Sale: The Seven Seas

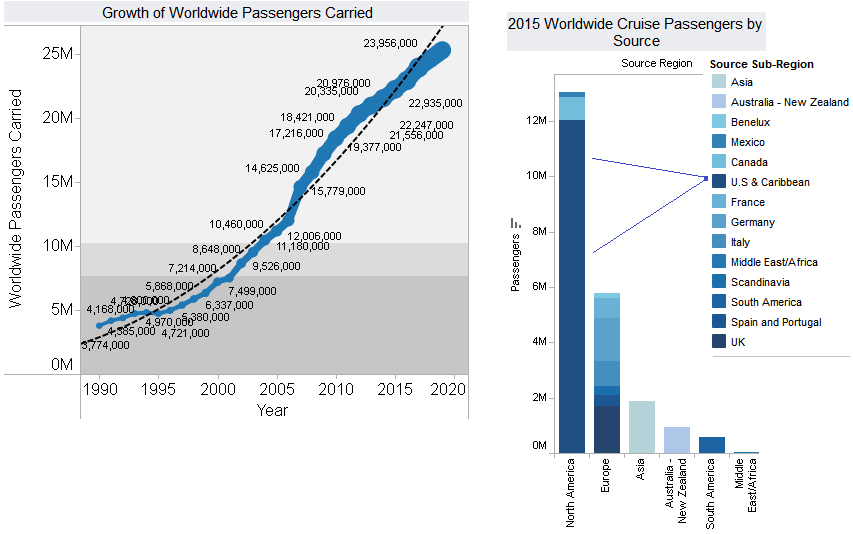

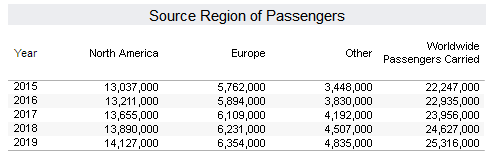

By 2018, over 24 million cruise passengers will be carried worldwide, 60% of them North American, 27% European, steadily increasing numbers of Chinese and other Asian nationals, and Australians topping off the count. Consider that in 1980, total worldwide passenger numbers were 1.5 million, and that at a time when ‘The Love Boat’ was still airing on prime-time TV!

Granted, the World has transformed a lot in the past 35 years. Not only has the planet’s population increased by 2.2 billion, demographics have also shifted, countries have relaxed or changed their travel policies (not to mention entire political regimes), the threat of a Cold War is a distant, chilly memory, and short of getting into a history lesson, for the most part we can say that things are indeed not only different, but in many ways better. Except North Korea, but that’s another story….

The Big Three

With 77.9% of market share, Carnival Corporation (CCL), Royal Caribbean Cruises (RCL) and Norwegian Cruise Lines (NCLH) dominate the cruising industry. Respective market shares break down to 44.3%, 24.5% and 9.1%. Privately-held MSC Cruises has a 6.9% share.

CCL has the largest fleet with 101 ships followed by RCL with 48, NCLH next with 24 and MSC half that at 12.

CCL, RCL and NCLH also have a number of subsidiaries that have either been acquired over the years or formed to cater to a different crowd.

Market Still Growing

Since 1990 the cruise industry’s worldwide passenger growth rate has been increasing steadily, with projections out to 2020 showing continued compounded annual growth at 6.55%. The industry is also expanding fast internationally. Yet only 53% of the target North American market have ever taken an ocean cruise. More people visit Las Vegas in each year than could fill the world’s fleet of cruise ships to capacity twice over, for the entire year. Worldwide, the numbers are even smaller with the US being the largest market of cruise passengers. The market potential remains large, especially in Asia, and cruise ship companies have started to specifically cater to that sector with some ships being built with cultural differences, cuisines and entertainment in mind.

Cruise Lines International Association’s (CLIA) 2015 data shows that worldwide number of passengers reached 23.2 million cruisers, the industry’s highest ever level. Projections for 2016’s (revised) global numbers are for another record high at 24.2 million passengers. The 2015 report adds that the highest increase was for the Asian market – a gain of 24% y/y, or 2 million more passengers. The South Pacific region (including Australia and New Zealand) reported a 14% increase, or 1.1 million.

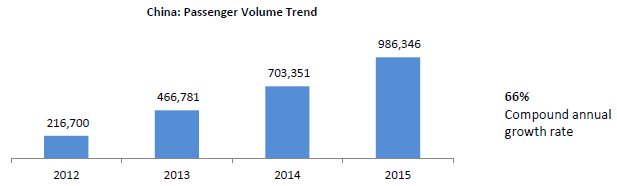

Sail Rises in the East

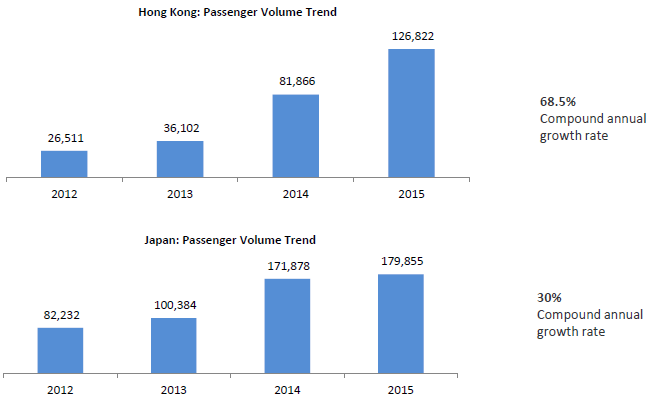

CLIA’s Asian Cruising Trends 2016 report supports the fact that major line companies have increasingly built up capacity in the region. In particular, China’s 2016 estimated passenger capacity growth is up to 70%, this following 2015’s 60% increase over 2014. A further increase of over 37% is projected for 2017. Of Asia’s total 2.08 million passenger count in 2015, 986,000 were from China.

Cruises originating in Asia, specifically in China and Taiwan, are typically of shorter duration and mini-trips of 3-5 days are far more popular than North American counterpart sailings of seven days. On-board spending tends to be higher as well especially in the casinos.

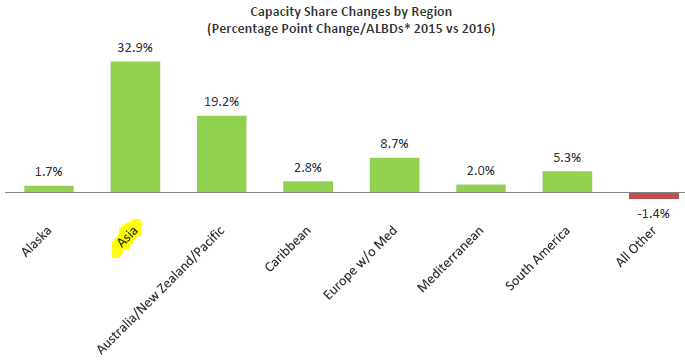

Cruise ship operators are re-allocating vessels to cater to the Chinese market, reducing count mainly in Europe and a little bit in the Caribbean. With projected market capacity growth to over four million passengers by 2020, this should not be a surprise. This projection doesn’t even cover Taiwan nor Japan, both of which have also seen continual robust growth.

Understandably, carrying capacity shift is towards Asian ports. As mentioned in our Starbucks (SBUX) write-up, with China’s middle class projected to expand from 300 million to 600 million within the next five years, passenger growth in cruising could very well increase exponentially.

Cuba Libre

Just before Christmas 2014, President Obama announced that the US-imposed Cuban embargo would be lifted after nearly 55 years. Cuba as cruise and holiday destination is now open for American travelers, offering a new, different and previously off-limits option. Cruise companies started announcing packages shortly after the decision, however there are some logistical issues to deal with to accommodate multiple large, modern ships and thousands of passengers.

While Canadians and Europeans have been vacationing in Cuba’s all-inclusive resorts for decades, their entry into the country has been via air travel.

Order Book

Ship building process, from design to launch, generally takes two to three years, therefore management must plan well in advance through what we can assume to be very comprehensive market studies. Your ‘average’ 2,500 passenger modern vessel costs $625 million, 5,000+ passenger floating cities will set you back over a billion dollars. These are definitely not last-minute impulse buys!

AMAM’s latest data shows over $40 billion in ship orders, $15 billion of that just for deliveries by 2019 year-end to RCL, CCL and NCLH. The order book is healthy and contracted shipyards busy.

Chart below shows orders for the Big Three out to 2019:

Set An Open Course

Starting in May 2020, Virgin Cruises will also start sailings with a brand-new, 2,800-passenger ship based out of Miami FL. Two more ships are planned to follow by 2022. Aimed at younger travelers, Virgin says its new line will offer an “intimate, modern, fun experience and with a sassy atmosphere“. It wouldn’t be Virgin without some red either! Funky ship design as well!

Recent Earnings

All three companies have reported this quarter

- CCL: Reported $0.49 EPS versus $0.39 consensus. Their timing unfortunately was just three days after the Brexit vote that saw share prices drop 13%.

- RCL: Reported $1.09 EPS versus $1.00 consensus. Lowered guidance on FX and Fuel costs. Stock rallied over 10% though on CEO’s $2 million share purchase.

- NCLH: Reported $0.85 EPS versus $0.84 consensus. Guided much lower, by 10% and stock dropped 12% on that.

Common theme with all three; Brexit fears, Zika fears, terrorist actions in Europe affecting North American travel (NA clientele fills European summer cruises), rising fuel prices.

Analyst Ratings

All three stocks have ample coverage and all three also have Bullish ratings with some having modestly lowered price targets since Brexit.

- CCL: Consensus rating Buy & price target $58.17

- RCL: Consensus rating Buy & price target $96.56

- NCLH: Consensus rating Buy & price target $59.69

Of the three companies, there isn’t any one that is better. Just big, bigger and biggest. As a comparison though, we can use P/E ratio;

- CCL 15.9X

- NCLH 17.3X

- RCL 20.5X

Other considerations:

- NCLH is a little late getting into Asia but they are the least exposed to FX with 20% European exposure.

- RCL has 9% capacity in China. If projections fail to materialize, or economic issues turn the tide (so to speak), then it could be impacted negatively.

- CCL was the first to report this quarter and was outside of Brexit-affected Euro and GBP exchange rate. Next quarter’s report could show weakness in Europe segment.

- CCL and RCL pay dividends, NCLH does not

- All three companies are equally affected by negative geopolitical news.

Final Thoughts

Clearly holiday cruises are still very much in demand in North America and increasing in Asia. There are itineraries most everywhere: Caribbean, Alaska, Antarctica, Europe, Middle East, Pacific, Far East….. Let’s say the entire planet. We haven’t even covered river cruises which are also seeing increased passenger numbers. Travelers are looking for adventure, take for example the repositioning cruise through Canada’s Northwest Passage: 1,000 passengers have paid from $22,000 to $120,000 for the 32-day sail! And…. it is sold out! If that doesn’t foretell this industry’s future possibilities, then probably nothing else will.

Recovery for these three depressed stocks may take some time, perhaps Winter holiday season will be most telling. For the patient investor who doesn’t mind collecting some dividends along the way, these stocks are definitely worth a look.