Netflix (NFLX) – Cable’s Nemesis

Back in mid-October, NetFlix (NFLX) reported 3rd Quarter earnings results that sent shares soaring 20% as it beat analysts’ expectations on both EPS at $0.09 vs. $0.02, and revenue at $2.29B vs. $2.28B. While the stock hasn’t returned to 2015 highs, it is well off the $95 range it floated on throughout the summer months.

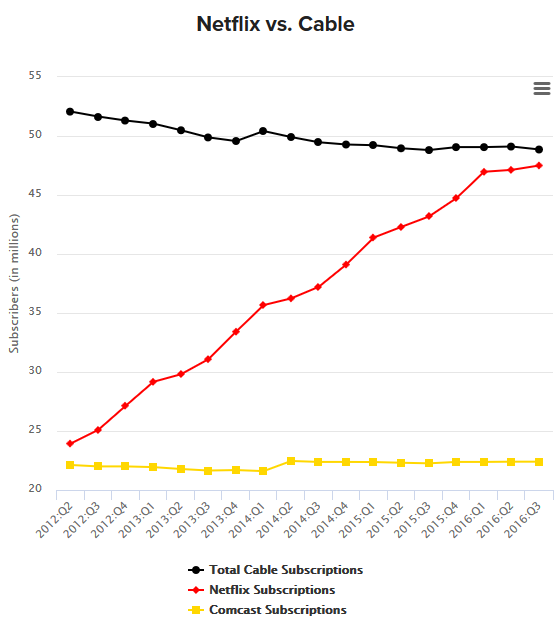

With Netflix though, investors are always looking at the subscriber numbers. As with earnings, 3Q data for both Domestic and International segments also showed a rise in net subscriptions, and management continued the good-news-parade by guiding 4Q subscriber count higher for both segments.

Survey Says….

A new RBC Survey conducted in both the US and Europe is showing favorable responses on both continents. Over 1,000 participants were questioned in the US and over 3,000 in Europe, with the majority in Germany and France.

Strong and Stable in the USA

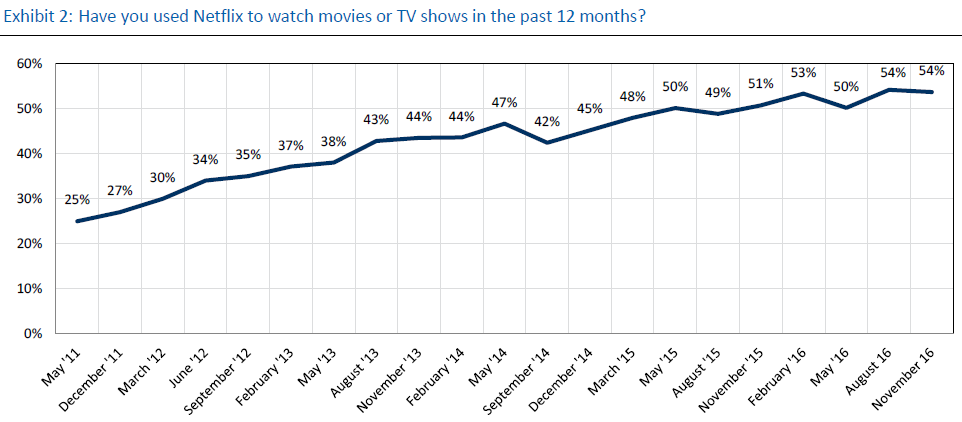

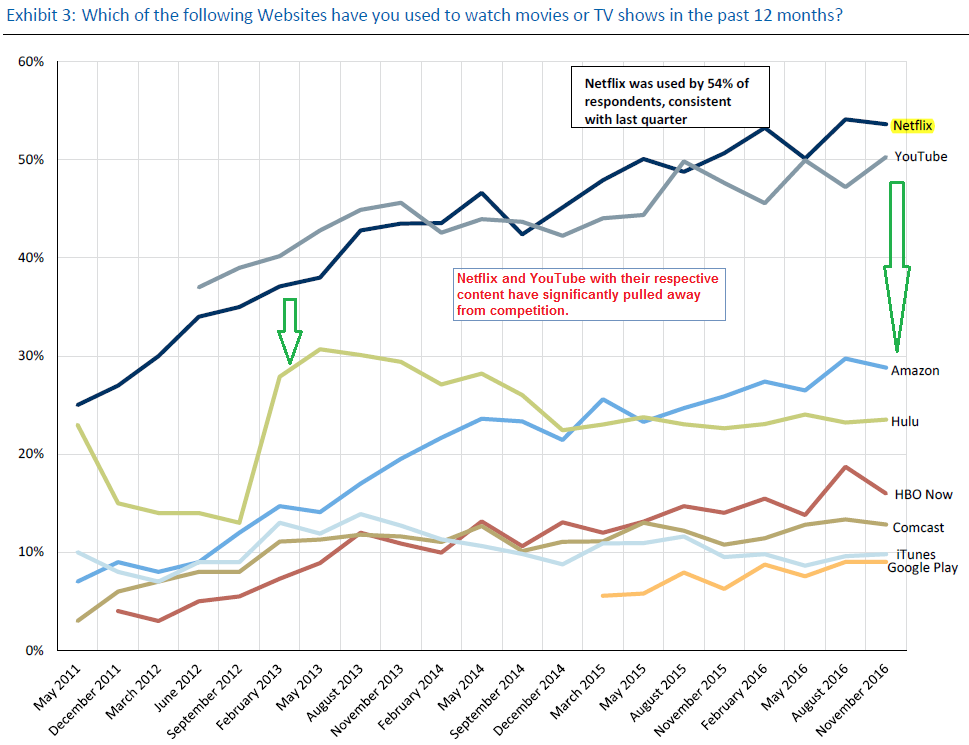

US results showed very high usage levels; 54% of internet users watch Netflix, higher than YouTube’s (GOOGL) 50% and Amazon’s (AMZN) 29%. Satisfaction levels remain high, albeit down slightly to 64% from Augusts’ 67%, possibly on price hikes and de-grandfathering of older subscribers’ fees.

Broken down into segments of subscriber satisfaction, the “Very Satisfied” portion has now dropped sub-40% for the first time since 2014. The 4 percentage point (pp) loss bringing it to 37% however is not all bad news, as two of those points increased the “Extremely Satisfied” crowd to 27%, while one point each went to lower satisfaction tiers.

The survey also highlights Original Content importance to viewers, with 55% of new customers having considered it to some degree in their sign-up decision. With widely watched, successful hit shows such as “Stranger Things”, “Orange is the New Black” and “House of Cards”, viewers have seen the value in programming creativity and this should help with loyalty to the platform.

YouTube remains the only close competition as Amazon and Hulu remain behind by 25pp or more. However, YouTube isn’t an apples-to-apples comparison with the vast majority of its content being user uploads. Yes, it does offer movies for rent or purchase, but its price-point and format versus Netflix’s all-inclusive monthly fee does not make it a true competitor.

In early November, Netflix launched a partnership with Comcast (CMCSA), having their streaming service available on X1 devices, enabling Comcast’s entire client base easy access to their library through their standard, 3-tier membership format. With an ever-improving content library and highly watched original content, increasing numbers of US viewers that are moving towards SVOD now have another platform from which they can try it out.

European Acceptance

An increasing number of European survey respondents indicated they would be likely to pay for streaming content, as compared to the December 2014 results. French/German willingness rose 14pp in both countries from 21%/20% to 35%/34% respectively. Corroborating the data, Netflix usage has made further ingress into these same two countries, rising 13pp to just under 20%. Subscribers are also showing a higher level of satisfaction, this compared to a more recent survey from May. In fact, 88% of subscribers have indicated “very” or “extreme” when asked their level of satisfaction from overall Netflix experience. This compares to 64% for the US.

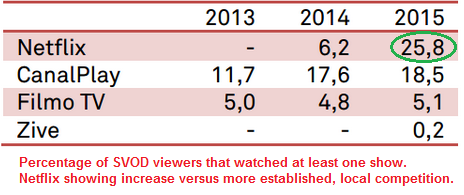

Netflix has also increased their market share, overtaking CanalPlay (Vivendi) for the number one spot in France, where they also have a higher, and newer content library. In Germany, it occupies the second spot, behind Amazon’s LoveFilm.

BritFlix

While not part of this survey, subscriber numbers from the UK have also shown considerable growth. Back in April, Enders Analysis reported Netflix consumer base as having reached 5.2 million, a 37% increase over 2014, outpacing all other British competitors put together

International Market Opportunities

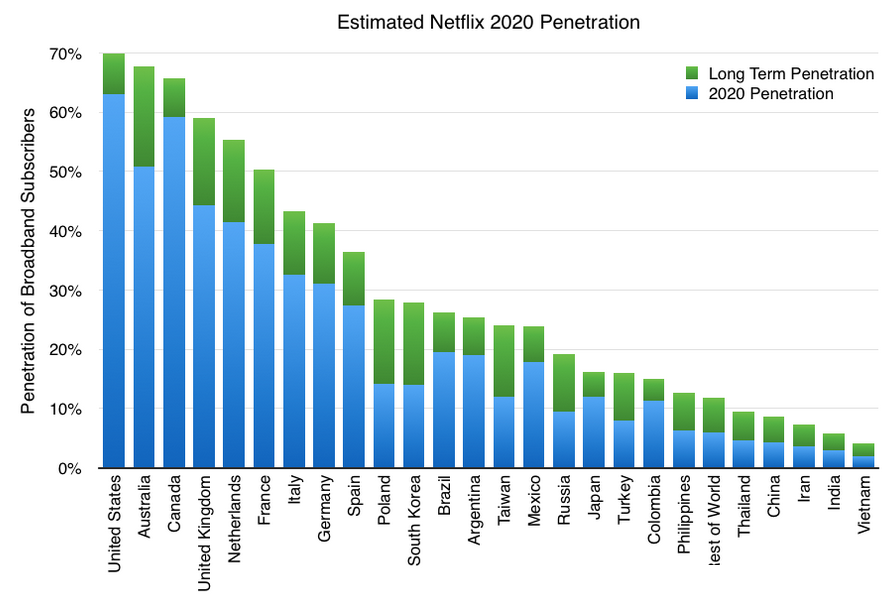

Earlier in November, management conveyed their thoughts on continued world-wide TAM availability. With only 15% penetration of ~570 million broadband households (not including China), Netflix has confidence that it is able to ramp up that subscriber base. TAM is also expected to expand to 820 million households within the next few years.

There are presently only four countries on Earth that Netflix does not serve: Crimea, Syria, North Korea and China. The first three have US government restrictions on American companies, preventing businesses to run operations. China has been on Netflix’s radar, possibly since inception, however at their October earnings release conference, management acknowledged the highly challenging regulatory environment for foreign providers of digital content. It has opted, for the time being, to license content to local enterprises, with expectations of a modest revenue stream. If at some point it is able to access China’s population, it would open the door to 1.4 billion potential customers in nearly 180 million households.

Crystal Ball

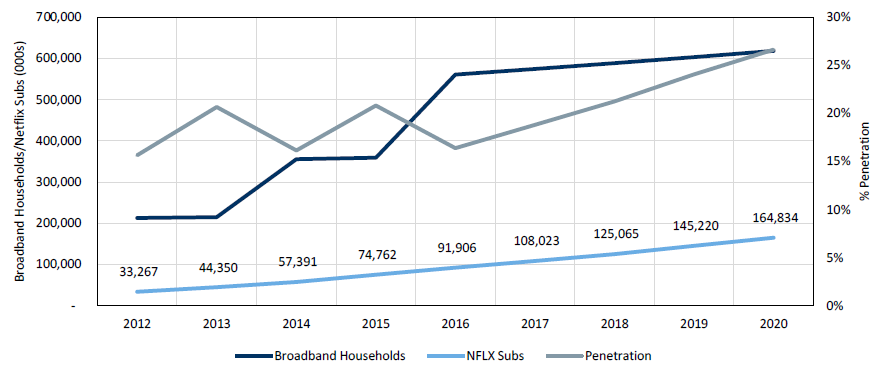

Can Netflix achieve 160 million Global subscribers? Based on 60% market penetration in the US and 27% world-wide, RBC Capital makes a Bull case assumption that it is a possibility by 2020 and this without any Chinese market contribution. Their calculations also suggest GAAP EPS of $8-$10 and a P/E multiple of 20X giving the shares a valuation of $160-$200.

Brean Capital is also in the Bullish camp with expectations that the subscriber base will reach 250 million in a decade, saying in a recent research that they believe Neflix “has created an unstoppable lead in the internet TV business and is positioned to dominate the business long term“.

DVD Decline

2004 was the peak of DVD sales at $22 billion. In 2015, sales registered at $6.1 billion, due to the proliferation of SVOD services of which Netflix has emerged at the forefront. For those keeping score, Netflix also rents out DVDs in the US, with just under 5 million subscribers.

Even movie theaters are having a harder time to bring in audiences outside of big-name draws, and with UHD/4K streaming bringing superb image quality to home viewers, more and more consumers are upgrading to large-screen televisions that are 4K ready, a fact supported by Consumer Technology Association (CTA) data forecasting 4K TV sales being poised for 40% annual growth in 2016 as the UHD market continues to expand. Expectations are that these screens will account for 56% of all TV sales in 4Q. For Netflix, this could also translate as having a number of subscribers switching from existing HD service to UHD/4K service, along with its $2/mo higher rate.

Final Thoughts

There is no denying Netflix’s popularity. Management has been on top of popular and original content, they have been increasing their library not just domestically but worldwide, and have still maintained their prices at a very reasonable level. At $8-$12, along with the ability to stream on multiple screens, it remains a great deal, limited in most cases by bandwidth cost and availability. Increasingly, television manufacturers are including a ready-to-launch apps within the smart functions, as are gaming platforms. International growth is still in its early stages and will eventually surpass US numbers for both subscribers and revenue. Lastly, if China decides to relax their regulations, that would be a huge market opening from which Netflix would certainly benefit immensely.