Monster Beverage (MNST) – China Acceleration

Last May, on the Jaguar front page, we highlighted Monster Beverage after a Morgan Stanley research note in which one of the topics that they spoke about was the company’s International market penetration, specifically China where the expectation is 10% market share by 2020, ultimately resulting in $4B in sales.

Yesterday evening, Stifel Nicolaus issued a research note on Monster Beverage and its China rollout. The first line of the note is what struck me as the most important: “According to Chinese media reports, the global brand owner of Red Bull is in discussions to modify its 20-year manufacturing and distribution joint venture in China with Reignwood Group. Reports suggest negotiations are ongoing and also that supply disruptions in 1H17 are likely as a result of a transition that could potentially include revised financial terms and the participation of the Austrian entity.”

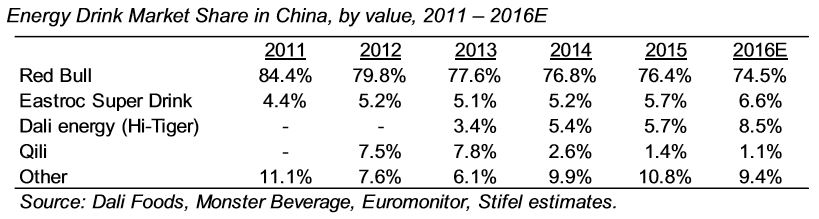

China is the world’s second-largest energy drink market, approximately $4.1B in 2015, or about 60% of the size of the U.S. and growing at least mid-teens in recent years. The market is dominated by locally produced and distributed Red Bull, sold in 250ml cans in regular (gold can) and extra strength (similar can to Western version and containing more taurine than the gold can version) for RMB 5.00-7.00 ($0.72-$1.01). Despite its leading share position historically, Red Bull has lost approximately 1,000bps of market share since 2011 (Table shown below), largely to a number of recently introduced brands. Monster Beverage is currently priced lower in this market in order to compete with the Eastern version of Red Bull.

For Monster, there is the potential for a strong read-through for China from market share and sales growth from South Korea and Japan, where the company has market shares of 24% and 42%, respectively. In South Korea, Monster’s share has more than doubled from a year ago, reaching 23.7% at the end of the third quarter following the product repackaging and transition to the Coke system in January 2016. In Japan, it achieved a 41.7% market share in the third quarter, from a low-thirties share in 2014. According to Stifel, they understand there are differences between consumers in these markets compared to Chinese consumers, but believe the Japan/Korea results are more comparable than the Europe/U.S. numbers.

To conclude, potential supply disruptions for Red Bull coupled with the strength of Coca-Cola’s (KO) distribution network could profoundly aid Monster’s China rollout.

Here are some other upcoming catalysts to keep in mind:

• The company announced today that its Chairman and Chief Executive Officer, Rodney Sacks, and Vice Chairman and President, Hilton Schlosberg, will host an Investor Meeting on January 12th to provide an update on the company’s business and operations.

• Q4 Results, while not confirmed, typically take place at the end of February.