Petco Health & Wellness (WOOF) – A Powerful Ecosystem

As one of the largest specialty pet supply chains, Petco Health & Wellness (WOOF) owns and operates almost 1,500 stores offering pet supplies, companion animals, and services.

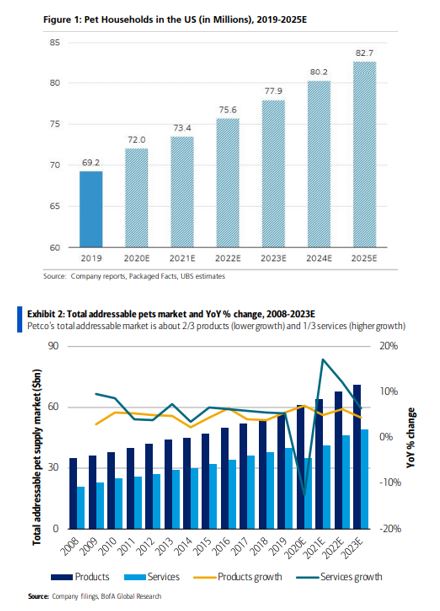

According to Packaged Facts, cited by Petco, the number of U.S. households that own pets is expected to reach 72 million in 2020. This equated to about $4B in incremental demand. Petco’s total addressable market consists of pet products (which include consumables, supplies, and companion animals), as well as services (which include veterinary and non-medical services). Pet products are expected to make up $61B, or 64%, of the total pet care market in 2020, and pet services are expected to account for $35B, or 36%, of the market. UBS estimates that Petco has about 5% share of the pet care industry with considerable room to grow. BofA, in their initiation note, says that the ~$97bn pet supplies and services industry has been growing at a steady pace of +5% CAGR from 2008-2019, showing strong resilience to economic cycles. Services, as they point out, are expected to grow more rapidly at 11% per year vs. 5% per year for products.

Last month, the company would report its debut earnings report, which saw EPS of $0.17 vs $0.11 and Revenue of $1.3B vs $1.31B. Q4 Revenue increased 16%, Comparable Store Sales increased 17%, Digital Sales increased 90%, and management said almost a million new customers entered the franchise.

Petco’s ecosystem is centered around four main channels: pet care center merchandise, ecommerce, grooming and training services, and vet services. CEO Ron Coughlin would spend time on the conference call discussing some of these:

Digital – This is a key component of the ecosystem, which showed a 100% plus digital revenue 2020 and has steadily gained share. Its user experience is winning over customers, and their assortment and pricing are now competitive, all of which drives substantial improvement in conversion. They’re also seeing compelling results from recurring revenue offerings, repeat delivery, and PupBox, which is a monthly subscription box program for puppies. They were up over 40% and 100% respectively for the year.

“And further powering our acceleration, we’re leveraging our data analytics engine to drive new customer acquisition both further momentum and multi-channel purchase conversion.” They have a base of over 20 million active customers which grew by nearly 1 million customers in each of the third and fourth quarters. So today, approximately 90% of those customers with their power of loyalty members, which gives the company insight into what they buy, where they buy, and when they buy. “One of the most robust databases of pet parents in the industry.”

Meanwhile, the company’s Pet Care Centers have now doubled as micro distribution centers and their footprint of physical locations have become a huge asset. At the onset of the pandemic, they launched curbside pickup over the holiday period and launched same day delivery, an offering that their digital pure play competitors just cannot offer. “We believe this will further enhance our customer attention with almost 40% of early adopters saying they prefer same day delivery.” Today, over 80% of Petco.com orders are fulfilled from these Pet Care Centers. By the end of the fourth quarter, their mobile app has been downloaded 3 million plus times and is driving merchandise sales and incremental services bookings.

Grooming & Training – COVID had a tangible negative impact on this business as they shuttered group training classes, and implemented capacity restrictions and grooming salons. In spite of those restrictions, grooming began to rebound in the second half. In grooming and training, “We expect to continue to take share in a fragmented market as we compete primarily with single unit operators, and our digital marketing capabilities provide tangible advantages.” Due to the 2020 COVID related closures, grooming and training will likely have a positive lap dynamic from Q2 to Q4 of 2021.

Vet Hospitals – The vet hospital business is shifting into high gear as they opened 20 additional hospitals in Q4 despite COVID related construction and permitting delays. This brings a year-end total to 125 locations. Their hospital customer count is up strong double digits year-over-year. “We are executing what we believe is the fastest vet build out in vet history and are seeing a strong performance ramp ahead of our expectations. Long-term we’re targeting up to 900 vet hospitals in our Pet Care Centers. This will have a tangible, annual and long-term impact on our financials. In addition to our rapidly scaling vet hospital business, our mobile vaccination clinic business Vetco services over 800 Pet Care Centers weekly and seeing strong customer demand.”

Management Meetings

Last week, BofA hosted virtual meetings with Chairman & CEO Ron Coughlin, CFO Mike Nuzzo, SVP of Finance Brian LaRose, and VP of Investor Relations Kristy Moser.

The tone of the meetings was optimistic regarding the favorable tailwinds of higher rates of pet adoption and increasing levels of spending per pet on the pet specialty retail industry broadly. Investors are increasingly concerned that “COVID-beneficiaries”—with which WOOF is often categorized—face difficult comparisons against 2020’s growth, but BoA views the tailwinds to the pet goods and services markets as sustainable.

Also, the management team expressed confidence in the company’s unique industry position as a full-service omnichannel provider of pet goods and services, and in its growth initiatives. The company is adding vet hospitals to 70 of its 1,450 pet care centers this year. Although services & vet combined will likely be less than 10% of total company sales in 2021 by our estimates, this is a critical long-term growth engine for the company and a key differentiator. Therefore BofA expects investors to remain keenly focused on the progress of the rollout, which appears to be on track.