Stevanato Group (STVN) – High Value Ramp

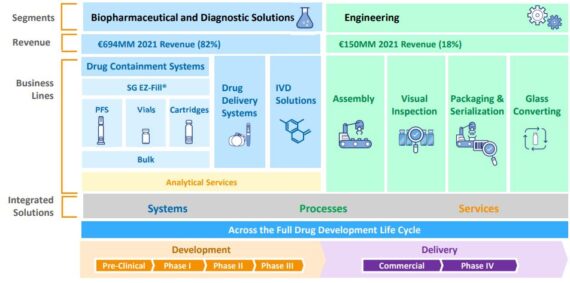

Headquartered in Italy, Stevanato Group (STVN) is a global provider of drug containment, drug delivery and diagnostic solutions, and engineering solutions to the pharmaceutical, biotechnology and life sciences industries. It operates through two segments: Biopharmaceutical and Diagnostic Solutions, which makes up 82% of total revenue and Engineering, which makes up the remaining 18%.

“Our solutions are highly integrated with the development, production, and commercialization processes of our customers. Our involvement at each stage of a drug’s life cycle, together with the breadth of our offering, enables us to serve as a one-stop-shop for our customers, which we believe represents a significant competitive advantage.”

When this company reported its Q1 earnings on May 4th, they said that Total Revenue increased 12% to €238M compared with the same period last year, mainly driven by growth in both of the company’s business segments, and the continuing shift to high value solutions, or HVS.

From the company’s 10-K: They refer to premium products in the Biopharmaceutical and Diagnostic Solutions segment as their high- value solutions, which are products, processes, and services for which they hold intellectual property rights or have strong proprietary know-how, and that are characterized by technological and process complexity and high performance. “Our high-value solutions deliver significant benefits to customers including, inter alia, faster time-to-market, lower total cost of ownership and higher flexibility. Among our key high-value solutions is our EZ- Fill®line of ready-to-fill injectable products, which can be customized to clients’ needs.”

They would add that in Q1, high-value solutions increased 25% to €76.7M and represented 32% of total revenue vs 29% in the same period last year. CEO Franco Moro would say, “The main driver for the growth of higher-value solutions is the fast-growing area of biologics, where we have very strong demand related not only to GLP1s, as I mentioned before, but also in monoclonal antibodies and mRNA applications.”

The focus for this company, as we look to the back half of 2023, is the production ramp. Management would highlight on the earnings call that in both the U.S. and Italy, “progress is advancing largely as expected.” They recently accelerated their expansion plans in Indiana in response to higher demand for high-value solutions, driven principally by the growth in biologics. The first production lines are on site. “We are actually bringing on staff and validation activities are still expected to begin in the fourth quarter.” Meanwhile, in Latina, Italy, validation is still expected to begin this summer followed by commercial production in the fourth quarter.

In their post-earnings note, BofA said that management has allocated more CAPEX this year to accelerate High-Value Solutions product expansions in Fisher, Indiana, and Latina, Italy. Stevanato expects to invest €500M in its Fisher plant vs €150M initially laid out in 2021, which in turn would provide approximately €500M of annual sales at full utilization. Some of this capacity starts to come online later this year and will underpin the company’s 2H23 revenue growth acceleration. The company believes that it has good visibility into demand given that additional capacity must be planned 18-24 months in advance. “Indeed, the company had no trouble backfilling the faster than expected roll-off of COVID-related programs in FY23 with other projects given that HVS capacity is still tight.” Another item to consider is that these HVS products have a gross margin profile in the range of 40-70% vs. 15-35% for standard containment solutions, and the HVS shift will help drive sales growth and margin expansion as penetration increases.