Parsons (PSN) – Believe in the Vision

Parsons (PSN), a government services company, provides software and hardware products, technical services, and integrated solutions to support its customers. They have developed expertise and differentiated capabilities in key areas of cybersecurity, intelligence, missile defense, C5ISR, space, geospatial, mobility solutions, and connected communities. In early-May, the company reported its Q1 earnings in which EPS came in at $0.43 vs $0.42 estimate, Revenue came in at $1.2B vs $1.06B estimate, while the company raised FY23 Revenue Guidance to $4.6B midpoint vs $4.52B estimate.

Total Revenue increased 24% Y/Y while the company reported its 10th consecutive quarter of book-to-bill greater than 1.0x. Specifically, it came in at 1.2x in Q1. When looking at its major segments, Federal Solutions Revenue increased 29% Y/Y, Federal Solutions Contract Awards increased 52% Y/Y, and Federal Solutions Book to Bill came in at 1.1x. Turning to Critical Infrastructure, Revenue increased 18% Y/Y, Contract Awards increased 49% Y/Y, and Book to Bill came in at 1.3x.

Following earnings, Truist analyst Tobey Sommer said, “We are warming to Parsons’ story on raised 2023 guidance and strong 1Q results driven by new business wins. We believe PSN should be able to capitalize on strong demand with a larger contract base and 27% y/y headcount growth. The company had a 1.2x book-to-bill with a 20% y/y funded backlog increase. Robust bookings continued into 2Q with a $1.2B ceiling value GSA win. In our view, the strong growth and profitability in 1Q gives credence to the guidance raise and LT outlook.”

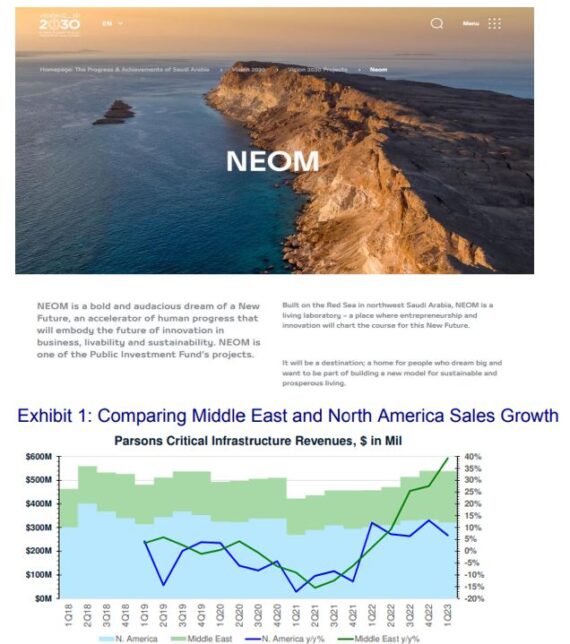

Going forward, there are two notable themes to keep an eye on. As I stated above, Critical Infrastructure sales increased 18% in the last quarter. This figure was driven largely by 38% growth in Middle East sales. Management noted that they are a contractor on all 5 of the 5 largest projects in the region and that they see Saudi Vision 2030 as providing a tailwind with a fairly long tail. Back in September 2022, I wrote about some of these key projects in a W/E Research write-up:

“Management highlighted key projects in the Middle East with significant funding that Parsons is working on/can pursue: 1) Neom, a city-building project in Saudi Arabia valued at $500B, and, 2) Qiddiya, an entertainment megaproject in Riyadh valued at $250B.”

On May 30th, Stifel hosted an NDR where the Middle East was discussed. Analyst Bert Subin commented, “So far, Saudi infrastructure spend is on track with projects like NEOM/Qiddiya ramping. Parsons has focused on Project Management in the region and is on all 5 giga projects. Management expressed confidence in the trajectory and does not see work slowing down, at this point. That could keep CI growing quite rapidly as Middle East sales grew 38% Y/Y in 1Q and now IIJA (Infrastructure Investment & Jobs Act) should sequentially show improvement as more projects are funded.”

The second theme, and one that is likely flying under the radar at this point, revolves around PFAS. This week, CEO Carey Smith was at the Stifel Cross Sector Insight Conference where she discussed how the company has been building service capabilities in the environmental sector with several patents/patents pending in the PFAS arena for remediation. According to Stifel, management noted they anticipate a TAM over $100B for the next decade and when they asked CEO Carey Smith to rank the opportunities in Missile Defense, IIJA, and PFAS/ PFOS, she noted PFAS/PFOS was tied for the lead with IIJA. “We see that as encouraging given it’s likely not something investors are contemplating in future estimates but could represent material upside if/when the remediation process starts in earnest. There’s been more PFAS-related activity lately as cases appear to be moving closer to the settlement phase, and that could help push remediation spending to the left.”