NV5 Global (NVEE) – California Dreamin’

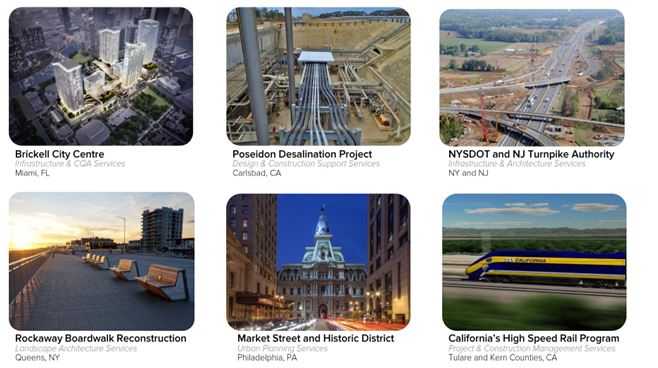

NV5 Global is a provider of professional and technical consulting and certification services that has specialized capabilities across segments such as Construction Quality Assurance, Infrastructure, Energy, Program Management, and Environmental. Its clients include federal, state, municipal and local governments with projects consisting of the planning, design, permitting, inspection and field supervision, and management oversight of transportation systems, water/wastewater systems, sports facilities, military base renovations, utilities expansion, renewable energy, and education and healthcare facilities. Earlier this year, the company announced a new goal to reach $600M in annual revenues by 2020. In order to achieve this goal, one can take a look at some of its notable projects, courtesy of its March Investor Presentation:

The company has been able to grow via acquisitions and contract wins since its IPO in 2013. Within the last 6 months, here are their recent purchases/wins:

December 1st – Acquired The Hanna Group, a Northern California-based bridge and transportation program management firm with 35 employees and approximately $11M in annual revenues.

Roth Capital analyst Jeff Martin said “the acquisition of The Hanna Group strengthens NV5 Global’s infrastructure presence in California, and notes that the former’s capabilities in program management are additive to the latter. The analyst believes The Hanna Group has significant growth potential, both from the project pipeline as well as increased capacity with the resource capability of NV5 Global, in addition to the potential to expand the business into southern California.”

December 7th – Announced that it acquired CivilSource, an infrastructure engineering consulting firm based in Irvine, California. CivilSource’s team of professionals specializes in the provision of comprehensive design and program management services on roadway, highway, and streets projects, as well as water and wastewater, flood control, and facilities projects. CivilSource’s large public client base includes 23 of 34 cities in Orange County and 22 of 88 Los Angeles counties, geographic regions with very high barriers to entry.

January 19th – NV5 Global announced that it has secured a $5M contract with Dallas Fort Worth International Airport, or DFW, to provide retro commissioning, infrastructure asset condition assessment and other services to modernize the airport’s asset portfolio over five years. The improvements will maximize efficiency and reduce energy use. In addition to the DFW win, NV5 was recently awarded a $5.4M contract to provide quality assurance testing services at Fort Lauderdale Hollywood International Airport, and terminal redevelopment and commissioning services for a terminal expansion at Salt Lake City International Airport.

March 13th – NV5 Global announced that it was awarded dual contracts to provide Delegate Chief Building Official, or DCBO, services on behalf of the California Energy Commission for the first construction phase of two combined cycle power plants owned and operated by The AES Corporation. The contracts were won by NV5’s Energy Group with a combined value of approximately $11M over three years.

April 17th – NV5 Global announced that it has acquired Bock & Clark Corporation, an established American Land Title Association surveying, commercial zoning, and environmental services firm based in Akron, Ohio.

One of the biggest stories that has developed and could prove to be a major catalyst for NV5 revolves around the recent news that the California legislature passed SB-1, a transportation spending bill that funds a $52B budget spanning 10 years, primarily for the state highway system and local streets and road system. On April 11th, Roth Capital analyst Jeff Martin noted that with California being a key market for NV5 Global, he believes the funding bill provides a tailwind for organic growth for the company. He reiterated his Buy rating and $43 price target.

It should be noted that the company will be reporting earnings after the bell today. Ahead of these numbers, Seaport Global issued a note on May 2nd in which they said they anticipate that the company benefited from an acceleration in delayed project work in New Jersey and the broader East Coast, which should drive strong organic growth. They anticipate that the company will maintain its 8%-10% organic growth outlook for the full year and speak to steady mid- to high-single-digit backlog growth. Further, they believe the M&A pipeline remains full and management will continue to talk about strength in building the internal infrastructure to support future inorganic growth. Lastly, given the passage of the CA Transportation bill and the run the stock has had during the quarter, they believe expectations are fairly high.

In addition to these earnings, the company has a handful of upcoming events it will be participating in:

• May 18th – Houlihan Lokey’s Global Industrials Conference

• May 24th – B. Riley Investor Conference

• June 10th – Annual Stockholders Meeting

• June 21st – Roth Capital Cleantech & Industrial Growth Day