Nike (NKE) Earnings Preview Sent to Clients Yesterday

This note was sent to JaguarOptions Pro clients yesterday, June 28, before NKE reported earnings. To learn more about our approach and how you can become a successful trader, sign up for 2 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

June 28, 2016

Nike (NKE) – Lets use our 3 pronged approach: Fundamentals, Technicals and Option Activity:

Biggest trade of the day moments ago:

– 10,000 July 50 puts sold to open for $0.78 credit

– 6,000 July 52.5/57.5 call spread bought for $1.48 debit

Willing buyer of 1 million shares below $50 (less than 5% from current price) is making a bullish bet for ~$110,000 net credit. Not a bad play actually. Separately, see under Activity Tracker, since June 15 every day we are seeing bullish order flow including October 55 put sellers yesterday.

On technical side, nothing to like here. Continues to make lower-lows on high volume. Stock under liquidation. But on long term weekly chart approaching 50% Fibonacci Retracement at $50.53 support.

Fundamentally, BAML channel checks from June 16: Trend is running better than last 2 years. Additionally, it is worth pointing in April / May both BAML and Morgan Stanley downgraded the stock to Neutral and Underperform, respectively, due to slowing basketball sales. According to this channel checks, over 4-weeks ending June 16, Basketball sales grew +7.6% y/y, accelerated from +3.3% in previous channel checks done in May. Sounds bullish to me.

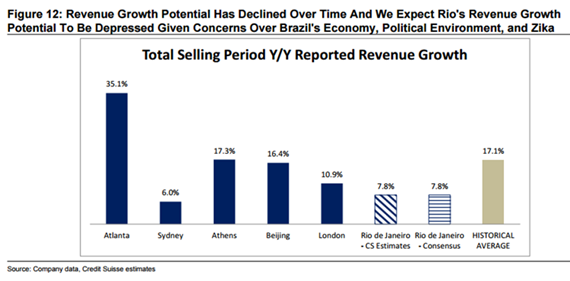

Lastly, here is out of box thinking from Credit Suisse on June 16. Historically average revenue growth during Olympic years is +17.1%. Consensus going into Rio de Janeiro Olympics is +7.8%. Seems low.