JaguarConsumer Weekly Callouts – May 29 (CHUY, LW, USFD)

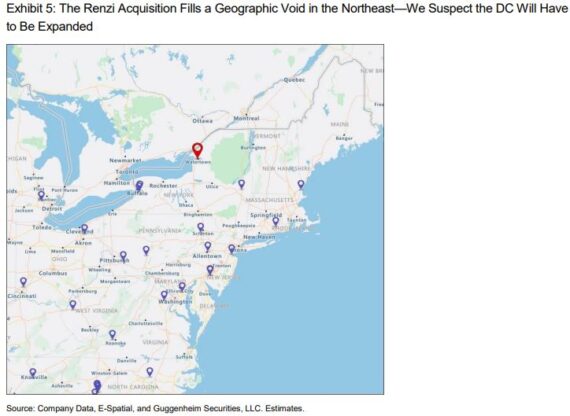

At the beginning of May, Chuy’s Holdings (CHUY) reported a solid Q1 number, with EPS coming in at $0.47 vs $0.36 estimate and Revenue of $112.5M vs $110.2M estimate. Revenue increased 12% Y/Y while Comp Sales increased 8% Y/Y. As Wedbush pointed out in a note this past week, management has exceeded expectations 17 quarters in a row, with the last underperformance in Q4 2018. In the process, restaurant-level margins are up more than 300 bps vs. 2019 when every other peer, except Darden, has seen a contraction, and its 2019-24 EBITDA CAGR is poised to exceed every peer except Texas Roadhouse. While CHUY’s share price is approaching all-time highs, at 10.1x their 2024 EBITDA estimate and 17.2x their cash ($4.54/share)– adjusted 2024 P/E, they believe the stock remains undervalued. In addition, Wedbush views CHUY’s relatively low average check, steady growth in marketing spend, and sustained menu innovation (Knockouts platform) as the primary drivers of comp upside relative to current 2023 expectations. Given current pricing expectations, they also expect CHUY’s relative value to expand vs. peers in 2023. They believe potential exists for COGS upside relative to expectations should commodity inflation in 2023 remain benign vs. current guidance of flat to slightly positive (it was 5% in Q1). Current EPS guidance is $1.71-1.76, which was raised after Q1 from $1.60-1.65. Finally, they note that 2023 is a 53-week year, with the extra week set to contribute approximately $0.10 in Q4.

![]()

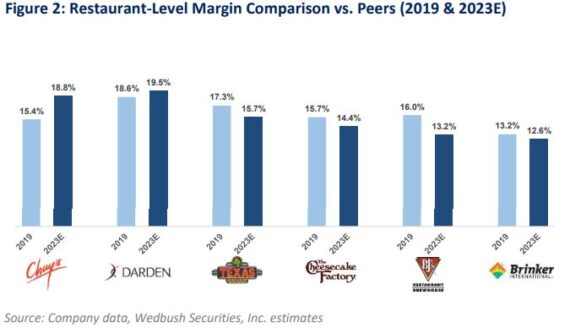

Stifel hosted a conference call today with Dale Lathim, the Executive Director of the Potato Growers of Washington. Mr. Lathim has been in this role for 30 years and remains at the center of the negotiations between potato farmers in the Basin area (Oregon/Washington) and potato processors, such as Lamb Weston (LW). Mr. Lathim provided an update on the planting progress and early development of the 2023 crop, the current outlook for potato prices for the 2024 crop, and a view of the capacity for additional processing facilities in the Western U.S.

“The main message from our call today revolved around the expectations for the potato crop in 2023 – potato contracts were signed last Fall, and Mr. Lathim expects a roughly 4,000 increase in acreage for potatoes in Oregon and Washington (5% increase), with a 10%-11% increase in Idaho as more contracted acres are added (+2,500 to +3,000) and non-contracted acres significantly increase (up at least 20,000), which together should provide more potatoes available to fill recent capacity increases and meet the fast growing demand for French fries.”

The industry has now started negotiating crop prices in the Fall, moving up the timeline by several months, which Stifel believe benefits both parties and provides more visibility around future costs which Lamb Weston can work into its contract negotiations and pricing decisions. Based on the current outlook for costs, Mr. Lathim believes a low-single digit increase in contract pricing for the 2024 crop is appropriate. Most important, this earlier timeline for pricing provides Lamb Weston ample time to address these costs with pricing and to potentially undertake smaller, but more frequent price increases to ease into a higher rate of pricing with the end-consumer/customer. This could be especially beneficial with its Global customers where negotiations typically take place in the Spring/Summer each year as typically one-third of its global contracts come up for bid, although this could be lower in 2023 following a greater percentage of negotiations this past year. “With better visibility into its costs, especially during this more volatile time, we believe it will allow the company to get pricing through on these contracts to help blunt the effect of higher costs overall.”

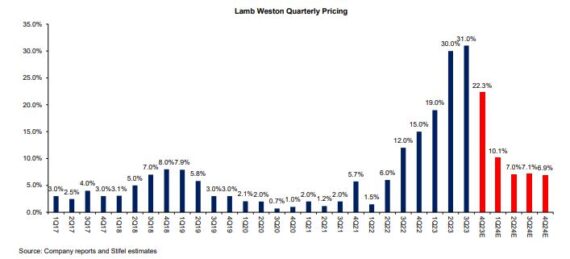

Earlier this month, U.S. Foods (USFD) announced it was acquiring Renzi Foodservice, a broadline distributor located in Watertown, New York. This acquisition is the first for the company since April 2020 and the first under CEO Dave Flitman. In a food distribution note, Guggenheim says:

“The recently-announced acquisition of Renzi Foodservice, a modestly-sized distributor in Watertown, NY—north of Syracuse—is a reminder of the important, incremental growth potential of selective M&A activity. In this case, Renzi fills in a geographic hole in the Northeast region—see Exhibit 5. Renzi operates from a 110K square foot warehouse in Watertown, serves the vast majority of New York State, carries 8,500 SKUs, and delivers ~30K cases per day from 25 trucks. This equates to a healthy 1,200 cases per route. It generates ~$180 million in annual sales, which likely means the need for a facility expansion. We estimate an EBITDA margin of 4%, adjusted EBITDA of ~$7 million, and a purchase price of $75 million or just over 10x. Procurement and other scale-related synergies would enhance profitability. The transaction is scheduled to close in the 3Q, and our estimates are unchanged. To us, this acquisition is, itself, less important than what it represents: a return to M&A as a value-creating option under the leadership of a CEO with a strong track record of successful business combinations. M&A is not included in our (or the Street’s) expectations—another source of potential upside.”