JaguarConsumer Weekly Callouts – May 21 (DEO, MCW, LNW)

![]()

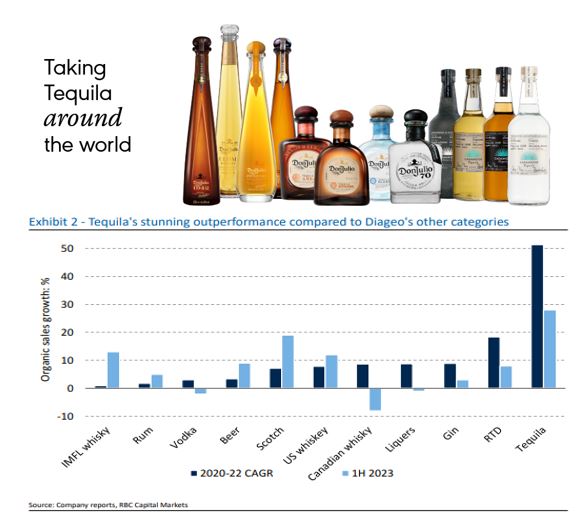

Across different industries, it’s not uncommon for a stock to become associated with specific parts of their portfolio, and for their stock prices to reflect that. As RBC Capital notes, surely everyone who follows Diageo (DEO) knows that tequila has been a great benefit to its sales performance in recent years, particularly in North America. In fact, they believe that tequila has benefited Diageo’s profitability to a greater extent than its superior sales growth would suggest, and that this is not widely appreciated. From 2019 – 2022, Diageo’s organic sales growth has averaged 8.7%. RBC calculates that without tequila it would have been two percentage points lower at 6.7%…impressive stuff from a category which in 2018 (the first year after the Casamigos acquisition) accounted for less than 3% of Diageo’s sales.

However, analyst James Edwardes Jones believes the outlook for sales and profitability for tequila as a category, and by extension for Diageo’s Casamigos and Don Julio brands, is murky. It will depend, among other things, on the trajectory of consumer confidence in the U.S., the receptivity of consumers in international markets – notably Western Europe – to tequila and the implications of easing of the agave supply bottle neck. “While the prospects for tequila might be opaque, we think it’s unlikely that it will be able to replicate the phenomenal growth in sales and profitability that has been such a major component of Diageo’s performance in recent years. If that’s the case, we don’t think that Diageo will have the wherewithal to continue increasing its marketing investment in the way that it has in recent years. Diageo has underperformed the consumer staples sector by -10% year-to-date with the vast majority of this occurring post HY23 results; the first sign of US disappointment. On the basis that Diageo’s tequila business will struggle to make as big a contribution to the group’s financial performance as it has in recent years (something which we had underestimated) we think there are more reasons than this to be concerned.”

Mister Car Wash (MCW) is the largest national car wash brand, operating primarily express exterior conveyor locations across the U.S. Stifel analyst Chris O’Cull was out with a note titled, “Will Titanium 360 Put a New Shine on Comp Trends?” This analyst is referring to a proprietary chemical compound called Titanium 360 that has been developed by the company that protects the car’s paint and enhances its shine. Mister Car Wash has been testing the service in Tucson since late 2022 and currently has it in around 30 washes across three markets. Stifel believes it will cost roughly $35K per wash to make these changes, and the equipment changes should occur in about one week at night, so operations should not be disrupted during the conversion.

“The company has not determined the pricing for the new Titanium 360 wash but has suggested it will be offered for $22.99-$24.99 (retail) and $35.99-$39.99 (UWC). This compares to the Platinum offering, which is currently the most premium MCW wash, priced at $19.99 (retail) and $29.99 (UWC); roughly 55% of UWC members utilize the Platinum offering and 45% the Basic offering. The company has not provided an average ticket amount for retail customers or average monthly spending for UWC members, so we estimated these amounts to determine a potential sales lift from the new service. Assuming Titanium 360 UWC adoption rates of around 5% on the low end and 15% on the high end (and a retail wash mix of 5%), we estimate the comp lift generated by the premium offering could equate to 2.5-5% from the ticket growth. Our last point about Titanium 360 is the company has not provided a rollout schedule. The company’s guidance does not reflect any benefit in 2023.”

This past week, Light & Wonder (LNW) submitted a proposal to acquire its majority owned subsidiary SciPlay’s (SCPL) remaining 17% outstanding shares for $422M. Light & Wonder was presented in a bullish report in last Sunday’s W/E Research. I will discuss any changes to the position in Monday’s Conversations podcast (Subscribe HERE).

Truist analyst Barry Jonas thinks a deal helps simplify the story and could be additive for a few reasons:

“1) LNW management will have full access to SCPL’s cash ($358M as of Q1 end), 2) The deal solves for the restricted use of proceeds from the sale of LNW’s sports division (sold to Endeavor (EDR, NR) for $800M in 9/22), where share repurchases were excluded, 3) Lead to some cost synergies (e.g. public company costs, some administrative costs, etc.), and 4) Better align LNWs operating divisions from a strategic sense (though we note LNW presently controls SCPL regardless).”

Just as important in my opinion is that Light & Wonder noted that it received conditional approval to list its shares on the ASX, and expects to have its shares listed at 11:00AM (AEST) on Monday, May 22nd. Truist believes several shareholders will transmute existing NASDAQ shares to the ASX. As we understand it there are limited transfer costs and timing is fairly quick. “Still, we think it’s an open question as to how much liquidity will be present on the ASX, and if it’s sufficient to warrant multiple expansion.”