NetApp (NTAP) 2Q17 Earnings Takeaways – Led by Margin and Guidance

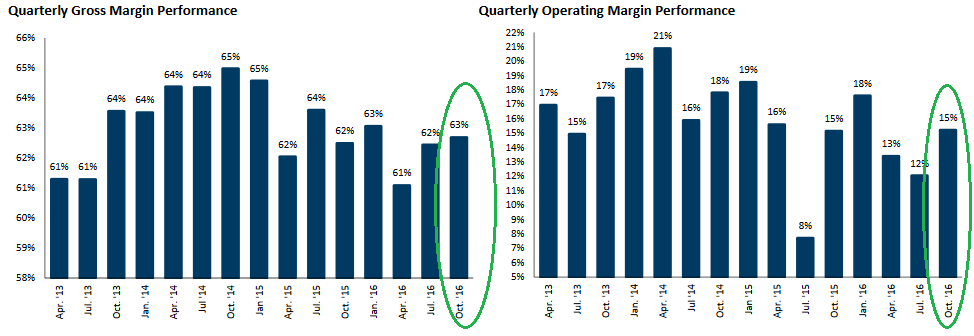

NetApp (NTAP) reported 2Q17 results, beating consensus on EPS of $0.60, and a slight miss on revenues at $1.34B. Free cash flow was $102 million, net of $56 million in CapEx. Gross, operating and product margins all showed improvement at 62.7%, 15.2% and 48.2% respectively, the latter a 150bps increase over last quarter.

Guidance for 3Q came in higher than Street expectations, with forecast revenue range of $1.325B to $1.475B (vs. $1.36B) and EPS of $0.72 to $0.77 (vs. $0.65). Additionally, the Company expects gross margins of 61.5-62.5% and operating margins of 18-18.5%, and is also on track to complete a $130 million net gross cost reduction by the end of FY2017.Moderating the last two years’ declines and negative numbers, management anticipates exiting FY2017 showing YoY growth.

NetApp now lags only Dell-EMC as the second largest all-flash vendor, a position it has achieved through M&A and organic growth. Going forward, it will need to monitor both large and smaller competitors attempting to increase their market share, and with $4.4 billion in cash and assets, further acquisitions such as the $870 million SolidFire deal earlier this year, could be on the horizon.