Landstar System (LSTR) – Checking In

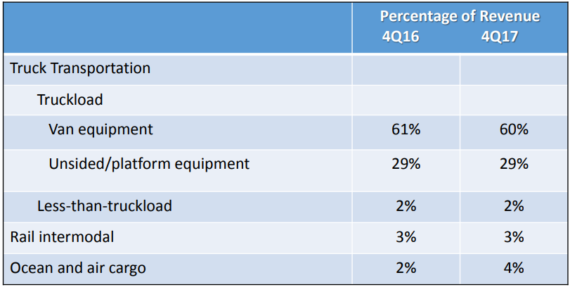

Landstar Systems provides integrated transportation management solutions in the United States, Canada, Mexico, and internationally. Landstar operates in several business areas: Truck Services, which includes full truckload and less-than-truckload transportation, Rail Intermodal Services, which contracts with railroads for capacity, and Air and Ocean Services, which provides domestic and international cargo services to customers.

Wall Street Expectations

Landstar will be reporting its Q118 earnings after the close today, Wednesday, April 25th. Expectations are for:

-EPS of $1.36

-Revenue of $1.04B

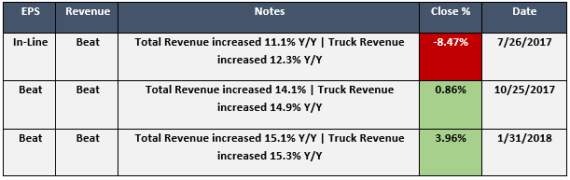

Historical Earnings Performance

Q4 Takeaways/Key Points to Watch

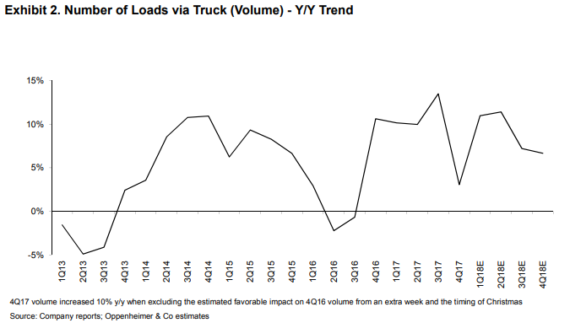

Revenue in the fourth quarter was up 15% Y/Y on the strength of increased loadings hauled via truck of 9% and increased revenue per load of 6%. Management would say that the 2017 fourth quarter operating environment was outstanding. They saw significant increases in both the number of loads being hauled by truck and revenue per load. Industry-wide truck capacity tightened as they moved through the quarter, while they continue to have a strong broad-based demand for their services.

In addition, during 2017, the company announced that they had a record 542 agents generate revenue in excess of $1M. Revenue from new agents, defined as an agent who contracted with Landstar subsequent to January 1, 2016, was approximately $117M in 2017. Gross profit was a record $544M, 11% over 2016.

CEO James Gattoni, when providing his outlook, would say, “During the first several weeks of 2018, strong volume and elevated pricing continues on our truckload services. Strong demand from the industrial sector, the ELD mandate and extreme winter weather across the country disrupting freight flow have all contributed to the strong start to 2018. The number of loads hauled via truck is currently running in a high single-digit percentage growth range over the same period of 2017. Revenue per load on loads hauled via truck also continues to be strong in the mid-teen digit percentage range over the same period of 2017.”

Channel Checks/Commentary

Oppenheimer – On April 5th, analyst Scott Schneeberger would detail his takeaways from his recent trip to Landstar’s 2018 Annual Sales Agent Convention:

• Landstar is benefitting from solid truck brokerage business conditions as a strong freight demand environment combined with tight truckload capacity (partly due to ELD implementation) has generated solid volume and pricing growth in excess of expectations.

• Landstar is investing $6-10M annually in information technology to drive sales efficiencies and enhance automation in the agent network. The company highlighted its recently implemented Landstar Maximizer, which is a mobile application technology aiding its truck capacity providers in searching/planning for loads to haul to optimize asset utilization/revenue generation. Landstar also highlighted its new transportation management system (TMS), which is a technology that streamlines the shipping and freight management process into one system. It is expected to drive efficiencies in business processes, including aiding agents with more seamlessly accessing capacity, processing/tracking loads and processing invoices/payments.

• Following ~10% growth in number of loads via truck in 4Q17, Landstar had originally expected number of loads via truck to grow in the high-single digits in 1Q18 per its 4Q17 results release on 1/31/18. On 4/3/18 Landstar indicated it anticipates growth in number of loads via truck in 1Q18 to be similar to the ~11% it generated in the first eight weeks of 1Q18.

Goldman Sachs – On April 10th, Matt Reustle initiated the trucking space with a Neutral rating, saying it is “too early to fade the trucking cycle.”

Among the stocks across Truckload, Less-than-Truckload, Rail and Logistics, the analyst started this morning, Reustle initiated coverage of freight broker Landstar with a Buy rating and $130 price target.

The analyst would say that the company’s “asset light” network model is comparable to other transportation brokerage type businesses, such as CH Robinson (CHRW) and Expeditors (EXPD), but with important differentiating factors, namely independent contractors dedicated to Landstar, independent commission sales agents, and high specification “Industrial” freight movement moving on spot contracts, he argued. The analyst told investors he believes these factors make Landstar’s operating model best suited to capture returns through a freight cycle while assuming less risk than asset-intensive operators in a downcycle.