Mosaic (MOS) 3Q16 Earnings Takeaways – Cash Burn Accelerates

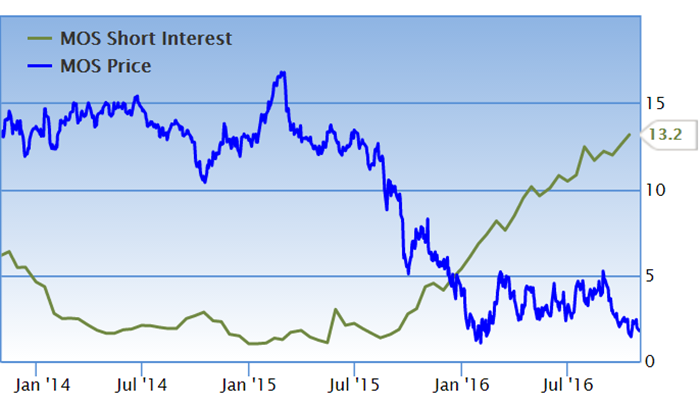

The headlines in Mosaic earnings would suggest a beat on EPS coming in at $0.11 vs. $0.10 estimate and revenues at $1.95B vs. $1.92B estimate. But finer details show a different picture. Particularly, the cash burn increased $400 million sequentially. The company is currently in the process of expanding revolver from $1.5B to $2.5B to boost liquidity but if this happens and cash burn continues, which is likely without significant rebound in potash prices, gross debt / EBITDA will expand dramatically further beyond already outrageous 3.5x which will put its investment grade bond rating as well as $384M/year dividend at risk of being cut – negative scenario for the stock which is teetering on brink of break down to new 52-week low.

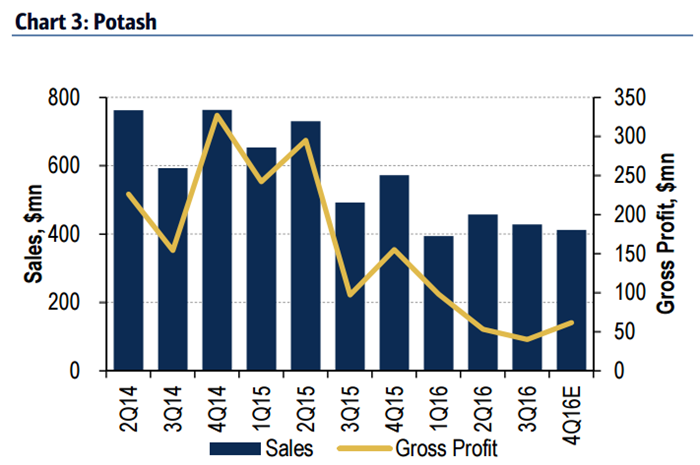

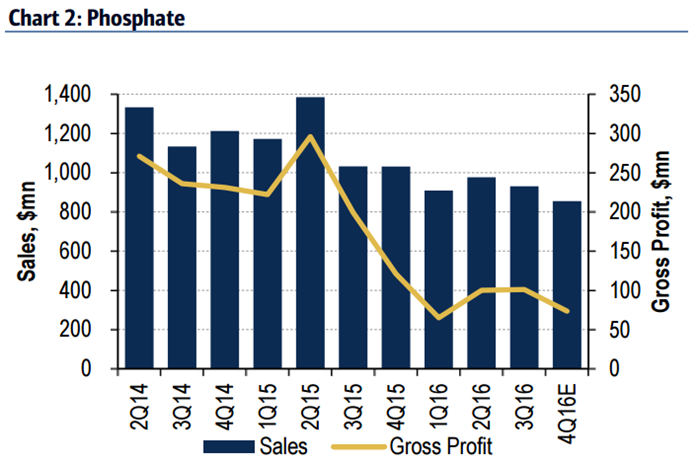

Will Potash Prices Recover? – Tough to see prices recovering materially given material new supply coming to market starting with Colonsay mine re-opening in early 2017 after long shut down, followed by significant capacity expansion in Morocco and Saudi Arabia in Spring 2017, followed by K+S’s Legacy mine starting mid year 2017. Worth noting Mosaic is guiding “high single digit” potash margins in Q4 compared to high teens historically speaking. The pressure is already on and these new supplies in 2017 will only make it worse without exceptionally sharp increase in demand which we don’t see happening. Note global DAP prices have been deteriorating rather more aggressively since Q3 ended, which is suggesting Latam prices roll forward beginning in Q4 will likely be below consensus view. In other words, we wouldn’t be surprised to see another guidance cut from Mosaic before the year is over.

2017 could turn out to be extremely tough for Mosaic. We note short interest in MOS has climbed steadily all year from 5% in January to 13% currently, now stand at 2-year high.