they think the win clears the path for continued innovation in the near-beer categories, de-risks the investment in 5m HL ABA (alternative beverage alcohol) capacity at Nava, and also could result in lower legal expenses.