Owens Corning (OC) – Raising The Roof

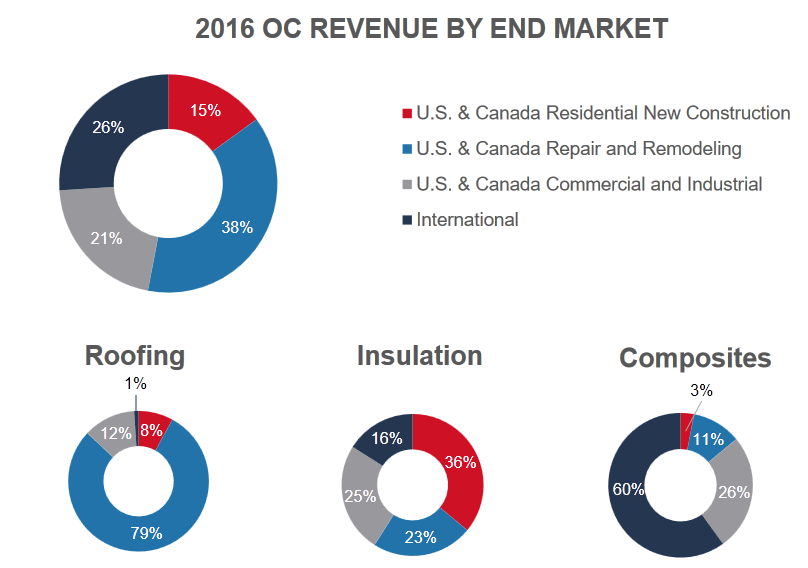

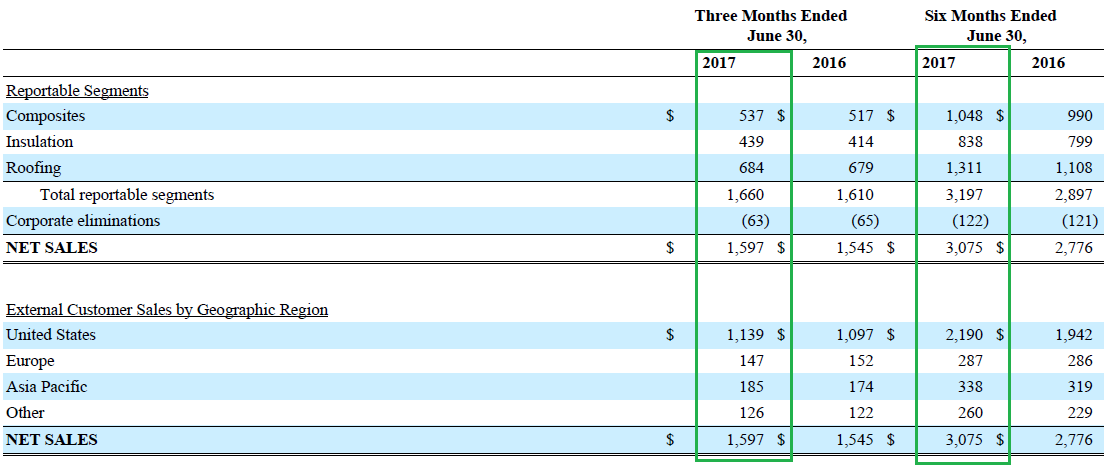

Owens Corning (OC) reported earnings on July 26th, with management highlighting their expectations of continued US housing starts and re-roofing demand to remain strong, offsetting potentially lower storm activity-related sales. Composite business keeps improving with strong volumes from 1H2017 anticipated to remain as a growth driver, while the Insulation segment continues regaining lost market share.

By the numbers

- 2Q EPS $1.20 versus $1.08 consensus estimate

- 2Q Revenue $1.6 billion versus $1.48 billion consensus estimate

- Effective tax rate expected to be 32% to 34%

- FY2017 adjusted EBIT is forecast at over $825 million

Insulation

The segment keeps benefiting from improving demand in residential housing sector, industry capitalization rate of 90%, and prices that have seen two successful, modest increases in January and June with a third one slated for September. The upcoming 8% increase is expected to improve profitability which management forecasts will push segment revenue to rise by more than $250m YoY. Further benefit is funneling from the acquisition of Pittsburgh Corning whose contribution should reflect in the numbers starting next year.

Overall, favorable tailwinds are to persist in 2017 & 2018 from pricing and market share recapture. Management has positive views on insulation whereas previously it did not, backed by stable operations and shipments going forward from their new mineral wool facility.

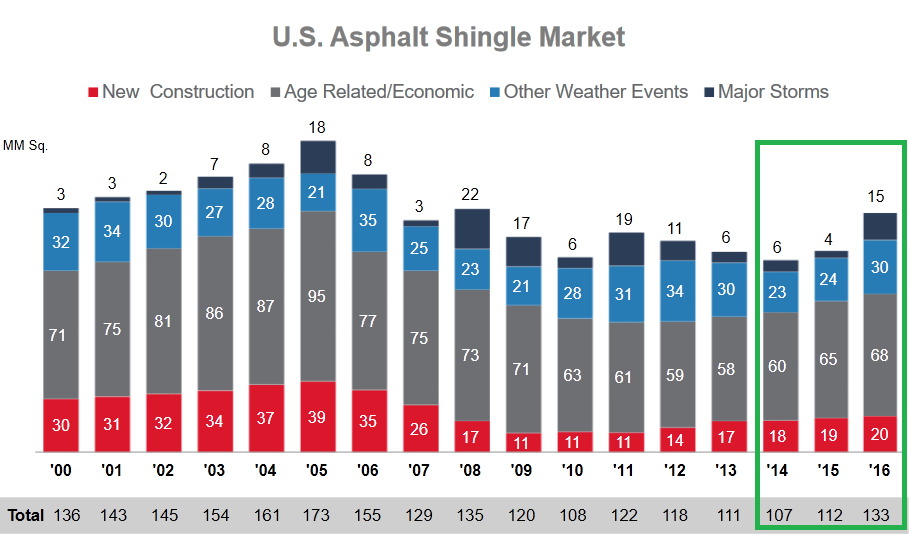

Roofing

Roofing product price increases in March and June should offset asphalt cost inflation and maintain the margin profile, helped along by sustained high volumes from storm activity and ongoing construction/renovation. Additionally, the industry shifted away from heavy 1Q discounting practices which will help improve profitability throughout the production-to-distribution chain.

It should be noted that 2Q faced a tough YoY comp in this segment and management’s forecast is for a flat 2H2017. However, this is an upward revision of its previous deceleration outlook, and certain analysts think that even with the new view, the company forecast remains conservative.

Composite

Although the company’s top revenue generator is still the roofing business, composite segment has been incrementally stepping up its contribution with a 3.7% YoY increase in sales to $537 million for 2Q. This division posted record margin EBIT with 7% higher volume than last year, with strong demand in all products and geographies which could help firm up prices. Shifting composite production to new facilities in India will increase profitability over the coming quarters with lower operations costs, a move away from higher-cost locations in North America and Asia.

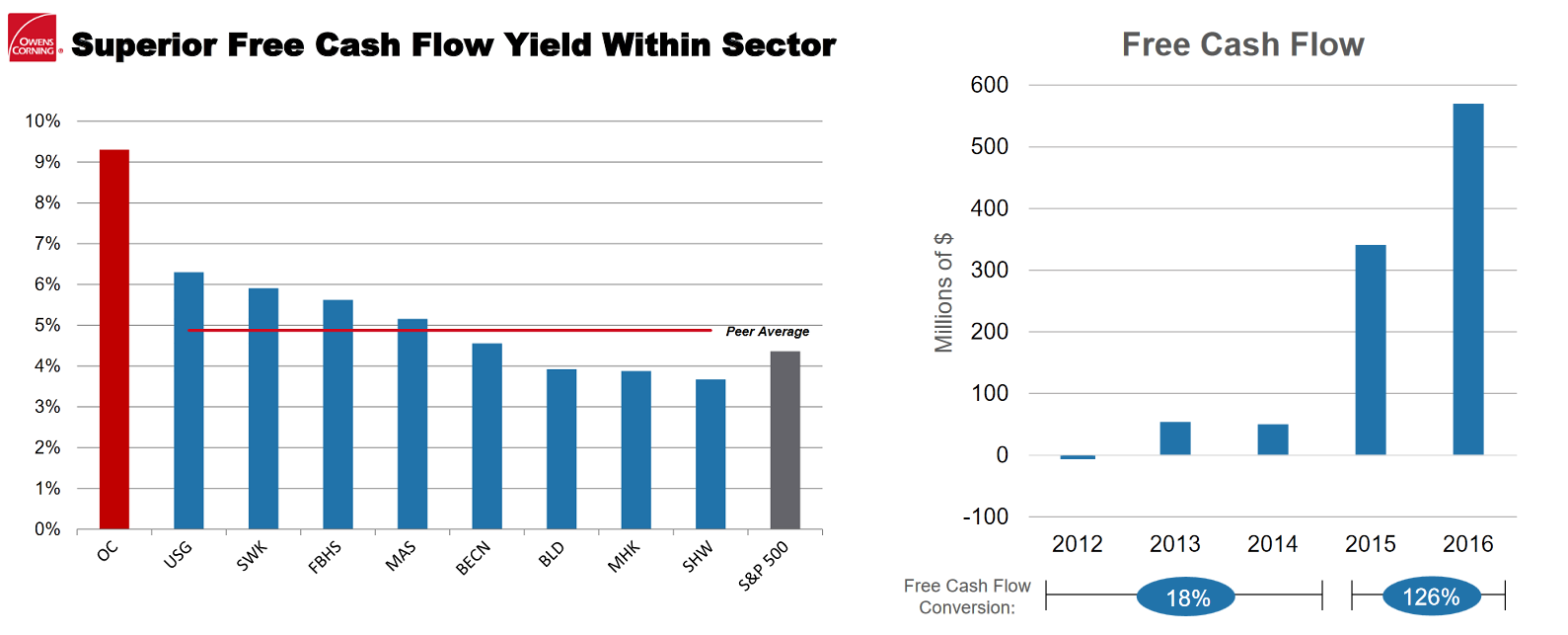

Free Cash Flow

Robust free cash flow generation should see further improvement from their composite production move to India. Management continues to buy back shares, make accretive acquisitions and generally re-invest in the business, a practice that will remain a priority, according to the company. Owens Corning had $206 million in cash at the end of 2Q and company plans to convert 100% of adjusted earnings to free cash flow; this could result in more M&A and a driver of further growth.

Analyst Coverage

- Bank of America rates shares at Buy with price target of $81

- Credit Suisse rates shares at Outperform with price target of $77

- Jefferies rates shares at Buy with price target of $82

- MKM Partners upgraded shares to Neutral with price target of $62

- RBC Capital rates shares at Outperform with price target of $79

- Stifel rates shares at Buy with price target of $83

Final Observations

Owens Corning has maintained its post-earnings trading range and is technically setting up for a breakout to new highs. The strength in the shares is also reflected by its strong recovery from the general market’s recent declines as well as positive disconnect from housing-sector equities’ downturn due to its diversification. Company focus on leveraging the business’s cost structure has resulted in materially stronger financial performance. While inflation and start-up costs affected pricing, price increases in products along with Owen Corning’s market recapture have the company expecting higher legacy business share return.