Mercury Systems (MRCY) – Backlog & Growth Remain Strong

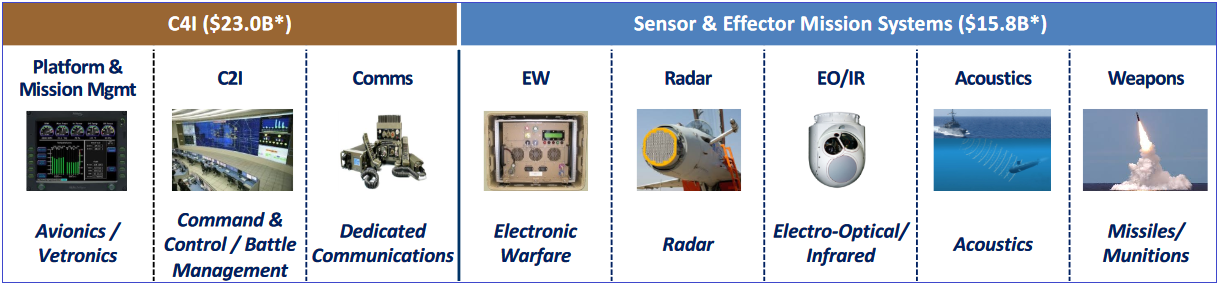

Mercury Systems (MRCY) is a US-based commercial provider of secure processing subsystems designed and made in the United States for various domestic critical defense and intelligence programs. Their principal programs include Aegis, Patriot, Surface Electronic Warfare Improvement Program, Predator, F-35, Reaper, F-16, Filthy Buzzard and AIDEWS. It also designs, markets and sells software and middleware environments for the development and execution of signal and image processing applications, and offers solutions in mission computing, safety-critical avionics and platform management.

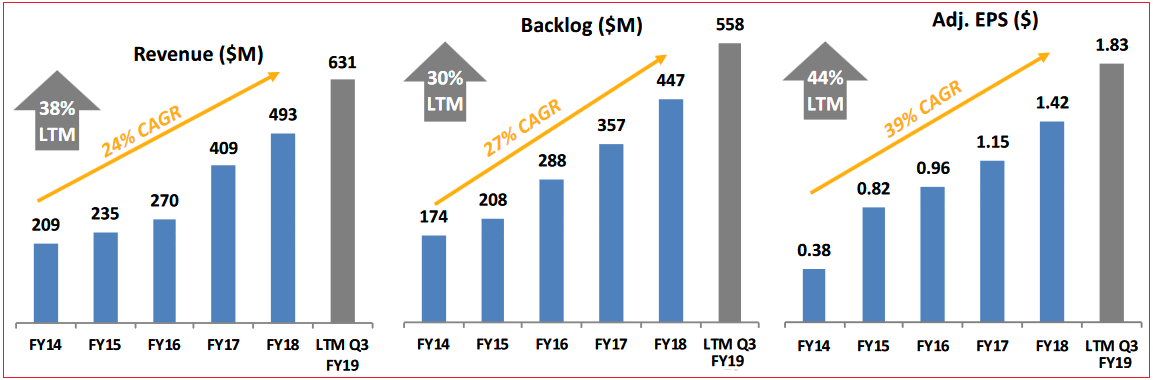

The company had a very productive 3Q2019, registering record revenue that was up 50% year-over-year with organic growth increasing 31% during the same period. Total backlog increased 26%, pushing backlog to new, record highs that were 30% higher than in 3Q2018, helped by a large booking of a $41M order for advance weapons application, and a $25M order for RF & Digital product segment for the Navy’s Surface Electronic Warfare Improvement Program (SEWIP).

In the past six years, Mercury Systems’ estimated lifetime value of their Top 30 programs has seen growth greater than 4.5x from multiple M&A transactions. From management’s commentary during last quarter, it appears that all businesses are doing “quite well” and seeing growth: overall, seven of eight market segments are expected to continue to grow through 2023, at a compound annual growth rate (CAGR) of 5.1%-5.8%, while the Weapons segment is expected to post 7.7% CAGR for the same period.

3Q2019 Earnings

- The company beat their quarterly expectations and guided FY2019 above consensus estimates.

- Revenue was $174.6M vs $165.73M consensus, up 50% YoY

- EPS was $0.50 vs $0.45 consensus, up 67% YoY

- Bookings of $189.7M, Book-to-Bill at 1.09x

- Backlog of $558.2M, up 30% YoY

- Free cash flow of $19.2M, compared to $2.6M) negative flow in 3Q2018

- FY2019 EPS guided to $1.79-$1.83 vs $1.78 consensus

- FY2019 revenue guided to $642M-$651M vs $642.43M Street expectations

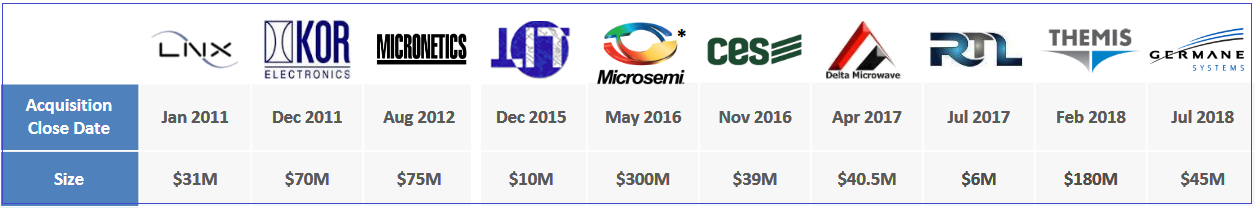

Management commented that they’ve made “solid progress” integrating their prior acquisitions and also continue to be looking for new opportunities to expand. Two weeks prior to the earnings call, they had announced the acquisition of two companies, paying a total of $46M for The Athena Group, a defense deployment platform-related enterprise that they had worked with on previous occasions, and Syntonic Microwave, a sensor processing capability developer that mainly transacts with governmental agencies.

M&A has played a large part in the company’s growth: over the past six years their total pipeline value has increased from $1.59B to $5.8B. Including to the above two latest acquisitions, Mercury Systems has deployed $704M in capital, adding ten companies into their widening business moat, diversifying their program base and in reducing revenue risk.

Equity Raise

At the end of May there was a secondary offering of 6M shares made by the company. Priced at $69, the shares were slightly lower than the previous day’s closing price. Management raised $455M which was used to pay down their $325M debt in its entirety.

New Contracts

Since late-April, Mercury Systems has received $40M in contract awards, both new and extensions of existing orders:

- $9.0M order for precision-engineered radio frequency (RF) subsystems integrated into an advanced airborne electronic warfare program (included in 3Q bookings)

- $2.1M order for custom-engineered radio frequency (RF) amplifiers (included in 3Q bookings)

- $3.9M development contract to prepare next generation airborne radar processing subsystems for production at their own manufacturing facility

- $8.2M follow-on order from a leading defense prime contractor for rugged, ultra-compact memory devices integrated into an advanced airborne command, control and intelligence application

- $16M follow-on orders adding to its previous, $152M 5-year agreement to deliver advanced Digital RF Memory (DRFM) jammers to the U.S. Navy

Based on management’s statements, Mercury Systems continues to see outsourcing as the largest secular growth opportunity in defense. They also believe they are “strongly positioned in well-funded defense budget priorities”, including Radar and Electronic Warfare modernization, avionics and mission computing upgrades and weapons systems as well as C4I. They still see significant design win opportunities in the missile defense area as ground-based radar installations get upgraded, and in C4I segment related to rugged servers and avionics. Electronic Warfare sector was said to have”significant activity” associated with emerging threats, and they are also seeing more opportunity in the smart munitions and space domains. The company also believes they will continue to take share from competitors based on the uniqueness and strength of their high-tech business model.