Natural Gas: Time To Get Bullish?

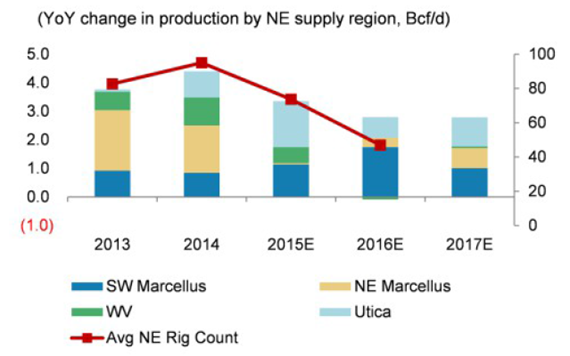

Three months ago in a detail note, this excerpt from Morgan Stanley caught our attention:

“The next three months may be challenging as seasonal demand wanes, but we believe this will be a buying opportunity. Unlike oil, natural gas has faced bearish trends for years, which required low prices to artificially lift power demand. But now, supply growth is moderating, and enough structural demand has been stimulated to begin to tighten balances. At current levels, the 2H16 strip should generate too much gas power demand. As inventories normalize, focus should turn to the underlying balance, which is more constructive than prices suggest. We see 2017 prices averaging $3.20/MMbtu vs. the strip at $2.55/MMBtu.“

That commentary was right on the money and now it is coming to fruition and we believe it is still not fully baked into consensus view.

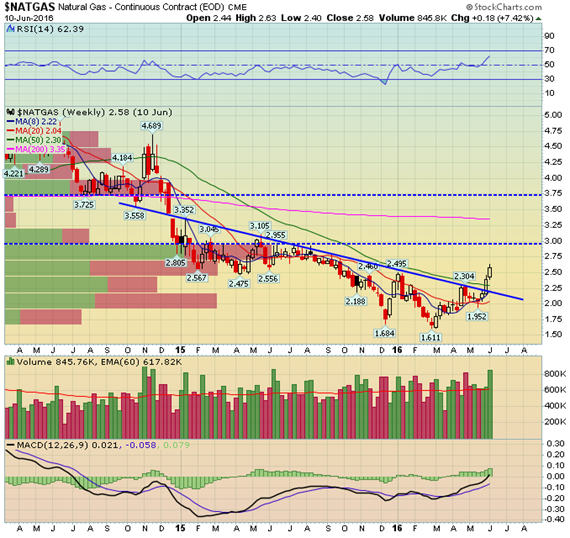

The week ending June 3rd, we saw NYMEX July natural gas prices rallied above $2.40/MMbtu for the first time since January, ultimately finishing up ~11% WoW. That rally continued last week with July prices now at ~$2.60/MMbtu. The main reason for this is re-acceleration in power demand with tighter supply. The last four storage builds have averaged ~1 Bcf/d tighter than summer targets while the storage surplus has decreased by ~360 Bcf since end-March.

To learn more about our approach and how you can become a successful trader, sign up for 2 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

Production cuts following energy bear market of 2015 led to supply cuts just in time when LNG needs more supply as ports open to ship overseas. On demand side, June month-to-date power demand in the US is currently running +2 Bcf/d YoY and at new 5-year highs driven by the Southeast, Midwest and Northeast. Here are forward contracts pricing moving higher steadily:

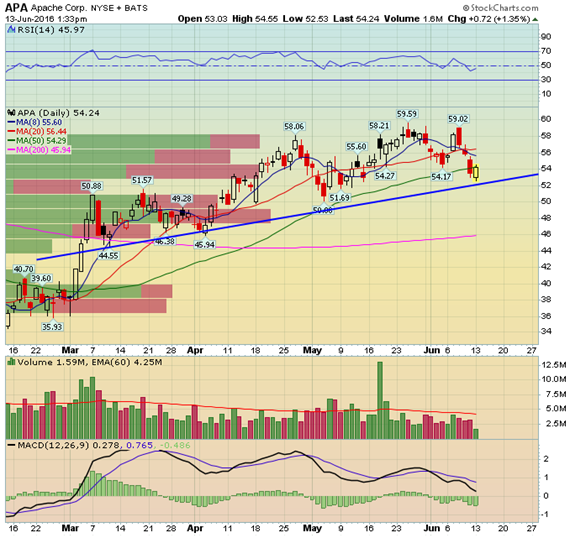

The bull thesis for $3.20/MMbtu target is playing out earlier than expected and that target is still 23% higher than current price. We wouldn’t be surprised to see continued bullish option order flow in natural gas stocks, such as Apache (APA) which is currently testing trend support after recent pull back.