JaguarConsumer Weekly Callouts – May 14 (FL, POOL, ZVIA)

![]()

On May 8th, Foot Locker (FL) announced that Blanca Gonzalez would be joining the company as Senior Vice President and General Manager for its WSS banner, effective May 15th. WSS, which was acquired back in 2021, is the #1 Hispanic-focused retailer in athletic footwear where it operates a neighborhood-based store presence and has a deep connection within Latino communities. Prior to her hire, Ms. Gonzalez worked for Nike (NKE), where she served as Vice President of North America Product Merchandising and brings more than 19 years of experience across various Nike leadership roles in Marketing, Merchandising, and Sales.

“Blanca’s vast knowledge of the sneaker industry attained throughout her tenure with our great partner Nike will be an incredible asset to our WSS business, which has tremendous potential,” said Chief Commercial Officer Frank Bracken.

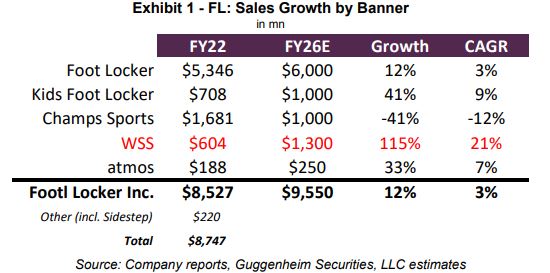

Guggenheim analyst Robert Drbul said that this hire is notable because the WSS banner, acquired in September 2021 for $750M, is an integral component of the Foot Locker growth plans in its 2026 targets laid out to investors in March. As Foot Locker ended 2022 with approximately $8.5B in sales, it has laid out a path to 2026 Revenues of $9.5B and a long-term sales target of $10B. The company expects WSS banner to grow the topline from $600M in 2022 to $1.3B by 2026, a greater than 20% CAGR. “This is the same expected sales growth in dollars as the company’s projections for core Foot Locker banner.”

![]()

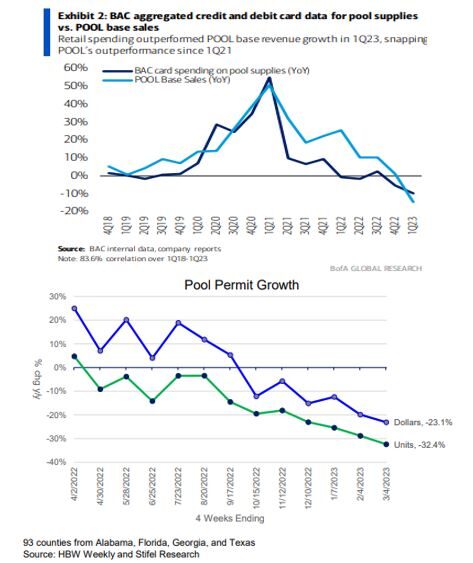

For the month of April, spending at pool supplies merchants, which has an 84% correlation with Pool Corp (POOL) base sales, was lower by 8.4% Y/Y, declining for the 7th consecutive month, according to Bank of America card data. Separately, Stifel analyst W. Andrew Carter was out on May 11th with his Biweekly Pool Permit note. For this topic, they analyze HBW pool construction permit data from 93 counties in Alabama, Florida, Georgia, and Texas as they estimate these counties accounted for 50% of 2020-2022 residential inground pool construction with inground pool construction accounting for 29% of 2022 U.S. pool category dollars. The permit database is updated weekly with trends through 3/4/2023 offering the most complete visibility given the lag in reporting. “For the latest four weeks ending 3/4/2023, pool permits declined 32% on a unit basis, down from –29% last period. Permit dollars declined 21%. We believe the data reflects weaker underlying demand which drives our cautious outlook for 2023 residential inground pool construction (-30% units, -24% dollars). We believe trends will be soft through the early part of 2023.”

![]()

Zevia (ZVIA), which produces zero sugar, zero calorie, and naturally sweetened beverages, reported its earnings this past week which saw EPS come in at ($0.04) vs ($0.16) estimate and Revenue of $43.3M vs $42.02M estimate. The company reported 14% sales growth, which was slightly above the top end of its guidance. Gross margins of 46.4% improved 470 basis points from last year owing to pricing and greater focus on profitability. Its Q2 sales outlook of $48M – $51 million implies modest 5% – 12% growth, due in part to the brand refresh contributing later in the quarter. BMO Capital says this is likely conservative as ZVIA achieved or exceeded the high end of the quarterly guidance range in four of the last five quarters. Meanwhile, it is maintaining its guidance for FY23 and continues to expect net sales to be in the range of $180M – $190M, an increase of 10% – 16% compared to 2022.

Regarding its “Brand Refresh,” BMO Capital analyst Andrew Strelzik noted that the rollout should be completed by June in high-velocity retail outlets and more fully by the end of Summer. “ZVIA’s brand refresh represents a potential springboard to improving brand awareness, trial, and household penetration across the product portfolio. The refresh includes new products/flavors, new packaging, improved shelf sets, and increased opportunities in single serve cold with support from marketing investments.”