Martin Marietta (MLM) – Texas Takeaways

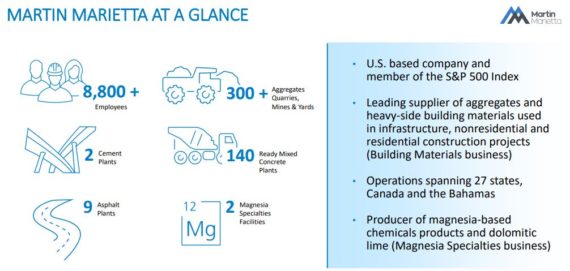

Martin Marietta, a building materials company, supplies aggregates and heavy building materials to the construction industry in the United States and internationally. Some of its offerings include crushed stone, sand, gravel products, ready mixed concrete, asphalt, paving products and services, and Portland and specialty cement.

Texas Aggregates & Concrete Association Conference

Stifel analyst Stanley Elliott out this morning following takeaways from the recent Aggregates & Concrete conference noting that long-term fundamentals in Texas look compelling. With nearly 1,400 new Texans every day, the need to keep up with suitable infrastructure is growing ever-important. Unemployment in Texas is at record lows at 3.7% and housing starts continue to outpace the national average. Texas is on track to create another ~250k jobs this year by some estimates. And looking ahead, Texas real gross state product is forecasted to grow 4% this year and next year, which is ahead of the U.S. Real GDP consensus estimate of 2.4%.

State demand for construction materials was solid in 2018 despite unseasonable weather and will remain a key driver for results across the materials space in 2019. Even with these headwinds state aggregate volumes totaled 298.6 million tons, roughly 6% more than California and Florida aggregate volumes combined. Ready mix volumes increased 3.1% in 2018 and represent nearly 16% of total U.S. volumes. Within Stifel’s coverage list, Martin Marietta has the largest exposure to the state (over a third of revenues) following the highly successful and complementary 2014 acquisition of Texas Industries.

Cross Sector Insights Conference

In addition, it should also be noted that Martin Marietta management spoke at the recent Stifel Cross Sector Insights Conference where management noted steady work flow in TX, CO, NC, FL, GA, SC, and IN (all part of MLM’s top 10 revenue producing states which generate ~80% of revenues). Stifel notes that many of these states are benefiting from an uptick in state funding (public funding is <40% of volume which is generally lower than normal) as well as generally stronger population growth trends.

JaguarScan

Finally, taking a look at JaguarScan, there was a small, but notable buyer on April 23rd of 100 July 220 Calls for $7.20, a $72,000 bullish bet that remains in open interest.