REV Group (REVG) – Strong End Markets for Buses, Ambulances, Fire Trucks and RVs

REV Group (REVG) is a brand new entry to publicly traded stocks although its history stretches back to 2006, as American Industrial Partners; the present name was adopted in November 2015. REV Group is a parent company to 27 brands manufacturing over 20,000 vehicles per year in 17 facilities in the United States. The company designs, manufactures and distributes specialty vehicles and related aftermarket parts and provides financing and services.

First Look

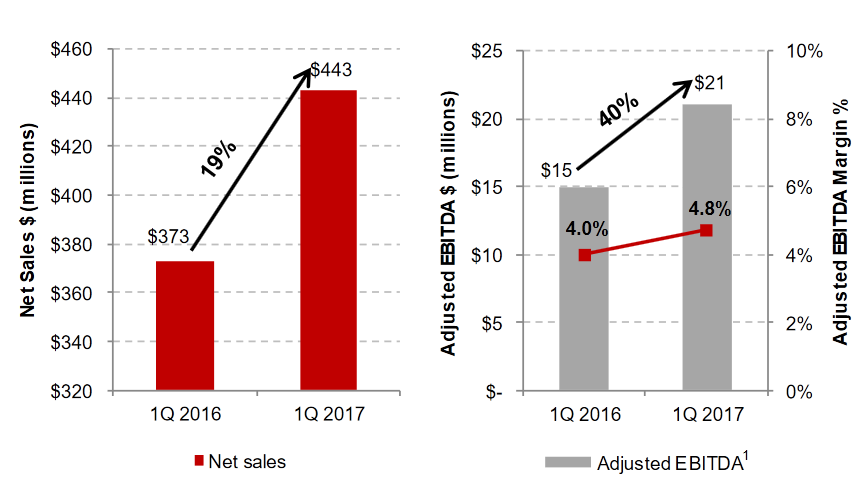

REV Group reported 1Q2017 in early March, their first as a public company. Management indicated that sales growth was driven by strong end-market demand, new product initiatives and market share gains.

- 1Q Net sales of $443M, up 19% YoY

- 1Q Net loss of $13.3M, mainly form a one-time stock compensation expense from their January IPO

- 1Q Adjusted EBITDA of $21.1M, up 40% YoY

- FY2017 Net sales guidance of $2.225B to $2.325B

- FY2017 Net income guidance of $40M to $43M

- FY2017 Adjusted RBITDA guidance of $150M to $155M

During the last quarter, transition of commercial bus production to a new facility affected YoY growth; it is expected to return to normal conditions shortly. RV sales saw a 21% gain as the company’s market share increased, helped along by solid growth in the industry during the course of 2016 and a good start to 2017 as evidenced by continuing unit sales at January’s Florida RV Supershow record-setting attendance that we covered in this previous report.

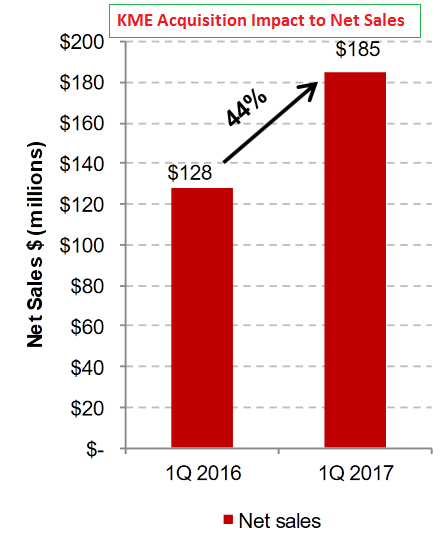

In April of 2016, REVG acquired KME, a fire equipment company, and then closed out the year by buying Renegade in December, a move which added Class C RVs to compliment their Class A-only makeup. As with most mergers, there have been some anticipated disruptions to production in the process. With KME, interruptions were as expected and schedule and backlog issues should see tapering over the course of the year.

Management also stated they will continue expansion through acquisition, given the right conditions and opportunity. In the past 10 years, there have been 10 such ventures and 4-5 potential companies were said as being evaluated at any given time..

REVG products are well known and respected within their represented market, and through strategic buyouts, incremental market share gains have strengthened the company’s business footprint. Industry equipment and manufacturer associations, as well as internal estimates rank REVG as:

#1 in Ambulances

#1 in Small and Medium commercial buses

# 2 in Firefighting Equipment

An estimated 72% of REVG sales come from businesses where it holds first or second place as ranked by market share.

Strong Balance Sheet

From their January 27th IPO proceeds, REVG paid off all outstanding Senior Notes and part of their revolving credit account leaving $83M of net debt on the books. CapEx was $18.6M last quarter and is expected to diminish for the remainder of the year. Starting in 2Q, the board will pay out a dividend of $0.05, $0.20 on an annualized basis.

Operating Divisions

REV Group operates in four reportable segments encompassing 27 market-leading specialty vehicle brands

- Fire & Emergency

- Commercial

- Recreation

- Corporate & Other

Product Lines

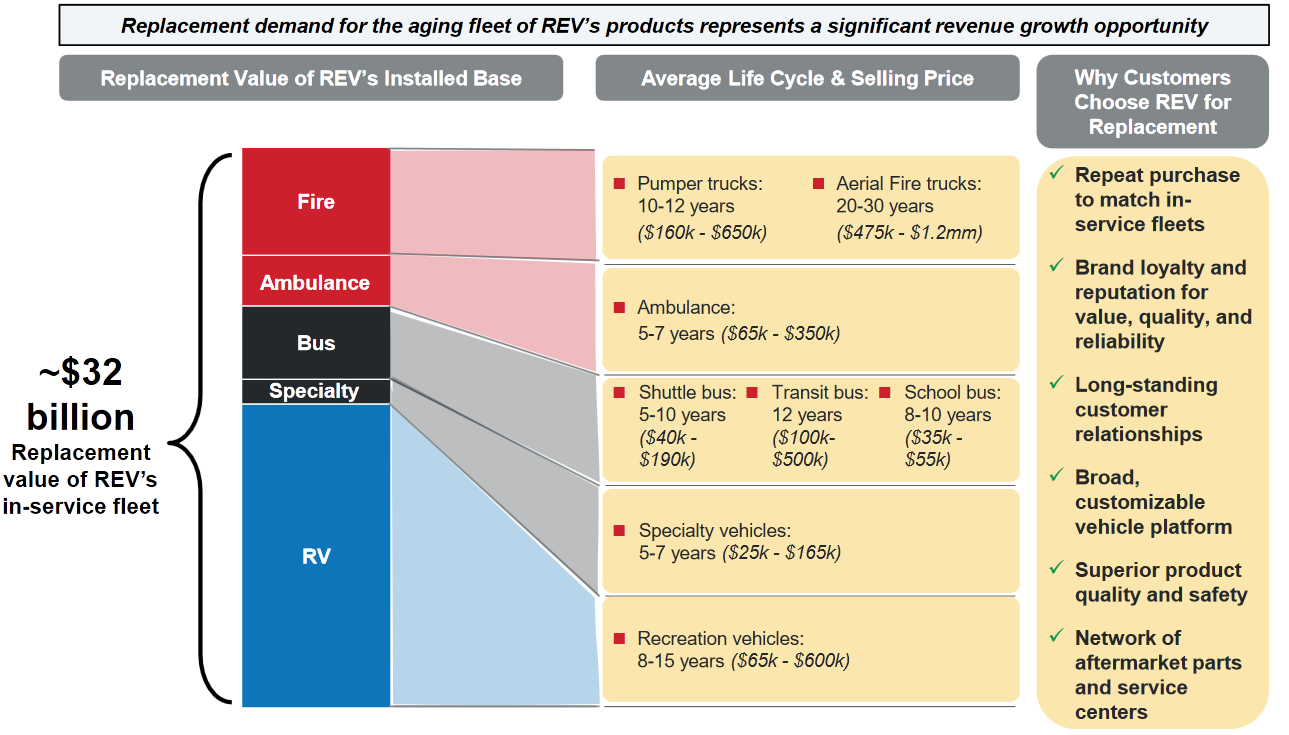

Fire Trucks are built by E-One and KME. Their applications cover every aspect of emergency situations, from airport high pressure and fast discharge trucks, emergency command centers, the usual compliment of the red trucks seen in all cities, pumpers, custom foam trucks and aerial ladders.

Also in the Emergency segment, REV Group manufactures ambulances under eight different brand names. Along with the familiar models commonly seen everywhere, they also manufacture heavier duty versions that can operate in hilly terrain, for example at oil exploration sites. Multiple configuration patterns are available to suit any client’s needs, and chassis manufacturers include Mercedes, Ford and Chevrolet, among others.

Another multi-application segment is their Bus division. Offerings again are from eight brands and include applications that cover pretty much all aspects of passenger transport – the ubiquitous yellow school bus, airport shuttles, handicap accessible and assisted living setups, city transit and luxury touring buses.

Recreational Vehicle is geared mainly to high-end, luxury Class A motor coaches under the brands American Coach, Holiday Rambler and Fleetwood with prices ranging $220,000 to $412,000. Another division, Renegade, deals with the “toter” RV side. These are what can be seen during NASCAR races for example, they are built on semi-trailer chassis and are able to pull a trailer with race cars, horses, or anything else that may be desired to be transported for events.

Other divisions that round out the production portfolio are Terminal Trucks that transport containers in shipping applications, Mobility conversion converting vans to accessible format, Street Sweepers, and the last one is a non-vehicle division, one that manufactures Fiberglass products – vehicle body parts, composite medical equipment parts, amusement park ride components, in fact anything that can be molded from fiberglass, they can make it, especially if it is of large dimensions.

Analyst Coverage

- Stifel initiates at a Buy rating with a target of $33. Calling it a compelling growth story with several opportunities at organic revenue and margin growth, potential for further market share gains, higher margin parts sales and future acquisition opportunities. Product diversification can sustain company revenues during cyclical lulls of certain sectors as others, such as emergency vehicles and city buses, tend to be late-cycle expenditures from government funded agencies.

- Jefferies also rates REVG as a Buy with a price target of $35. They note that shares are trading at a discount to peers and 1Q2017 earnings in early March were largely uneventful without surprises.

- Credit Suisse believes that REVG can increase its Adjusted EBITDA margins by 2019 through organic growth from aftermarket sales, new product introductions and operational initiatives. They rate the stock at Outperform with a $33 price target.

- BMO initiated the stock at Outperform with a $32 target.

- Baird initiated the stock at Outperform with a $31 price target.

- Wells Fargo has an Outperform rating with a $33 price target.

- Deutsche Bank rating is a Hold with price target at $30.

- Morgan Stanley rates REVG as Equal Weight with a $30 price target.

Final Observations

REV Group management believes that demographic shifts in the growing elderly population in the U.S. could mean increased demand for buses and ambulances. Additionally, fire trucks and ambulance replacement cycles were pushed out during the great recession, and states and municipalities have fallen behind historical replacement rates. With sales and profits expected to ramp up during the remainder of 2017, secular trends seemingly intact and supportive across all segments, aftermarket high-margin sales growth double-digit increase forecast and possible accretive M&A activities, REVG appears to be a good candidate long term growth prospect to fulfill analysts’ price.