Matthews International (MATW) – Energy after Death

Matthews International (MATW) is well-known as a global provider of memorialization products used in cemeteries, funeral homes, and crematories. When looking at the company breakdown, we will find that 48% of total revenue comes from this legacy business. The segment’s products, which are sold principally in the United States, include cast bronze memorials, granite memorials, caskets, and cremation and incineration equipment. The segment also manufactures and markets architectural products that are used to identify or commemorate people, places, events and accomplishments.

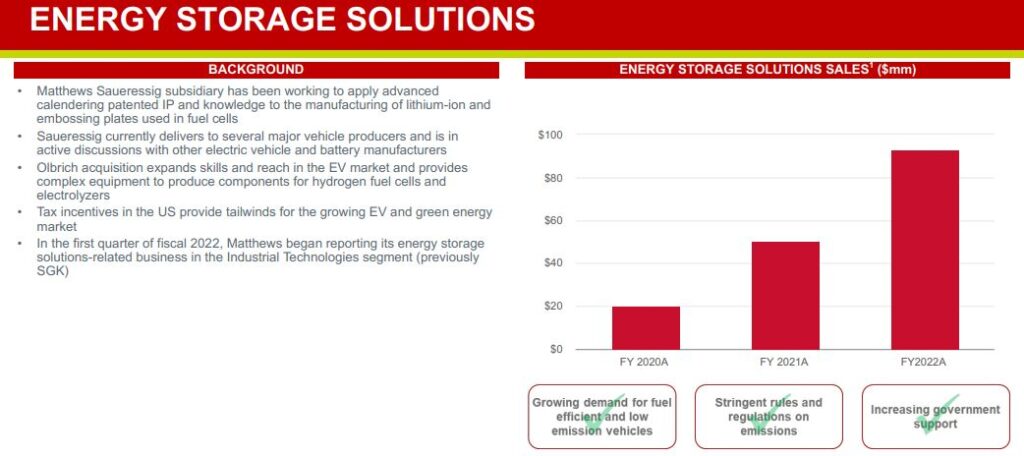

Meanwhile, Matthews also has SGK Brand Solutions, which makes up 33% of revenue and helps companies to define, create, produce and transform their packaging and marketing supply chains and the brand assets that flow through them. Finally, we have an Industrial Technologies segment that makes up 19% of revenue. Certainly a far cry from caskets and memorials, this segment includes the design, manufacturing, service and distribution of high-tech custom energy storage solutions. As the company’s 10-K states, the energy storage solutions business produces engineered calendering, laminating, and coating equipment used in the manufacturing of lithium-ion batteries and components of fuel cells. The segment currently delivers products to several major vehicle producers and is actively pursuing opportunities with several other electric vehicle and tier-one battery manufacturers.

Back in mid-November, shares jumped by 7.5% after it reported its Q4 earnings that easily beat on both EPS ($0.82 vs $0.72 estimate) and Revenue ($457.13M vs $419.21M estimate).

Memorialization sales were $206.3M vs $195.9M a year ago. Management said that the growth was primarily the result of higher cemetery memorial and U.S. cremation related product sales and increased pricing to mitigate the effects of inflation. Casket unit sales volumes for the current quarter were lower than a year ago, primarily reflecting the decline in COVID-related deaths. Turning to SGK Brand Solution, sales came in at $146.3M, a decrease from $158.8M last year. Unfortunately, currency rate changes had an unfavorable impact during the quarter. At this point, I should mention that at a recent Bloomberg Activism Forum, Barington Capital discussed its stake in the company along with the need for a refreshed board of directors, the request for the company to cut costs, and ultimately evaluate selling its Brand Solution/Packaging business.

The New Growth Engine

Turning to the company’s Industrial Technologies segment, management highlighted that sales came in at $104.6M vs $84M Last Year. CEO Joe Bartolacci, in his prepared remarks, said that they continue to make significant progress in their energy business where they are anticipating “significant orders” from multiple customers in the coming months. They expect these orders will cover all aspects of the Energy Solutions business, including green mobility solutions like dry electrode and hydrogen fuel cell as well as energy generation like photovoltaic.

“Our products and services solve some of the most difficult challenges facing the energy storage industry today. And as a result, we are seeing a ramp-up in interest in our industry leading — in our industry-leading capabilities, resulting in many of the most significant OEMs across the globe knocking on our doors. They recognize our extensive experience in roll-to-roll processing, the core of our specialized equipment derived from our history in printing, which gives us a competitive advantage in the renewable energy market.”

Sure enough, fast forward to January 2nd when the company announced continued momentum in the business with Q1 orders already exceeding $200M. B. Riley, following this news, noted that Matthews received orders from a number of manufacturers of electric vehicle, battery, and hydrogen fuel cell components. The announced order levels are about double fiscal 2022 revenues for the energy storage solutions business.

Analyst Liam Burke would remind investors that energy storage includes the company’s market-leading engineered calendaring process for the production of dry battery electrodes, or DBE. Dry battery electrodes are a developing battery technology using a powder-to-film process that simplifies battery manufacturing. It was during Q3 that Matthew acquired German-based engineering firm OLBRICH GmbH, which added a gravure-based laminating process for DBE and complements the company’s dry DBE gravure-based calendaring process and improves its positioning in DBE production.

“The energy storage business has more than tripled over the past three fiscal years, and the current backlog announcement indicates that the business is poised for significant growth in fiscal 2023.”